Fibonacci harmonic patterns are commonly used by traders to identify buy and sell signals. They're statistical patterns with many variations that have been profitable in the long-run since the early 2000's.

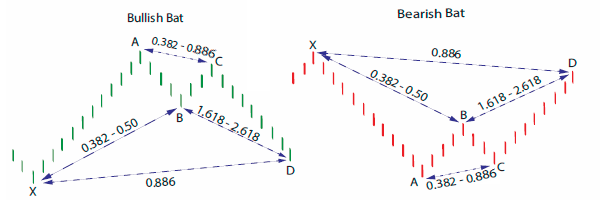

Here's a quick overview of a Fibonacci Bat pattern:

- D is the buying or selling price

- X is typically the stop loss price, but it should be slightly lower/higher

- B is typically the take profit price

Here's a market example of a Dash/USD trade using a 3 hour chart:

- Buy at $305

- Take profit at $345

- Stop Loss at $280

Risk/Reward Ratio

Risking: $305 - $280 = $25

Potential Profit: $350 - $305 = $45 or 14.75%

Risk/Reward Ratio: $45/$25 = 1.8

To stay profitable in the long-run, make sure that you're risking at least as much as your potential return, which means maintaining a risk/reward ratio of at least 1.

Happy trading!

Sir i want to ask u, the most important fibonacci lavel in 0.886 at XD ?