I want to start of this post with some disclosure. I do own KuCoin Shares, and use KuCoin's Exchange, and I'm therefore bias in my opinion. Keep this in mind when reading this post. Furthermore, IF you appreciate this post, and want to get started with KuCoin Exchange. Please use my referral link: https://www.kucoin.com/#/?r=1y3a6 or use my referral code: 1y3a6.

It makes 0 difference for you when joining KuCoin, but for me, it means the world. Since I want to get out of the hamster-wheel and start writing posts like these on full-time, any help is much appreciated. I hope you find this post useful.

To give you some sense of my credibility in this field. I have extensive experience using the following exchanges: Coinbase, Gdax, Bittrex, Bitfinex, Binance, Yobit, HitBTC, Huobi, Cobinhood, Cyptopia, BitGrail, and KuCoin. Out of all of these I recommend the following:

- For Bitcoin, Ethereum, Litecoin and Bitcoin Cash trading, use Gdax Limit/Stop-Limit orders to minimize fees

- For all other Coins, use KuCoin to the greatest extent

- If KuCoin have not listed the Coin you desire, use Binance

Addressing China Shutdown rumours

KuCoin is based in Hong Kong, which is located in China, but is not subject to the rest of China's laws and regulations [4]. Hong Kong retains its own economic system, which distances them from any regulation placed on Cryptocurrency exchanges in the rest of China. This is because Hong Kong was a British colony from 1841 to 1997, and has since been subject to China's "One country, Two systems" policy [10]. This means that KuCoin will not be raided, or shutdown.

Now let's look at why everyone should look into joining the KuCoin Clan (pun intended, couldn't contain myself, I'm not a racist, or a monster, please don't hate me, fuck Trump).

KuCoin Share Review

"Currently, the daily exchange volume of each worldwide top 10 platform has already reached $100 million and maintained the prosperous development. Based on the calculation of 0.1% commission, the daily income of a vibrant platform shall reach $100,000" [1][2]

KuCoin offers a Bonus Plan for every user holding the KuCoin Share. They share 50% of the Exchange revenue from the trading and withdrawals fees with the KuCoin Share-hodlers, these dividend payouts are made daily, and automatically. KuCoin has issued 200 million tokens, 100 million of which is held by the team. They do however provide the statement that at most 100 million tokens will be calculated in the Bonus Plan during the official buy-back and destruction [1][11][2].

This Bonus Plan incentives a Buy-and-Hodl strategy when investing in KuCoin Shares, but more importantly; it gives KuCoin Share the characteristics of a Equity Asset Class, like Stocks [6]. But this Equity is superior, because Equity = Assets - Liabilities, and KuCoin basically have 0 liabilities, being operated in a decentralized manner [7]. Why is a big deal then? Well, because institutional investors are traditionally used to valuing an investment opportunity using tools such as Price / Earnings, or P/E ratio. Earnings in this equation meaning = revenue - costs [8].

When evaluating investing in KuCoin Shares, investors will now have a foundation for the valuation applying the P/E ratio on KuCoin Shares. This is in contrary to almost every other Cryptocurrency which is operating on a Proof-of-Work consensus algorithm. Proof-of-Work separates the business side from the customer side since miners get the rewards, and users are paying customers.

Proof-of-Work Cryptocurrencies = Shareholder in the economy

KuCoin Share-holder = Shareholder in economy AND Financial trading platform

KuCoin Shares are likely to appreciate in value in bull periods even with stagnant growth of user base for KuCoin Exchange. This boils down to the logic that when in a bull market, assets listed at KuCoin will on average (mean) grow in value, therefore the fees collected from people using the Exchange to trade, will increase in size proportional to the average growth among the available Coins on KuCoin. With 50% of all profits from fees going back to the holders of KuCoin Shares, the earnings for each shareholder will increase, thereby improving the Price / Earnings ratio, making it an increasingly attracting position to hold even for investors not using the KuCoin Exchange.

Furthermore, the KuCoin Share's equity dividend structure is daily, and not yearly as seen in most Equities, or Stocks. Compound interest can be thought of as interest-on-interest, and it's the holy grail for large scale investors [3]. As the dividends are paid in the coins of respective cryptocurrency instead of getting fiat cash dividends, they are already re-invested to provide these daily compounding dividends. Since the only compounding interest attributes of KuCoin Shares is based on the premise of 3 points:

- KuCoin Shares typically holds the greatest trading volume on KuCoin Exchange, meaning a large portion of the fees being distributed comes in the form of KuCoin Shares, this will in turn increase your share of the collected fees.

- The Coins distributed from the fee collection will likely increase the trading volume since users now own more Coins than they would have if they performed the same trading on an Exchange which keeps all the profit from trading fees.

- Since dividends will be distributed proportional to the Coins trade volume, you will get larger dividends in the most traded Coins. This is likely to lead to increased interest and awareness of not-yet-researched Coins, and will result in increased diversification of Cryptocurrency portfolios. This in turn will promote increased trading on the KuCoin exchange, further feeding the shared economy financial trading platform.

- KuCoin Exchange offers lowers trading fees for trades being settled using KuCoin Shares as payment method for the fee.

Example to show the effect of daily compounding and yearly compounding:

- Stock A has a 5% yearly dividend to shareholders. On the day of this dividend yield, the total distributed dividends value will be subtracted from the total market cap of Stock A. Investing 1000 USD in Stock A will result in the yearly compounding dividend equal to: 50 (USD) = 1000 (USD) * 0.05 (Dividend)

- Now ponder that the 5% yearly dividend from Stock A is now distributed in a daily compounding instead of yearly:

5 (Dividend) / 365 (Days) = 0.01369863013698630136986301369863 (Daily Dividend)

51.27 (USD) = 1000 (USD) * (1 + 0.01369863013698630136986301369863 (Daily Dividend)) ^365 (Days)

If Stock A and KuCoin Share is priced the same, has the same earnings, and the same dividend yield, KuCoin will be a more attractive position to hold in a long-term dividend yielding portfolio. When this process is done using a larger investment, and for a longer period than one year, the benefits of daily compounding really adds up. Like the snowball rolling down a hill.

Now calculating the P/E for KuCoin, let's use their estimate shown in the quote above as baseline for this study. Assume that KuCoin makes 100,000 USD per day from fees, 50% of this capital is subject to token-holder dividends. 50,000 (USD) * 365 (Days) = 18,250,000 USD in yearly dividends. Let's also assume they will destroy or distribute 100,000,000 of the 200,000,000 million tokens, leaving 100 million left.

0.1825 (Annual(Yearly) USD dividend per Coin) = 18,250,000 (USD dividends) / 100,000,000 (Tokens)

54.03 (P/E ratio) = 9.86 (Current USD price 2018-01-17 10:47) / 0.1825 (Dividend)

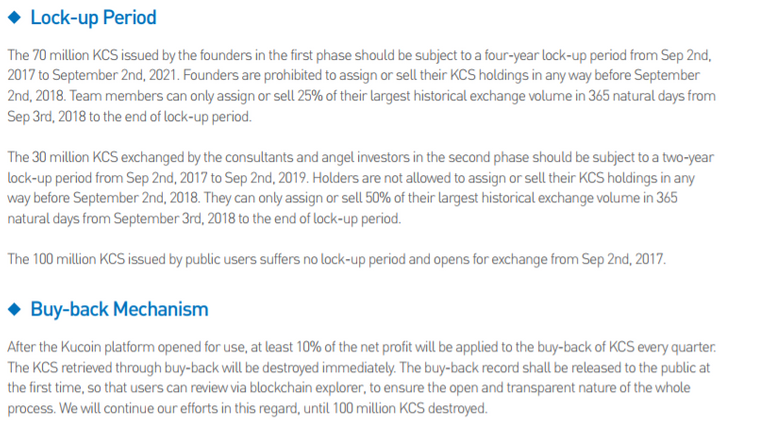

This calculation does not take the daily Compounding interest effect into account, which applies on KuCoin, but instead uses a yearly dividend model. I'll admit I didn't want to spend the time doing that calculation also. Also note that the total tokens used in the calculations is a lowest possible estimate. Below is the information regarding KuCoin's Buy-back mechanism and Lock-up period.

[1]

Now back to KuCoin Shares Bonus Plan, the dividends you receive are in the Coins which the trade/withdraw fee came from. This means you will automatically be paid in an automatically diversified Crypto portfolio providing you with exposure in the Coin market with a balanced portfolio since the weights of each Coin is determined by the trade volume in that Coin. You will therefore receive a portfolio which will have the largest weight in the most traded Coins, therefore automatically letting the market reach consensus on your ideal Crypto portfolio.

This also makes KuCoin Shares a possible Hedging opportunity for your Crypto portfolio [5]. Since we have established the incentive for a buy-and-hold strategy, it should further be strengthened in times of bear markets since a lot of traders will move their risky positions, either into fiat currency, or a larger cryptocurrency which is less likely to be as affected by the bear market. Trading will therefore increase during these periods, resulting in higher dividends from the increased fees being collected. These fees will be even larger than most will anticipate since fees will be collected from people moving capital into KuCoin Shares, and into BTC and then sending them off to an exchange which lets them sell the assets for fiat currency, meaning they pay a fee for selling, then for the withdrawal. Considering trading done using KuCoin Shares as payment is cheaper than using other Cryptocurrencies, will further increase the flow of capital towards KuCoin Shares, and add further momentum for the compounded earnings you receive.

Also, because of the Equity characteristics that KuCoin Shares display, and available trading pairs between KuCoin shares and smaller Coins, capital is likely to flow into KuCoin Shares. This is also likely to happen in a rapid pace since people are more urgent to get out of their positions. Holders are of KuCoin will also be less urgent to sell of their assets, on average that is, meaning the KuCoin supply will likely have a large spread on sell orders, while the buying orders should clear the Supply quickly, which of course results in a increased price.

KuCoin Exchange

My personal experience with KuCoin has been pretty flawless in comparison to most other Crypto exchanges. I'll admit, when it comes to platform response-time, Gdax takes the price. But when it comes to trading Altcoins, KuCoin is the creme of the crop. On their markets tab you can easily navigate through their list of available cryptos, with real-time updated prices without having to enter the Coin specific trading view. Prices are also displayed in both USD and BTC, which makes head calculations a lot more easy. The speed at which you can trade with this tool is amazing, for every person who ever wants to get out of a position quickly, or trade in multiple currencies in a rapid manner, this function is gold. Their website is very intuitive, making it easy to navigate, and find what you are looking for.

KuCoin has giveaways and airdrops regularly, by simply moving existing positions in Cryptos being listed on KuCoin, you can earn airdrops. These airdrops are very well advertised and visible, making them accessible to every user, without the user having to actively search for Airdrop and Giveaway opportunities.

Maybe the most attractive part about using the KuCoin exchange is its accessibility to new Coins. KuCoin is one of the top contenders when it comes to quick listings after completion of ICOs. This means that users of KuCoin can enter markets before the herd.

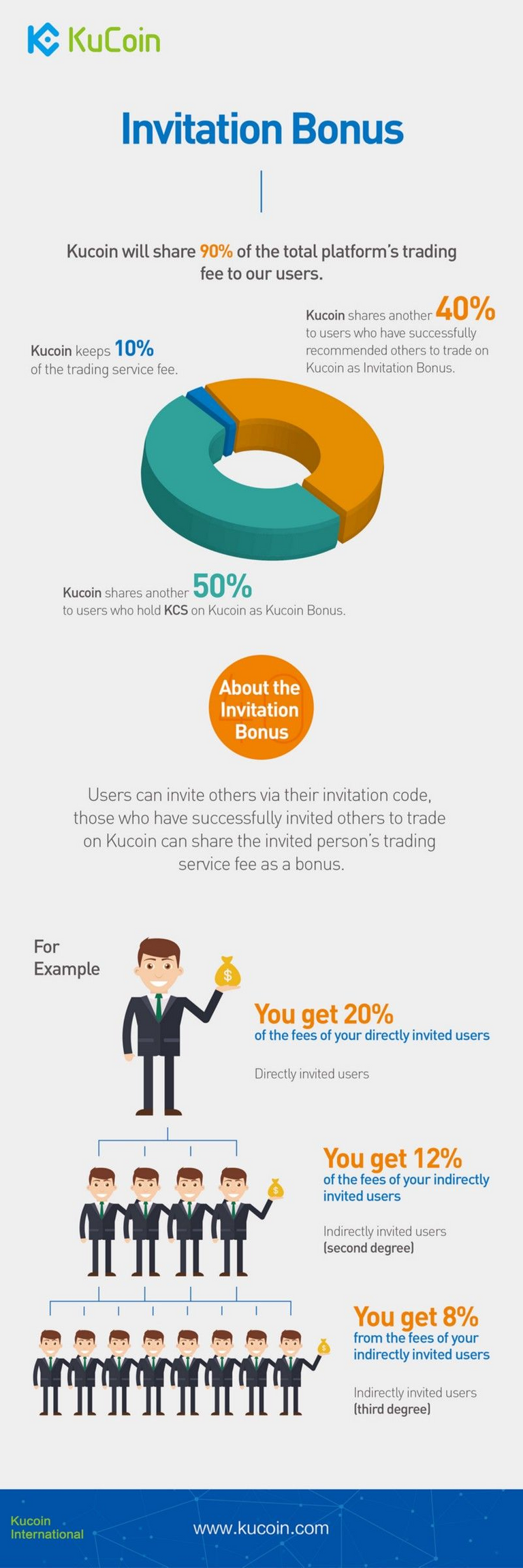

KuCoin Invitation Bonus

KuCoin offer a very attractive referral program. This is an Affiliate program based on the Multi Level Market (MLM) business model, aka. Network marketing. Example of businesses operating on a Multi Level Marketing business model are Herbalife (Accused of being a pyramid scheme, might very well be true), NuSkin, AMway, etc.

Many people associate MLM bussinesses with pyramid schemes, with well justified basis for their opinion. A pyramid scheme is defined by the requirement of up-front payment to enter the business, and it also promises payment from other participants in the pyramid scheme down your "recruitment chain". Why this is a scam is because if they promise a x % return from each person below you in the chain, and then from the next person in their chain, and so on and so forth, it soon becomes impossible to pay out since it will create 0 income on the bottom levels, and eventually the pyramid will crash. This is however NOT the case with KuCoin, which promises additional portions of the trading fees collected from your "recruitment chain", but with a maximum of 3 levels and it requires no signup fee [11][12].

[2]

Once again, if you did appreciate this post, and want to get started with KuCoin Exchange. Please use my referral link: https://www.kucoin.com/#/?r=1y3a6 or use my referral code: 1y3a6. Also if you want to stay updated with Cryptocurrency news, you are welcome to follow me on Twitter: https://twitter.com/AxBlocks

Concluding remarks :

The rapidly growing number of holders of Cryptocurrencies will only increase the public interest for Cryptocurrencies, likely leading to more people getting into trading Altcoins and investing in ICOs. With KuCoin's very attractive promotion offers currently, and the great platform they offer, I expect to see the user base for KuCoin grow in a rampant manner, like we have seen with Binance and Coinbase recently.

Also considering the recent signup halts we have seen from Binance, Bittrex and Bitfinex, not being able to handle all the growing customer base. This is a testimony to the potential market share that KuCoin has the opportunity to acquire. Furthermore, the recent regulation placed upon South Korean exchanges will lead to the capital that was moved from China to South Korea during the September China Fud, will now likely partially flow in to Kucoin's Exchange and KuCoin Shares.

Stats and Links :

Coinmarketcap - https://coinmarketcap.com/currencies/kucoin-shares/#charts

Website - https://www.kucoin.com/#/?r=1y3a6

Twitter - 100,000 Followers - https://twitter.com/kucoincom

Reddit - 7118 Readers - https://www.reddit.com/r/kucoin/

KuCoin news - https://news.kucoin.com/en/

Telegram Contact - https://t.me/KuCoin

Telegram News - https://t.me/Kucoin_News

#KuCoin #KucoinShares #KCS #Binance #Gdax #Coinbase #Yobit #Huobi #Cryptopia #Cryptocurrencies #Blockchain #Crypto #ICO #Airdrop #Giveaway

Sources :

[1] KuCoin White paper

[2] KuCoin Website

[3] Compund interest (interest on interest)

[4] KuCoin base of operation

[5] What is Hedging?

[6] What is an Asset Class?

[7] What is Equity asset class?

[8] Price / Earnings - P/E

[9] Asset classes

[10] Hong Kong

[11] KuCoin Exchange Bonus Plan introduction video

[12] KuCoin Bonus Plan

https://assets.kucoin.com/kucoin_whitepaper_en.pdf https://www.kucoin.com/#/?r=1y3a6 https://www.investopedia.com/terms/c/compoundinterest.asp https://imgur.com/a/xSFXH https://bitcoinexchangeguide.com/kucoin/ https://captainaltcoin.com/kucoin-exchange-review/ https://www.investopedia.com/terms/h/hedge.asp https://www.investopedia.com/terms/a/assetclasses.asp https://en.wikipedia.org/wiki/Equity_(finance) https://www.investopedia.com/terms/p/price-earningsratio.asp https://en.wikipedia.org/wiki/Asset_classes https://sv.wikipedia.org/wiki/Hongkong https://news.kucoin.com/en/kucoin-bonus-plan/

Just signed up after reading a few posts like this one. Shame I didn't see this back when I signed up for Binance. I bought $500 worth of BNB back in late Nov. If I'd know about Ku I def would of signed up with them instead. Though Binance has been good to me. Got me into Neo at $38, so can't complain.

Nice post.

Thank you Steve! Happy trading

Hey, thank you for posting this in depth review about KuCoin. I am just beginning my crypto investing journey and being able to have a diversified portfolio without researching every coin is a godsend.

Hey, It's my pleasure. I hope you found it useful, and good luck on your cryptocurrency adventure.

Let me know if you have any other question I might be able to answer for you

@originalworks

Great post! Detailed as well.

I understand that Kucoin is having some serious withdrawal problems at the moment. Is it still a good investment? Can anyone advise on the current state of Kucoin exchange?