11 September 2017

Review of the first two weeks

In his teachings on superforecasting, Prof. Philip Tetlock insists on the importance of finding the right question to ask.

Are indicators determinants?

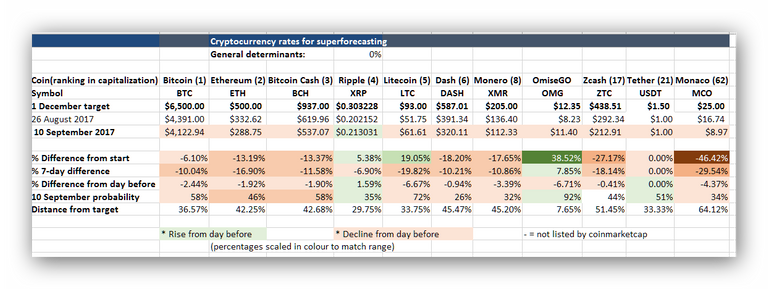

I started on 26 August with the query whether major cryptocoins would increase by 50% in three months (by 1 December). My major interest was whether the market would move according to indicators (I identified seven), i.e. are they determinants?

The seven indicators

My keywords for these indicators were price, validity, (as a) refuge (from crises), (other stock) investments, (political) context, competition and governance. I scored them plus or minus 5 to 1 %, depending on how firm the developments were.

Few solid developments, but many small ones

As might be expected, few developments earned 5% in either direction. A Chinese statement against illegal ICOs (initial coin offerings) could not be scored at any more than 1% because of the ambiguities. Most analysts attribute the percentage declines (up to double figures) over the past week to a threatened Chinese crackdown. Some thought it showed the Chinese authorities were concerned purely wth scams and want to provide a safe framework for cryptocurrency investors.

Will all boats rise with the tide?

But does it make sense to set the same goal for all cryptocoins being studied? My presumption was that the market itself was growing as a whole, and therefore the cryptocoins should all rise together as their attraction increased for investors.

Revising the goals

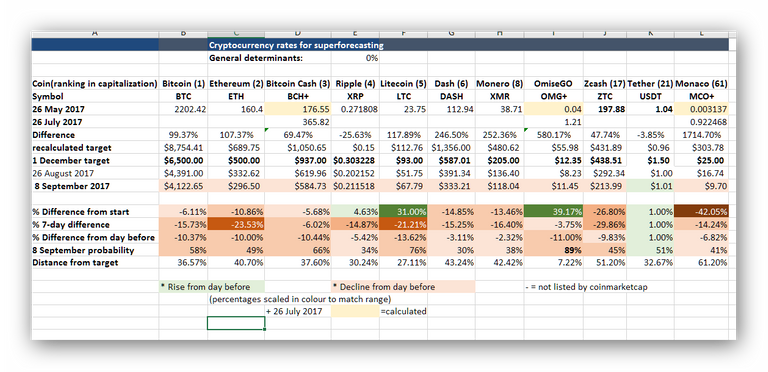

But the two-week changes and the three-month history suggested this was not true. Some cryptocoins, even among the strongest, have suffered more than others. So I extrapolated back three months from 26 August and then forward for each cryptocoin being studied. This is the result:

Some tokens were only launched after 26 June, so I had to calculate a fake price back from the 26 July - 26 August result.

I was not convinced by this approach, so I have left the goals as they stand. The previous three months did not typical progress, particularly with the spikes and falls. Even excitable analysts found the results anomalous.

Cryptocoin developments

Japan's GMO goes into bitcoin mining

GMO, an online giant, has announced it will operate a bitcoin mining center in Northern Europe.The 7 September statement said:

"We believe that cryptocurrencies will develop into new universal currencies available for use by anyone from any country or region to freely exchange value, creating a new borderless economic zone. Under such situation, it is important for cryptocurrencies, including Bitcoins, to secure its reliability as currency in order for them to further develop and spread."

Cryptopolis and Crypto Valley, 8 September 2017

Chiasso tax office will accept bitcoins from 1 January

Chiasso, on the Swiss border with Italy, is following the northern Swiss town of Zug in allowing citizens to pay taxes in bitcoin. From January 2018, taxes can be paid in bitcoin up to a value of CHF250 (around $260).

It is more of a publicity gesture, until the ceiling is raised. But the municipality revealed that eight startups have chosen Chiasso to open their businesses and negotiations with others are underway. The Chiasso Mayor has met with a group of entrepreneurs, and Chiasso will consider being a founding partner in a non-profit group of disruptive technology leaders. It also announced the first of regular Meet Up meetings in October with international representatives.

The capital of Switzerland's Crypto Valley, Zug, accepts bitcoin for tax payments up to CHF200.

Crypto Valley announces work on ICO Code of Conduct: 7 September 2017

CVA's statement recognized that "The rapid development of token launches has raised concerns around stability and security, and? investors are often unaware of the true nature of their investment, and the documentation published to accompany token launches often minimizes or ignores the associated risk.".

"Four of the five biggest [token] launches have been based here, raising bitcoin and ether worth a combined total of over US $600m," the statement said.

It added:

"The CVA is fully convinced that, in the long-term, token launches are a sound, innovative approach to raising investment capital. Switzerland should support this trend by being the first country to recognise and support these tokens and token launches.

"This should be achieved with clear, comprehensive yet flexible regulation that clarifies the legal status of token launches, tokens and the investments made therein.

"We also believe the industry would benefit from a clear code of conduct surrounding token launches, to help companies fulfil their legal and moral obligations and give investors a clear understanding of the risks involved.

To this end, the CVA and its members have begun a project to draft such a code of with the help of a multi-disciplinary team from the fields of law, tax, accounting, cybersecurity, communications, and more."

Both these developments seem hardly large enough to rate a score as viability and governance indicators until the tax acceptance is more important and the code is completed.

Zug sets up CryptoHub

London, Berlin and Singapore already have them. Now Zug is to get a cryptocurrency and blockchain hub, known as "Genesis Crypto Valley Labs", with room for at least 30 startups. It is due to open later this year, and plans to be the first of several, according to its cryptocurrency backers in an announcement on 4 September.

The backers are a risk investor specialized in insurance, a digital investment bank and crypto specialists at a Swiss law firm. The companies' websites had no confirmation of the finenews report on 11 September.

Swiss fintech cooperation pact with Singapore and deal with Israel

Swiss Fintech and Technology Association (SFTA) and Singapore Fintech Association have signed a memorandum of understanding for closer cooperation, according to a statement on 6 September 2017.

A Swiss delegation is to visit the Singapore Fintech Festival in November. Representatives from Singapore in turn will visit Switzerland in 2018.

Ueli Maurer, the Swiss finance minister, on 4 September signed an agreement with Israel's finance minister to increase cooperation between the two countries' finance industries with a view to boosting fintech, reported finenews.

Swiss crypto 'sandbox' for small companies

Maurer has suggested that companies which have accumulated less than $1 mln in third-party funds would be allowed to test out their innovative financial technology ideas without the usual regulation surrounding finance and digital currency.

Though not specifically targeted at cryptocurrency enterprises, banking licenses are also being re-evaluated, he said, to allow small firms to obtain licenses for those who offer deposits, but not lending.

To encourage crowdfunding and offer funders more security, the government plans to raise the legislated time that donors can withdraw their donations from seven days to 60.

Together these minimized regulations will allow for "sandboxes" where startups and smaller companies can experiment and innovate within controlled conditions.

These are certainly developments worth scoring if they come about, and even more if they spread beyond one country or attract substantial money. A Ministerial announcement is a pretty solid promise in Switzerland. It would require a national referendum to halt the law if it is passed.

Breadwallet

[The swissinfo website profiled the country's fintech in a 23 August article] timed for the arrival of a cryptocurrency start-up, Breadwallet](https://www.swissinfo.ch/eng/business/crypto-valley_swiss-fintech-steps-up-global-hub-drive/43460244).

'Swiss blockchain know-how comes to Russia'

This was the blockchain news headline on 7 September for a report by founder Richard Kastelein about a Tatarstan conference entitled "Blockchain: The New Oil of Russia".

Søren Fog, co-founder of the Crypto Valley Association, headed the Swiss delegation and gave a speech on starting a blockchain and cryptography ecosystem from scratch.

He told blockchain news:

"Blockchain-based solutions for industry, especially supply chain, may have a game changing effect of the elimination of counterfeits from the market, inclusion of third world service providers and freeing up immense amounts of working capital bound today in the supply chain, creating a win for particularly developing countries. I'm committed to help the Russian government in the execution of pilot projects in this and other areas."

During the conference VEB, the biggest Russian institute coordinating developing programmes, agreed with Fog to collaboration on implementing blockchain projects in the Russian Federation.

They also discussed creating a joint Swiss-Russian Centre of Competences in blockchains, said Kastelein.

Nelli Orlova, CEO of Innmind, a Vaud-registered startup and investors platform with members in Belarus, Ukraine and Russia, also took part in the Kazan conference and released an overview of blockchains for the public sector.

UNECE expert named keynote speaker at blockchain conference

InnMind announced its first Meet Up on blockchains in Stockholm on 7 September. It is one of a series of conferences.

Marcelo Garcia, a Smart Cities Expert of the United Nations Economic Commission for Europe, was named as keynote speaker. His topic: "Blockchain economy: how it will influence the development of the technologies and innovations". However, he did not appear on the conference's website list of speakers as of 11 September.

Marcelo was slated to brief participants on startup projects and blockchain initiatives in UN member countries. He is a blockchainer and founder of BroadLights.org, supplying "affordable wireless broadband to the most vulnerable communities". His grandfather built the first news radio station in Brazil, he records. Marcelo is a longtime resident of Switzerland. He is associated with Barcelona's IESE Business School in its public-private partnerships sector for cities.

Earlier commentaries

Excel version

Click here for an Excel 1997-2003 version of this table with records for every day until now, free for download. There's also an Excel version of the shorter summary screenshot used above.

Superforecasting

Indicators

I've listed my seven indicators and explanations of what I consider important here.

Wow that's a lot of information. Thanks. What are the target prices in your excel analysis based on?

I haven't seen the comments before. Sorry it has taken so long to reply. The target price is 50% above the August 26 price in three months. I started with a 50% probability (a coin flip). I thought three months would give crypto coins a chance to overcome any blip from the July-August rollercoaster. The 50% target was pretty arbitrary (it works out at four times the original price in one year). I was more interested in seeing how much developments (rather than simple investments) were reflected in the price, though price movements are obviously also a stimulus. Hope that helps you understand what I am after.