Why are most Venture Capitalists politically liberal? Why are most tech startups based in heavily taxed and regulated California, New York, and Massachusetts? If VCs invest in innovation, why has there been such little innovation within the venture industry itself?

These are questions I have been trying to figure out over the past 22 years as a serial entrepreneur and then, most recently, as a liberty activist/politician. At age 19, I started my first company during the .com era, met with hundreds of VCs, and received term sheets for over $100MM in venture funding. For a variety of reasons, I never went the venture route, although I spent a brief amount of time as a venture capitalist after the .com bust.

I adopted a libertarian view of capitalism at an early age and have been involved with the liberty community for the past 8 years through The Free State Project. I have always viewed individualism and voluntary exchange as being at the heart of capitalism. This understanding is at odds with the three questions I posed above.

The Blockchain Revolution has the potential to decentralize power, money, and information in a way that benefits everyone on the planet by empowering every individual through voluntary trade. Trying to answer the three questions posed above against the backdrop of the blockchain revolution reveals that the traditional VC ecosystem is a clear and present danger to the widespread adoption of blockchain technology. I have outlined my reasoning below along with a plan to combat these parasites.

Venture Capitalist Defined

I think the following is an accurate definition of a venture capitalist.

Venture capitalist

a middleman who invests other people’s money (much of it taxpayer theft) into startups.

Traditional venture capitalists typically exhibit the following traits.

They invest little to none of their own money

Most VCs fail to outperform the market

VCs make a nice living off of fees regardless of whether or not they make money

Synonym: middleman, parasite, crony

What do you mean by taxpayer theft?

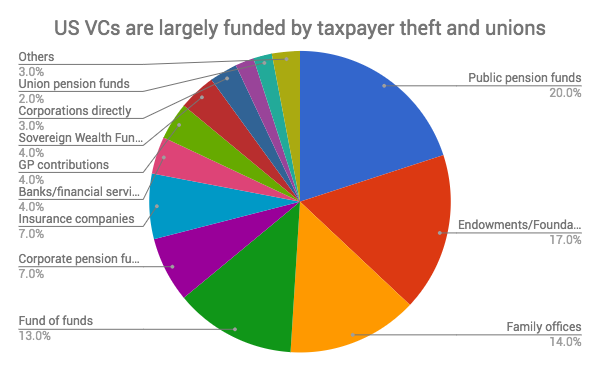

There is nothing wrong with investing and managing other people’s money; however, the largest investors (limited partners) into the venture funds who back innovation are ~50% funded by taxpayer theft and unions.

Public pension funds provide retirement benefits for public employees and are funded through force by taxation. Universities enjoy non-profit status, receive billions in taxpayer theft-funded research grants annually, and receive payment via student loans that can’t be discharged via a typical bankruptcy procedure.

Source: Dow Jones' Private Equity Analyst.

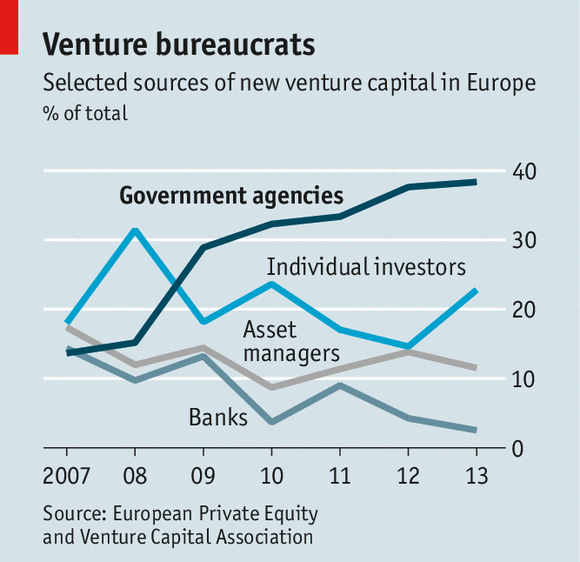

And, if you think this is pathetic, take a look at Europe:

So if you add up public pension funds, endowments, sovereign wealth funds, union pensions funds, and some percentage of fund of funds (since the other categories I just mentioned also invest in fund of funds) you get to over 50% of venture funding coming from organizations that are funded by taxpayer-theft. Many of these public pension funds and university endowments have social goals for investing (outside of just trying to maximize financial returns). This influences who gets funding, where the funding happens, and when the funding occurs.

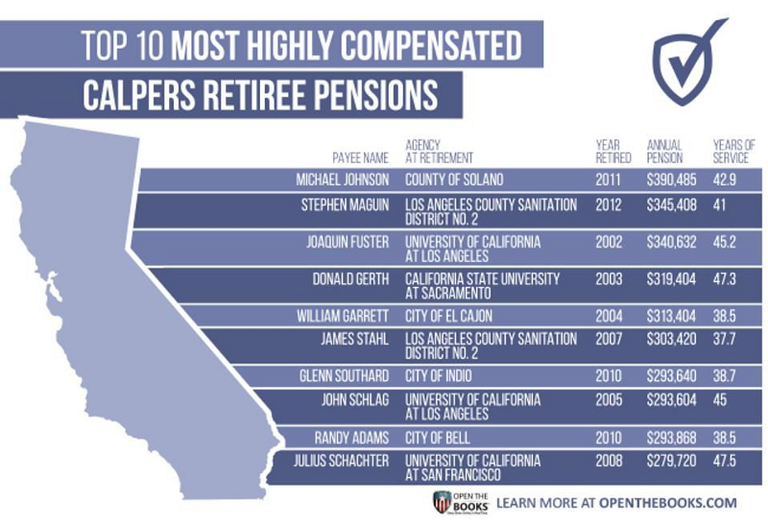

The single largest public pension fund investor is California Public Employees' Retirement System (CalPERS). As of June 2016, CalPERS announced that they held $26.4 billion in Private Equity investments. They have previously stated that they have a target of 5% of their Private Equity holdings reserved for venture capital. This means that CalPERS holds ~ $1.3 billion in venture capital investments. The total venture capital investments for 2016 was $61.4 billion.

CalPERS includes all CA state employees including teachers and their bloated university system. All of CalPERS money comes from taxpayer theft.

Let’s dig one level deeper and see who the biggest beneficiaries are of the CalPERS pension system.

I bet you never thought that one of the biggest beneficiaries of venture capital investing was the former administrator of the County of Solana, Michael Johnson, who rakes in $390,485 per year or that a retired sanitation worker from LA makes $345,408 per year!

One of the only things more collectivist than public employees (more specifically the employees of a mandatory, compulsory public education system) are any types of funding strings that might come at the direction of those who invest pension funds on their behalf.

How the taxpayer-funded investors in venture capital politicize venture investing and promote malinvestment

You don’t think the type of people that would manage a public teachers pension fund would make investment decisions based on ideology over financial performance, would you? CalPERS history of “social investing”. This is a matter of fact and a case study in the potential damaging effects of public pension investing.

“CalPERS has also steered billions of dollars into politically connected firms. And it has ventured into “socially responsible” investment strategies, making bad bets that have lost hundreds of millions of dollars. Such dubious practices have piled up a crushing amount of pension debt, which California residents—and their children—will somehow have to repay.” -Steven Malanga, City-Journal, Winter 2013

At the peak of the mortgage crisis, CalPERS lost $160 billion of value in their portfolio. Of course, they have a habit of not taking responsibility for their actions and have sued everyone from ratings agencies to investment banks. Fortunately for taxpayers, CalPERS ultimately lost a Supreme Court case (5-4) regarding their suing of some of the major investment banks.

Bullying venture funds into not making capital calls to cover-up their other poor investments

When a venture capital fund says they have raised $x million, they don’t actually have that money sitting in the bank.

Here’s how it works:

*Limited Partners (like CalPERs): commit to investing a certain amount of money into a venture fund

*When the venture fund needs to make an investment (or group of investments), they make a capital call.

*The limited partner is contractually committed to invest the money as per the terms of the agreement. If they default there are mechanisms for buying out the limited partnership interest at a discount, etc.

Here’s an example of what happened during the mortgage crisis in 2008 and how it negatively impacted startups:

*CalPERS places outsized bets on mortgage backed securities and on direct investments in real estate in California and New York that ultimately went bankrupt.

*Their reckless positions put them in a position where they have to liquidate their more stable holdings (like Apple stock) in order to maintain minimum liquidity levels.

*Leveraging their size and influence as large limited partners, they “subtly” tell the venture funds that if they make a capital call, they will honor it but may be disinclined to invest in the venture firms' next fund

*Many venture funds choose not to make the capital calls choosing their LPs interests over the companies they invest in.

*The companies didn’t receive the funding they expected and either have to scale down or go out of business.

Sound far fetched? This actually happened during the crisis. And this is exactly the kind of thing that venture capitalists don’t tell you.

Myth versus Reality

There have been numerous books, articles, podcasts, etc. about the mysterious of venture capital. Like every other type of middleman, the thrive in obscurity and have gone out of their way to make what they do look like magic. I want to demystify some of this for you.

The process by which traditional venture funds are structured, how they raise money, and who the raise money from tells you everything you need to know.

A typical venture fund last for 10 years and the agreements that the venture funds have with their investors determine the parameters for the size, state, amount, geography and industry of investments.

These initial agreements spell out which industries they can invest in, how much they allocate for initial investment (say Series A) versus follow-on investments, where they invest (California for example) and how much is allocated for salaries and overhead. Typically 2% of a fund is allocated for salaries and overhead per year!

As an example, a fund may only be able to invest $3-$5MM in Series A technology investments and may not exceed $15 million over the lifecycle of that investment and must invest 75% of their investments within a 25 mi radius of CA.

They will try to convince you that it is there superior intelligence and experience that leads them to whether to invest or not and at what valuation. You will hear things like “venture capital investing is more of an art than a science”.

The reality is that these are more likely factors that determine whether a VC invests than the merits of the opportunity:

*How much of their fund do they have left?

*How has the rest of their fund performed?

*Do they risk being embarrassed and losing LPs because your business model is too innovative and might offend a “social investing strategy”?

*Is your contact at the venture capital firm junior within the firm (do they have any clout)?

*Is there some internal political battle/pissing contest between the partner sponsoring your deal versus the senior team?

Knowing the structure of venture funds and the source of funds allows me to finally answer my three nagging VC questions:

Why are VCs based largely in CA and MA?

Their largest taxpayer-theft funded LPs (like CalPERS and Harvard University endowment) are located in those areas and it is a contractual term in the investment deal.

Why are VCs liberal?

Over 50% of their funding comes from taxpayer-theft related sources. In short, their funders are liberal and have a liberal social investing strategy using other people’s money)

Why don’t VCs innovate?

The standard 10-year deal fund structure is dictated by their large, bureaucratic, tax-payer theft funded investors.

My view of capitalism wasn’t wrong. Venture capitalists are actually Venture Socialists.

As an entrepreneur, there is no reason to subject yourself to this crony fraud.

This is why ICOs are such a threat to VCs, and also why the VC ecosystem, desperate to protect their crony enterprise, are the biggest threat to ICOs and, by extension, the broad based adoption of blockchain technology.

The crony VC threat to ICOs

If you have a startup and can raise money through an ICO, you don’t need a VC. Further, if your ICO is for a legitimate utility token that provides value within your ecosystem, what is the possible usefulness of having a VC buy a bunch of your token at the ICO. The short answer, there is none.

“The most massive market manipulation and pump-and-dump schemes related to ICOs comes from VCs themselves. They are the principals artificially manipulating the price of these tokens, denying the ecosystem of valuable tokens, and keeping the opportunity to make money out of the hands of the individual and the entrepreneur”.

Technically putting together an ICO isn’t all that difficult or expensive. However, VCs and their crony lawyers, accountants, and banker pals have tried to instill FUD into the marketplace. If you talk to a lawyer today they will tell you that an ICO will cost at least $200K, and will propose the following kind of breakdown:

*Legal fees: $50K (this includes making sure that you comply with securities laws, put all of the BS disclaimer language into the white paper and marketing document), and draft appropriate advisory agreements.

*Accounting fees: $50-$75K: If you want to sell to foreign investors you will need to talk to a big accounting firm and form an offshore entity in a place like Switzerland or the Cayman Islands.

*Smart contract development: $50K to develop a smart contract

*Smart contract audit: $10-20K (kind of an equivalent to having audited financials if you were doing a traditional IPO)

Marketing/PR: $50-100K to use a “top tier” firm

They will tell you that SEC action is expected any day now and that you should protect yourself from any pending action. They will also tell you that in order to pay for the $200K+ in fees in order to get the ICO launched, you should take equity capital from VCs. As an added benefit, it is discussed that the VCs will invest in your ICO. How is this whole structure not a pump and dump scheme?

Also, consider this: It takes the average startup 7 years to get to liquidity. This is going to generate hundreds of thousands in legal fees for lawyers during that time period. If liquidity is nearly instant, and if people replace lawyers with smart contracts, how do these law firms stay in business? The motive behind SEC scare tactics is becoming clearer now, isn’t it?

Sowing the seeds of SEC-sanctioned destruction

The whole approach taken by the VCs, their cronies, and the SEC mirrors the .com bubble. I started in ecommerce company in 1995. At one point, we went around the country meeting with investment banks and gearing up to do an IPO (this was in the 1999 to 2000 time frame). I remember meeting with a “top equity analyst” at one of the most noted investment banks during the .com era. If I recall correctly, he had put out a buy rating on a public e-commerce company that had a $100MM burn rate and negative gross margins. I asked him, “what was there path to profitability, to make it up in volume?” Of course, that once high-flyer ultimately went bankrupt. At the time, however, the investment bankers that were in the room told me my burn rate wasn’t high enough and that the most important factor for them in doing an IPO was who the venture investors were and whether or not we had locked up a multi-million dollar contract with a company like Yahoo! or Excite.

This is an outline of the generic VC/crony pump-and-dump Y2K internet scheme:

- Hype up internet portals (Yahoo!, Excite, Lycos, Geocities) and take them public. The first major round of companies to go public were portals/search engines. These companies weren’t profitable but the analysts and bankers pitched them on the amount of traffic they had and the potential for ad revenue. They would forecast advertising revenue based on what would appear to be ridiculous CPMs (cost per thousand impressions).

- Promote the future of success of ecommerce companies as being based on exclusive, uneconomical advertising deals with portals: In order for your e-commerce business to succeed, analysts and bankers would claim that you needed to lock up advertising with one or more of the major portals. These partnerships would often involve you paying $50MM+ in order to acquire a customers that would require a completely unrealistic number of repeat purchases to make the ROI work. That didn’t matter, they said. It was a land grab, they said. You had to be first. They made money on the portals they just took public by inflating their revenue with these horrible contracts, and then positioned themselves to do the investment banking on the next crop of ecommerce IPOs. This is the stuff of Pets.com legend.

- VCs and their cronies win/the public and entrepreneurs lose. In some cases the SEC came in and slapped the bankers and analysts on the wrist after the fact. For the most part, the bankers and analyst did fine while the public and the entrepreneurs suffered.

My point in all of this is not to say that the SEC should do more. It is to say that the SEC has been and will always be complicit in providing a safe harbor for this type of activity. Put simply, they are unnecessary. The individual should be able to make their own decisions, not the SEC-Wall Street crony complex.

All of these regulators and cronies are at risk if ICOs are allowed to continue as it is very quickly being exposed that they add no value and inhibit innovation.

Consider this, you already see the venture community rallying around ICO-platforms like Coinlist. They are already pitching the benefits of being compliant and make statements like:

“Get access to vetted blockchain investments. CoinList uses best practices honed from years of startup investing experience on AngelList to screen and select blockchain companies.”

You don’t think that “vetting” might mean that their VC buddies get in early and have the opportunity to participate at a deep discount, do you? This hypocrisy needs to be exposed, and individual rights and voluntary trade should be defended with maximum effort.

Protect blockchain freedom for all/expose and destroy the cronies

It is for this reason that we are taking a firm stance at Stark360 (http://www.stark360.org) to fight against these cronies and promote the real power of blockchain technology: empowering the individual through voluntary trade. The parasites in the venture capital community are trying to use scare tactics to convince you that you have to take their money, use their lawyers, and use their platforms. They are trying to defraud the public into thinking that their participation in the deal makes it sound for others.

I have been involved in the crypto community for 7 years. Guess what, the VCs weren’t involved in the creation of Bitcoin or Ethereum. They are parasites trying to use their connections and influence to come in after the fact and cement their positions through obfuscation using lawyers and accountants.

Defending blockchain freedom will require action, some of it proactive and some of it reactive. Here are some initial action steps:

Expose the structure and nature of the venture capital ecosystem: Create and share memes about VCs and their cronies in Stark360’s FB group. In my experience, these cowards don’t like to have public attention drawn to their nefarious activities. Informing other entrepreneurs first and then the public about how the venture capital ecosystem works is a very low effort activity that can reap some positive results.

Expose cronyism and collusion in real-time: If you are an entrepreneur meeting with VCs and their ilk, to the extent it is legal, record what they say regarding their role and value in the ICO process. The public hates hypocrisy, and any future action by the SEC can be rendered moot if we aggregate enough rage by demonstrating that it is the parasite class in conjunction with the SEC creates the bubbles. This fight is for the individual and decentralization and against cronyism and collectivism. We have the moral high ground.

Fight the SEC publicly and in court: There is no reason to think that the SEC is necessarily going to clamp down on ICOs. In fact, most of the really questionable behavior is coming from the companies that are VC-backed. Keep in mind how absurd the scare tactics are coming from the lawyers. Ask yourself this question, to the extent you have a token that is used within your ecosystem, what possible value is there in having “accredited investors” hold a bunch of these tokens? If there is any pump-and-dump or market manipulation going on, it is happening here. Also, consider their track record. Is there any evidence whatsoever to suggest that the SEC did anything to prevent either the .com bust or the mortgage crisis? Does the organization learn from its mistakes or is it a revolving door of cronyism that sows the seeds of the next wave of destruction? The first head of the SEC, Joseph Kennedy, was a bootlegger. Since then, they have all been bootlickers. That tells you just about all you need to know. Stark360 will deploy a decentralized network of activists, investigative journalists, and lawyers to publicly expose SEC corruption as well as challenge their actions in the court on behalf of blockchain companies.

Change the law: Even if there are bad rulings and any subsequent appeals are unsuccessful, always remember that Congress makes the laws that the SEC follows. Stark360 is working on proposed legislation to clearly deregulate the SEC with respect to blockchain matters.

Final thought

Note: Everything I mentioned above applies to traditional VCs. To the extent that there are new and innovative models emerging (which I hope there are), keep an open mind to those and please contact me with information about them. However, here is a quick guide that I would use in considering whether to take money from a venture investor:

Are any of their investors funded through taxpayer theft? If yes, kick them to the curb. You don’t need the social investing strategy of a bunch of parasites. You also don’t need to have information about your company broadcast everywhere (btw, this is one of the real reasons VCs don’t sign NDAs). VCs leak information like a sieve by virtue of the reporting requirements they have to their investors.

Do they add any value besides cash? If no, they’re out. Money is plentiful and there is an order of magnitude more money available in crypto than in all of the venture funds combined.

Do they believe in individualism, free markets, and voluntary exchange? If no, they are a bunch of commies trying to profit off of your effort all while trying to destroy your freedom.

The potential of decentralization, individual empowerment, and voluntary trade dwarfs the impact of the internet by 100X. This is the good fight, and the traditional VCs and their cronies are the enemy.