Wild Wild West

It's a common expression within the crypto community to describe the current state of cryptocurrency as the "Wild Wild West". What is this in reference to?

In the early days of the United States' westward expansion into the unexplored and ungoverned territories, brave travelers would traverse unsafe conditions to claim their piece of land in the free world. Risks were abundant but ultimately overshadowed by the dream of independence.

Settlers were isolated from the comfortable luxury and infrastructure provided by the settled cities in the East and had to defend their assets and land themselves. Fences to protect livestock were built, roads to connect plots of land were constructed, railroads were built across the west bringing the building blocks modern society (wood, coal, and other resources).

The Connection to Crypto

Many subjects have been discussed in the crypto community since Bitcoin's emergence in 2009. Hot wallets, cold wallets, or hardware? Proof of Work or Proof of Stake algorithm? Centralized exchanges or decentralized exchanges? Some form of governance or "full decentralization"?

There is no clear right or wrong answer. Each decision is completely up to the holders, investors, speculators, and developers. There is no governing entity that is regulating how and when a currency should be traded, sent, and used. The inherent properties of crypto allow for the borderless transfer of wealth and decentralized nature of transactions. Although, with this seemingly lawlessness playground, a plethora of malicious actors have made their way into the "Crypto Wild West".

With no regulatory bodies, recourse for theft, and a sub par level of security understanding, users have been left to fend for themselves in light of recent hacks.

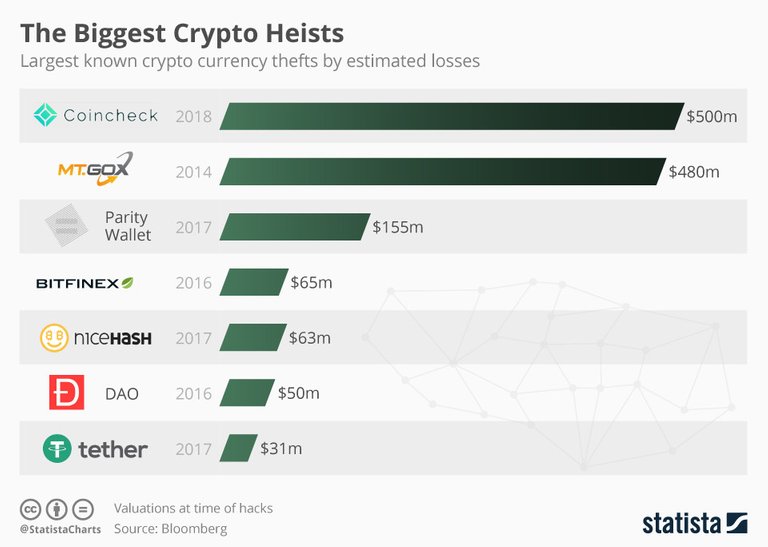

A target for these attacks have been large centralized exchanges which hold millions of dollars worth of crypto assets for their customers. Exchanges have done their best to offer certain security measures but mistakes and mismanagement have lead some to bankruptcy (Mtgox) and some were so severe that developers were forced to create a brand new currency to deal with repercussions (DAO hack).

In almost all cases of theft, customers were left abandoned and beyond frustrated with no recourse. The funds that were stolen were untraceable and unretrievable.

A New Era of Decentralization and Governance

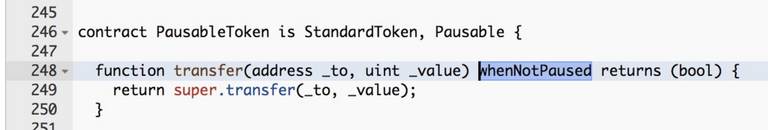

After the DAO hack, a need for certain loss prevention functions within decentralized assets was demanded by communities. The purpose was to create a way to mitigate the loss of funds in the event of a hack. Developers heeded this call and developed what is called a "freeze" function, caked into the very code of their cryptocurrencies.

The freeze function works as an "emergency switch" to allow funds deemed as stolen or hacked to be recovered and sent back to their original owner. This function called into a much needed debate over levels of decentralization. A Reddit user called BlockEnthusiast explained, "Token freeze functions are not bad by default. It's a question of what are the mechanisms behind calling them."

Funds Are Safe

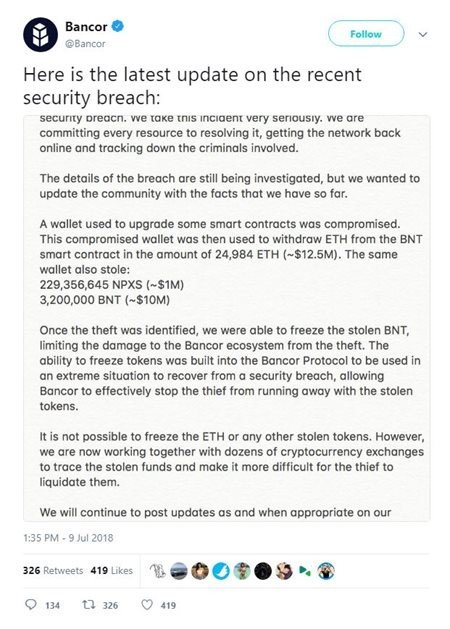

Just recently, on July 9th, an conversation-starting event occurred in the crypto-space. A well known decentralized network and exchange, Bancor, had a wallet breach that resulted in $23.5 million dollars worth of Ethereum, NXPS, and Bancor's native currency BNT, stolen from a wallet they controlled.

Interestingly, $10 million worth of stolen BNT were able to be frozen and retrieved back into the original wallet using the freeze function. Purists of decentralization were loud in their concern for such a function to exist but an overwhelming majority welcomed a seemingly new era of built-in security facets into digital currencies.

Eyal Hertzog, Product Architect of the Bancor Foundation, described the true meaning of decentralization in response to critics in an interview with prominent Youtuber "Crypto Beadles"

"I think that one of the core aspects of decentralization is the fact that something cannot be owned. For example, open source software. It cannot be owned because anyone can fork it. That is the protection mechanism against abuse. So the threat of forking is what keeps the network administrators at bay by not abusing their power because they can be forked at any moment" - Eyal Hertzog

Eyal then explains that if people had the ability to fork centralized entities like Amazon or Youtube, they would have already been forked to better fit the users and customers. For illustrative purposes only; a forked version of Amazon that takes 25% fees over the current 50% would be widely adopted by the community. This of course is not possible due to Amazon's centralized infrastructure.

Now we can ask ourselves a simple question. Would a thief target a cryptocurrency that was designed to have such a security mechanism in place? The time and effort required to breach into a wallet or exchange that holds BNT has now been rendered useless by this mechanism.

The following tokens have also implemented the function: EOS, Tron, Icon, OmiseGo, Augur, Status, Aelf, BNT, Qash, and Maker.

In true spirit of decentralization, the people will ultimately decide which cryptocurrency is adopted into the mainstream and which functions are in place for the security of funds. Will your favorite project blaze a new path to connect the wild west of crypto to the rest of the world or will it fall victim to outlaws?