In my last post I told you what I like about TenX, why I am investing, and what I don’t like about TenX. If you have no idea what TenX is, and what a TenX Token will offer you → READ ABOUT IT HERE

Before I start a numbers based comparison between TenX and other market players, I want to point out that it’s up to you to do the math yourself (so don’t blame me if I made an error at some point in the calculation. You are welcome to point it out and I will fix it). And don’t take this post as investment advice — it’s my personal opinion.

I also want to point out again that an ICO (or to be more specific a Token sale in the case of TenX) is not an IPO. You don’t own a share of TenX if you hold a Token. But that’s not the only difference — you can’t compare a white paper with a sales prospectus. The controls in the stock market are super strict, and if you claim something, you better deliver — or your ass will get sued.

With an ICO and a white paper you are in the wild west. It’s a new frontier, and the old rules don’t necessarily apply. How binding the promises in a white paper are and how easy you could press claims on a document like that — that’s new territory.

Last time I pointed out that I loved that TenX combined the Token sale with a venture capitalist approach and that I love that they have a working product. The Token sale is just the next round of funding. Normally you lose 50% of your company in the first founding round with a venture capitalist. If you make it to round two you lose another 30%, and that’s only if you have something to show for. In the case of TenX, they only started with the second round (the Token sale) after they had a working product. That’s not only fare to the Token investors — it also means they only collected the money they need to grow (round two) and didn’t get all the money upfront in one round (development & growing) like most ICOs, where you get a huge unknown.

How much trust you put in the white paper numbers, that’s up to your intuition. I personally think the numbers for 2018 are realistic. The numbers for 2019 and 2020 are dependent on a lot of factors.

How fast is the world changing and adapting crypto? How much competition will there be out in a year or two? How good is the tech of TenX, and equally important, will the founders of TenX keep efficiently working together in the future? The last point might seam trivial, but a huge number of companies fall apart because the founders grow apart. I point all of that out because investing in a startup is a gamble. You are not investing in a company that’s been publicly traded for years and already found its niche. The higher the risk the higher the returns you have to get from an investment.

And now lets have a look at the numbers :

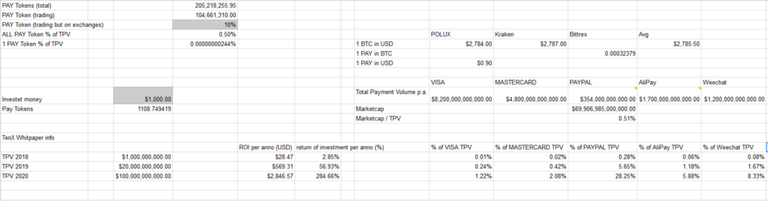

Lets start with the simple stuff. There are 205.218.255,95 TenX PAY Tokens and 104.661.310 Tokens trading on exchanges at the moment. 0.5% of the total payment volume gets divided among the PAY Token holders. So 1 PAY Token represents 0.00000000244% of the total payment volume reward. For the calculation I made the assumption that 10% of the publicly traded Tokens will stay on an exchange account and therefore will get no share of the payout. If you make an investment today (1 PAY = 0.90 USD) you should get an ROI (return on investment) of 2,85% in 2018, 56,94% in 2019 and 284,71% in 2020 according to the TenX white paper (and the assumption that 10% of the Tokens don’t get a share of the reward).

Let’s compare the goals of the TenX white paper with other payment providers to get a feeling for the volume we are talking about.

Visa processes a total payment volume of 8.2 trillion USD a year.

Mastercard processes a total payment volume of 4.8 trillion USD a year.

Paypal processes a total payment volume of 0.354 trillion USD a year.

So if TenX is able to achieve the goals of the white paper, they would process 0.28% of the PAYPAL volume in 2018, 5.65% of PAYPAL in 2019 and 28.25% of PAYPAL in 2020. By 2020 they would make > 2% of the Volume of Mastercard.

( https://docs.google.com/spreadsheets/d/1w_0HDUp9vYymE_8VdmibAoszvZg4x6e4xpwigfuFonA/edit?usp=sharing )

Sounds like a lot, doesn’t it?

Yes and No.

It’s just my two pennies worth, but when you look at the volume of Visa / Mastercard and Paypal you only see the western part of the world. Alipay and Weechat processed 2.9 trillion USD together in 2016. If you not only focus on the western world but also look at the “future growth” markets, you might see these numbers. There is a lot potential for a crypto payment provider. The timeline 2020 might be a moon shot, but 0.1 trillion USD in Total Payment Volume could be realistic some day soon.

If there is an easy way to spend crypto in the real world (e.g. a TenX card), transferring crypto like cash between people becomes a lot more realistic. Think about it. If you are able to spend it with ease, you are more likely to accept it instead of cash. What if you could pay your cleaning lady over your phone from your crypto wallet to her crypto wallet and she uses her TenX card to buy groceries in the shop? In the western world with a hard currency you might pay her in USD or EUR for now, but in country with a good amount of inflation or huge burdens to get a bank account, that might already be a huge improvement on the status quo.

Also there is a chance that crypto could establish itself as the new cash. Think about what happened in India, where over night cash became practically worthless .. (just google the words India and cash if you have no idea what I’m talking about). You may be able to see the value crypto might have to someone from e.g. India.

The timeline of TenX might be a moonshot — but 0.1 trillion USD in Total Payment Volume is doable.

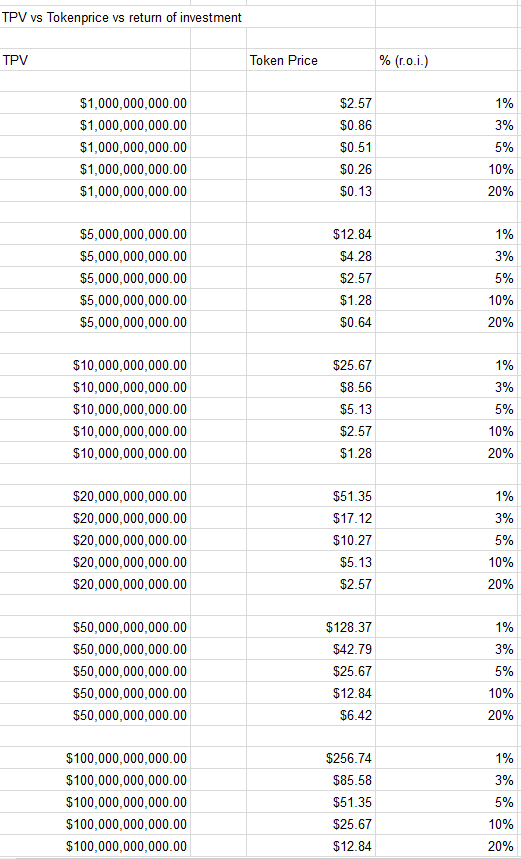

Let’s have a look at the question what should I pay for my TenX Pay Token?

Well, it depends on your expectations. Let’s put the return of investment in relation to the Total Payment Volume and see where we stand and in what direction we are going. As you can see, if TenX makes it to 1 billion Total Payment Volume, a 3% ROI means a token price of 0.86 USD. I don’t see too much risk in TenX getting to 1 billion (but that is, like this entire article, just my personal opinion). Let’s say they make it to 1 billion and the next milestone is 20 billion in 2019. If they get to 20 billion and you expect an ROI of 20%, it would mean a PAY Token is worth 1.28 USD to you.

How realistic this target is will change over time, and with the results TenX will provide… but I stick to my opinion. At the current price TenX is worth the shot.

If you want to download the calculation and check my math => https://docs.google.com/spreadsheets/d/1w_0HDUp9vYymE_8VdmibAoszvZg4x6e4xpwigfuFonA/edit?usp=sharing

If you want to share your opinion on the matter, post a comment.

And if you liked the post, you can drop me a PAY token (or Ether so I can buy more PAY ;) : 0xb1CeD1F256b9d5088eecE9b9D8ba08CF1976D109

I updated the calculation.

Now I split between the circulating Token supply and the total Token supply. I also included the present value of a perpetuity ("ewige Rente" in German) in the calculation to have a base for calculating a "fair" token price.

https://docs.google.com/spreadsheets/d/1w_0HDUp9vYymE_8VdmibAoszvZg4x6e4xpwigfuFonA/edit?usp=sharing

Thanks for sharing this with us. I was lucky and got into the TenX ico and get 12k Pay tokens. I belive its a pretty good investment. My point of view:

https://steemit.com/cryptocurrency/@rockz/tenx-why-i-believe-in-pay-tokens

Congratulations @chris83! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPawesome article on TenX mate...please check my passive income assumptions on this video and let me know what you think? I'm basing the payout numbers on 105,000,000 current tokens (I know that is a round up).

https://www.youtube.com/edit?o=U&video_id=LYnYzCqoUyc