Investing and trading cryptocurrencies is almost entirely speculative as the technology is still quite young and there are no widely accepted and reliable valuation metrics to use for valuing coins as investments.

Therefore it is highly psychological and emotional for some people. For these reasons, the high volatility and fear-greed cycles continue to drive investor decisions to buy & sell in ways which, to put it lightly, are against their best interests.

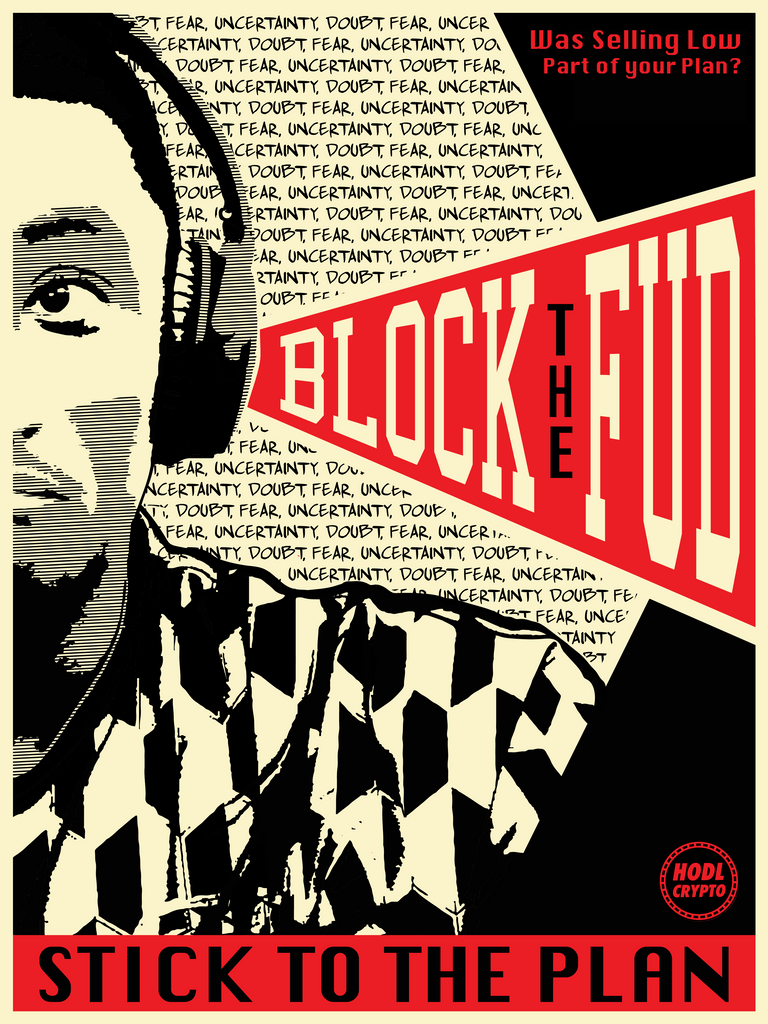

It's human nature to listen to FEAR, UNCERTAINTY, and DOUBT (FUD) in order to protect your investments. In fact, it is a protective mechanism for you to pay attention to FUD. For long-term success in the crypto space, you will need to learn to block the FUD and HODL in a down crypto market.

FUD comes in various forms and affects some more than others; both coins and their investors.

Primary Examples of Crypto FUD (Macro-Level):

- Government regulation and bans on crypto in general

- Exchange hacks and other "mishaps" on exchanges

- Negative mainstream media reports

Secondary Examples of Crypto FUD (Specific):

- Missed Goals/Roadmap targets and deadlines

- Partnerships falling through

- False rumors & disinformation

- Negativity about dev teams and founders

- Misleading technical analysis

While it's true that technical analysis is a valuable tool in crypto investing and trading, if there is big negative news, the FUD Factor will kick into effect and trump any T/A indicator traders are looking for and all the price analysis goes out the window for a massive dump.

If you find yourself in one of these situations holding the bag on a coin with a plummeting it's almost always best to hold and wait for the volatility to blow over. Eventually, prices will consolidate and you will have a better opportunity to make a rational decision more in-line with your original plan of investment.

Always Have a Plan and Stick to it

You should always have a plan and goal for your investment portfolio as a whole, and what role each position plays in the overall portfolio.

Your plan does not need to be stringent enough to prevent any flexibility to adapt to new market conditions and capitalize on them, but it should cover the basics as to when you will take profits, whether based on the value or on a time horizon.

Having such a plan will prevent you from making bad short-term decisions when the FUD kicks in. By sticking to your plan, you make only rational decisions and wait patiently for your milestones on the longer time horizon.

We Can HODL Here - A Tip for Short-Term Thinkers

More seasoned investors tend to handle volatility much better than newbies. If you have a problem handling the short-term fluctuations you may need to work on tricking yourself into thinking long-term.

The "We Can HODL Here" Meme

If you use your imagination, how different would you feel if you could skip past countless days of impulsively checking coinmarketcap and blockfolio and find enormous gains without expending any mental or emotional energy deciding whether to panic sell or not?

At the end of the day, HODLing is a decision only made easier by the passing of time. Impatience is what causes people to screw up and give into FUD.

Was Selling Low Part of Your Plan?

I have a personal friend who recently consulted with me about selling off their crypto holdings, or more accurately, all the surplus capital in excess of what they had originally invested.

This person came to me for advice, on the basis of what they believed to be a rational thing to do. Here is an outline of the jist of the dialogue:

hodl: Why do you want to sell?friend: Well.. I'm not ready to sit through a multi-year bear market

hodl: Now is a very bad time to sell. Do you truly believe we will see a multi-year bear market?

friend: I have no idea, i've been hearing [ABC..XYZ FUD] what do you think?

hodl: Absolutely not, there is no chance in my realm of possibilities we will see a multi-year crypto bear market.

friend: Well, what are you going to do?

hodl: I have no intention to "cash out" any of my holdings until 2020. At this point I will take a look at things and make some decisions. Did you have a plan for cashing out?

friend: Not exactly, but you believe in this much more than I do, and I'm just not sure where I see this going.

hodl: The truth is we should have all taken profits in December, but none of us did. We all suffered from recency bias and got caught up in the greed and hype. Was your plan to sell low?

friend: Lol, of course not.

hodl: Then you should ride this out and decide what level of risk and exposure you're willing to deal with. Wait for this bear cycle to end, and if you still feel over-exposed, which obviously you do now, then take some out.

The Moral of the Story

Always have a plan and a goal to look forward to. During times like these, we really need to be able to "keep our eyes on the prize" and not give in to panic and FUD.Panic selling, and considerations of panic selling are done so because you are thinking your situation may not improve or advance further. Therefore, you are retreating.

Don't retreat - the battle is far from over, and crypto will prevail. I encourage anyone reading this to ignore the FUD despite the fear you may be experiencing.

Design available on prints, accessories, and apparel at the hodl art shop

Block the FUDHold On For Dear Life

Posted from my blog with SteemPress : https://hodlcrypto.org/2018/04/02/block-the-fud-and-hodl-in-a-down-crypto-market/

If your hodling period is more than 5 years, there is nothing to worry about.