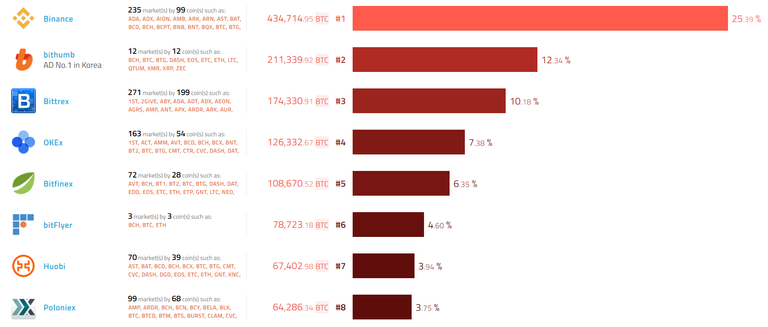

Asia currently holds the most of the cryptocurrency trading volume. Shown in the chart below is the top exchanges sorted by trading volume. China, South Korea and Japan are the primary contributors to this trading volume.

Since the Chinese ban on Bitcoin, and the more recent crackdown on Bitcoin mining electricity consumption through restrictions on power use in areas with low-cost electricity, the trading volume and Bitcoin miners have simply moved to Japan or South Korea. This is why we saw the pretty harsh regulation implemented by South Korea, excluding all non-Korean citizens from trading at Bithumb among others.

This boils down to the fact that a lot of the trading volume on Bithumb is more than likely coming from Chinese traders which have moved their assets to exchanges outside the Chinese governments reach.

Making the assumption that since the Asian market holds the most trading volume, we should naturally assume they also hold the most cryptocurrency. Many of us are also making the assumption that cryptocurrency, Bitcoin, and distributed ledger technology will continue to grow, some even believe it will happen exponentially. With such unequal distribution of capital, in favor of the Asian continent, any resemblance of the Blockchain revolution we all want, will most likely result in a economic shift of power.

In the event that the cryptocurrency total market cap encompasses all trading, in all asset classes. Alongside all contracts, applications, server hosting, cloud storage, insurance, streaming, Forex trading, etc. etc. As of 2017, the global fiat market cap is estimated to be around $280 trillion, this estimate was made by Credit Suisse. This by all accounts a best-case scenario, which is likely to never occur, but still, the possibility is still there.

I think it is fair to assume that in the event of our cryptocurrency revolution, in a 5 years time the cryptocurrency market could encompass 10% of the global wealth, this assumption is made using the exponential growth seen in 2016, and 2017 in combination with the rapidly growing number of use cases that this technology brings. A 10% encompassing of the global wealth market capital would put the total cryptocurrency market cap at $28 trillion. These estimates are by no means professional, or based in reality. They are merely speculation based on the size of the markets which Distributed Ledger Technology has the ability to improve, and/or takeover.

Since the Asian continent also holds the most people, it is also fair to assume that the wealth distribution coming from cryptocurrency gains will be more distributed amongst the population. Of course it will not be a fair distribution, but a more diversified wealth distribution than we will see in the US and Europe.

My prediction is that this will have a much larger effect than most will anticipate, speeding up the already quickly growing middle class in Asian economy. Even though this sounds scary, I'm not sure its all that bad. Sure, global economic power domination is not optimal, i'll admit, but looking at this through an environmental and humanitarian perspective, it is gold. China, India, and south east Asia are some of the biggest polluters in the world. This is mainly due to them being stabbed economically during the industrial revolution, and continuous today, by the West of course. The white man is always to blame, hard to admit.

Asian countries has because of bad country economics and a rapidly growing population had to resort to environmentally hazardous energy production such as Coal mining. With a big influx of wealth into the Asian economy might be the push they need to stop fucking up our planet.

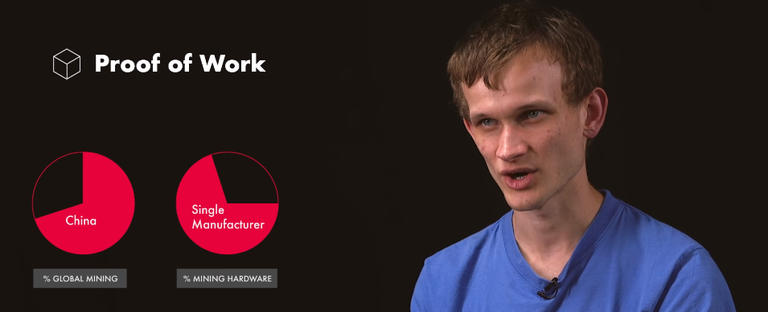

Anyhow, I believe as time goes, we will see the global trading volume evening out with more and more institutional money flowing in from the US and Europe. I do however believe that Bitcoin and Blockchain mining will primarily be in the hands of a few Asian mining pools for the foreseeable future due to climate, proximity to mining rig production companies, current trend, and Asian ingenuity.

"70% of mining (Bitcoin mining) is done out of China, and 70% of mining is done using mining hardware created by one company, and run by basically 5 - 10 guys."

- Vitalik Buterin

Sources

Top trading volume exchanges

https://www.coinhills.com/market/exchange/

China Bitcoin exchange ban

https://www.forbes.com/sites/kenrapoza/2017/11/02/cryptocurrency-exchanges-officially-dead-in-china/#471fea42a839

China regulates Bitcoin mining power usage

https://www.cnbc.com/2018/01/03/bitcoin-mining-power-usage-comes-under-government-regulation-in-china.html

South Korean regulation on exchanges

https://news.bitcoin.com/south-korean-banks-crypto-accounts-government-plans-a-ban/

Credit Suisse, Global wealth report 2017

http://publications.credit-suisse.com/tasks/render/file/index.cfm?fileid=12DFFD63-07D1-EC63-A3D5F67356880EF3

Vitalik Buterin on Casper, Proof of work and more

This just goes to show you that NOTHING will be able to stop Bitcoin and all of its children :-D

I agree, Distributed Ledger Technology is here to stay.

You cannot put the genie back into the bottle.

Good

Yes, very good indeed