You've probably heard it before.

So what exactly is this bubble, is it real and how dangerous is it?

Well..

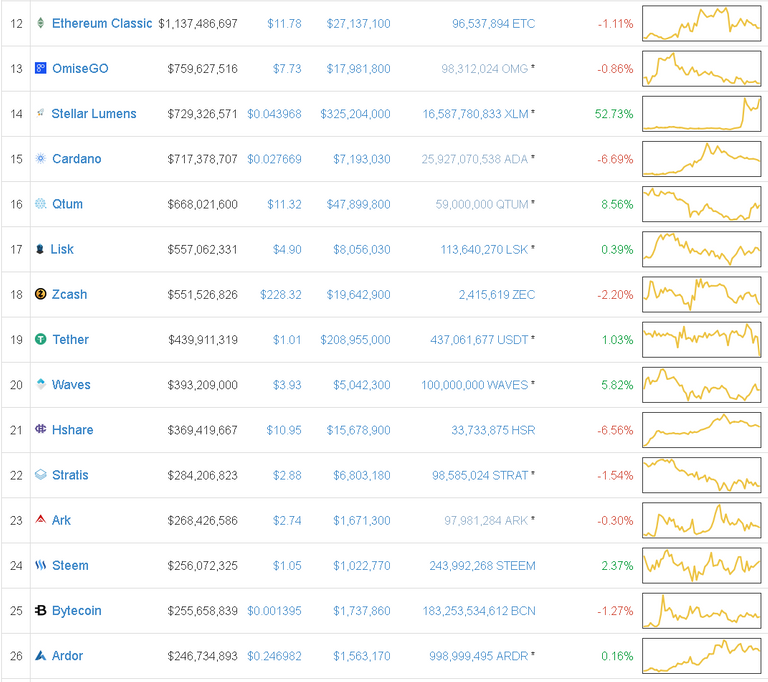

That depends on a lot of factors. In order to understand the actual landscape current capitalization chart will be very important:

We're looking at a lot of blockchain solutions here and a lot of them are represented as ICO tokens. It's important to note that some of them, like EOS, are developing their own independent blockchain solution and tokens merely represent holder's future stake in that blockchain.

Why is it bad and why is it important?

There are two forces at play: liquidity and dependence.

By nature cryptos are not a very liquid asset. There are many reasons for that but basically no one treats cryptocurrencies like cash. If people have an abundance of cash they tend to invest it: stocks, real estate, et cetera. Cryptos act as both means to pay and means to invest.

Dependence is harder to measure. We have hundreds of exchanges and trading pairs by now. You can buy most stuff with BTC, ETH and usually few others. There are direct fiat-crypto gateways for a dozen cryptos. But still that is not the case for majority of them: if you want to sell your token chances are you have to sell it for ETH first and then sell your ETH for fiat. This creates a dependency.

So, we're left with the current scenario:

ETH has seen a massive bullish run this spring. Because of low liquidity a tonne of wealth has been generated. Now there's a lot of money just sitting there. This is a big chunk of market viewed by people as an investment. They're not going to sell it in the next 1-2 years. ICO craze starts. And they accept ETH. And this is great for investors and for people who are already invested in ETH because it's both easy & "safe" to invest into them. There's not a lot of difference for investors -- you're trading one non-liquid asset (you weren't going to sell it so to you it is non-liquid) for another. However the problem is that for a company who runs an ICO received ETH is very much liquid: it is used for advertisement, development, hardware, research, everything.

If you ever ran a business you realize that knowing your budget is 101 requirement. Imagine yourself in a place of any ICO. How are you going to calculate your budget for the next year if you have 100 000 ETH but you'll need to pay for a lot of things in fiat?

True and horrifying answer is you don't. You could assume some worst case scenario and that's about it. Ideally you want to withdraw ETH into fiat constantly depending on your expenses.

But what will happen if ETH rapidly drops in value in a few days by 20-50%? (which is uncommon but totally plausible in crypto market)

Cascade effect

You still have all your expenses in place. And you need fiat. You'll have to sell a lot more ETH to get that covered.

This, in turn, will create a cascade effect alongside all tokens dependent on ETH, spiraling and destabilizing the whole crypto market. Problem with the cascade effect is that it will be very hard to stop or turn the trend around. Some tokens like EOS or those that don't have a cut of tokens owned by team have a better chance surviving in this environment but those directly using ethereum network as a platform will suffer the most.

This is something very real and probably bound to happen eventually. Short-term it will be devastating but plays no role long-term.

That was a technical aspect of the bubble...

And one more thing

There's second problem harder to measure: do half of the ICOs present a meaningful product?

The top 50 are more or less unique tokens usually providing platform or a service: for example Golem creates a computational power marketplace. This is very futuristic and I don't see it being massive in next 5 years but I do see slow growth and raise to the top possible. Still, Apple stocks will probably grow more than Golem in a next year. Or take Ark, an interesting solution in development to link blockchains together. These make sense. But there are other kind of tokens.

Latest stupidity I've observed is a decentralized anti-virus. Making things decentralized is great. Go for it. Consumer looks for the best and most affordable product. Stamping decentralized on it isn't going to make one. You have to write the best software, be the most competitive and reputable. Rules of business didn't somehow magically change. Decentralization gives me, as a consumer, protection against fraud and censorship, and sometimes privacy. Those are great additions to any business but certainly not the most important.

There's so many more of them. Dating apps. Weed delivery. Online massage(Yes!). Hell I've seen a Russian ICO with a basis premise of renting out your unlimited SMS tariff and people with pay-per-SMS tariff would buy that from you cheaper instead.

I consider most of them to be fraud. Nothing stopped anyone to create a business like that from scratch before and beat everyone. Many have tried. Problem is -- tinder, like it or not, is a great product. You're not going to overtake dating market by starting an ICO.

Wolf's Voting Bot checking in for @ajesetave !

You earned yourself a 0.32$ upvote!

PS: You can earn 30% Vote-Cashback by upvoting this comment and all other post/comments by @therealwolf

Checkout: http://steem.link/introduction-wolfs-voting-bot

@minnowpond1 has voted on behalf of @minnowpond. If you would like to recieve upvotes from minnowponds team on all your posts, simply FOLLOW @minnowpond.

To receive an upvote send 0.25 SBD to @minnowpond with your posts url as the memo To receive an reSteem send 0.75 SBD to @minnowpond with your posts url as the memo To receive an upvote and a reSteem send 1.00SBD to @minnowpond with your posts url as the memoAs a follower of @followforupvotes this post has been randomly selected and upvoted! Enjoy your upvote and have a great day!

Thank for a great read. We do have a ICO problem, as this level freedom without regulation many abuse to start scam-venture, unfortunately at the cost of fellow investors. Following for more of this ;)