HOMELEND

Homelend is an ecosystem platform where real estate will be financed for home buyers. The platform will offer decentralized and transparent procedures for the young couple and mature citizen looking for a secure platform to access funding. Homelend makes interfaces for coordinate communication between borrowers, loan specialists, and other stakeholders in the mortgage industry. This permits mortgage crowdfunding utilizing p2p security models, transparency and automation given by ledger distributed technology (DLT) and smart mortgages.

What is the home connection ecosystem platform?

Homelend will link borrowers and loan specialists together without the need of intermediary but rather controlled by smart contract. The Borrower will apply for a home loan advance through Homelend’s ecosystem platform. This application is examined and affirmed (or not relevant) through machine learning and man-made consciousness methods. Every moneylender would then be able to buy an "iris" to raise pre-affirmed advance assets. All procedures are controlled by non-human mortgage brilliant conventions. On Homelend's ecosystem platform, data gathering is done "all-computerized". Indeed, even the information in paper-based records must be exchanged to a circulated stockpiling based advanced stockpiling innovation. This information is given by the client and checked through an expert confirmation supplier.

The financial resource will flow from the borrower (at last the vender) financial asset to the mortgage organization is absolutely executed by the smart mortgage. Homelend's money related administrations, controls or choices.

After the purchaser gets pre-endorsement from the framework, they get a home loan on the home loan ecosystem platform regarding a specific property. Thusly, the borrower will influence a specific face and the measure of the credit to will be resolved.

Homelend Business Model

Homelend platform is a decentralized solution that will extraordinarily improve the probability of home financing for some people and families. Our incentive for touchy social orders and dynamic methodologies has settled on p2p systems that utilization innovation. All things considered, Homelend depends on a sound and beneficial plan of action, and is very much aware of the business sectors that are inadequate in the market demonstrate. Homelend, then again, makes speculation open doors for some people through arrangements that coordinate customary enterprises into land with inventive innovations, for example, blockchain. Then again, numerous people, including the present constraints of conventional credit hazard models,

Favorable position Homelend

Since quite a while ago, streamlined and effective in documentation

Homelend actualizes a p2p that automatic process that lessens business forms from 50 to 20 days by embedding’s business rationale into smart contract mortgages, digitizing documentation and dispensing with pointless procedures.

Homelend will solve the poor service delivery

As a result of the sureness, security, and transparency that DLT gives, you can record exchanges, including advances, without a bank going about as a go-between. This lessens the expenses for the borrower and moneylender while limiting the separation between them.

From questionable and inconvenient to straightforward and simple to utilize

Homelend expects to make a basic and reasonable advance process and in addition being smart. This enables the Borrower to apply for a credit whenever, track the status of the application whenever, and interface specifically with the home loan moneylender.

From solid, dependable and tenable

Paper-based procedures and centralization are enter factors in the uneasiness and weakness that describe the customary home loan industry. On account of the one of a kind sort of DLT and a smart contract, Homelend can give an ecosystem platform where individuals can trust, be straightforward, and safely exchange a considerable measure of cash.

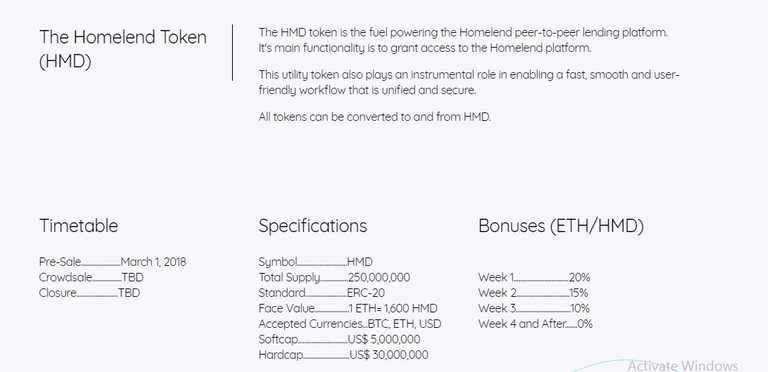

Token Homelend (HMD)

The HMD token is a fuel that backings the Homelend distributed credit ecosystem platform. The fundamental capacity is to give access to the Homelend ecosystem platform.

Token –this is a utility assume an imperative part in executing and keeping up a quick, smooth, and easy to understand coordinated work process.

All tokens can be changed over to HMDs.

The symbol : HMD

Supplying : 250 million +

Standard : ERC-20

Face value 1 ETH = HMD 1,600

Currency : BTC, ETH, USD

Soft cap : US $ 5 million

Hard cap : US $ 30 million

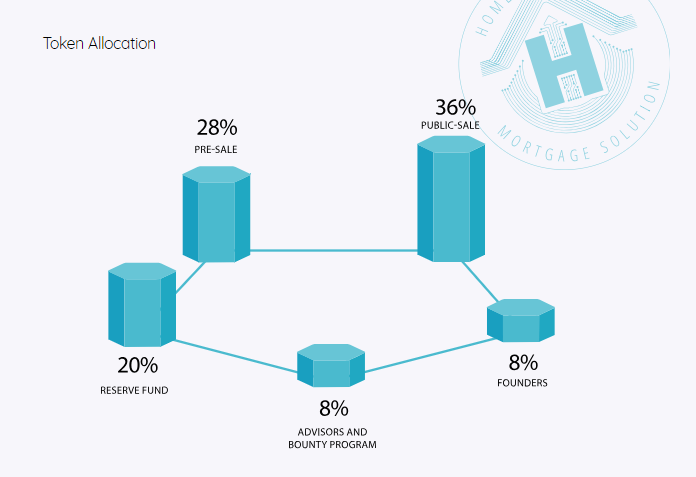

Token allocation

28% of pre-

36% General Sales

Reserve Fund 20%

8% of advisors and bounty programs

8% Founder

Continue to use

General Administration 25%

40% Development

35% of architectural society and marketing

Roadmap

Group and Advisor

Official Team

Itai Cohen, Chief Executive Officer

Netanel Bitan Chief Technology Officer

Ricardo Henriquez, Chief Innovation Officer

Amir Nahmias

Group improvement

Michael Tanfilov Strategic Planning Director

Kanat Tulbassiyev is a main engineer of square chains

Slam Stivi Backend Developer

Visual fashioner Quijano Sol Alvarado/Assistant people group

Vinod Morkile Block Chain Developers

Advisory Committee

Eliran Madar Business Development/Investor Relations

Joram Uzan Entrepreneur

Moti Friedman Marketing Consultant

While Danny was assessing

Raghuram Bala Analytical Technician

Isando Samuel Sun Block Chain Expert Advisor

Marc Kenigsberg Tokenomics Advisory and Data Management

Business Growth Consultant Haham Adina

Give Feedback MORE INFORMATION MORE INFORMATION Links below:

Website: https://homelend.io/

Telegram: https://t.me/HomelendPlatform/

Facebook: https://www.facebook.com/HMDHomelend/

Twitter: https://twitter.com/homelendhmd

ANN thread : https://bitcointalk.org/index.php?topic=3407877.0

https://bitcointalk.org/index.php?action=profile;u=1299546

As a civil paralegal who has seen the fiasco MERS made of the land records in the US; I have preached for years how blockchain technology could repair that situation, remove the rampant fraud (yes Jaime Dimon; I'm talking to you and your ilk AGAIN) perpetrated by the traditional, fiat institutions and restore our ability to finally have security in our mortgage system after all of these years. I'll most definitely be investigating this project further. Thank you for bringing it to our attention; and for bringing this idea into the cryptosphere where it belongs!!!