Elon Musk finally couldn't help it.

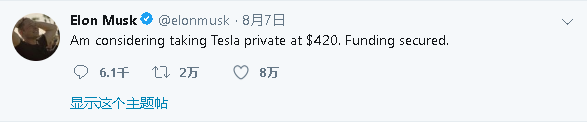

Elon Musk quietly sent a Twitter. .

"I intend to privatize Tesla into US stock and guarantee $420."

Tesla was privatized, that is, delisted and even found funds.

As the deep water bomb of Elon Musk, Tesla's share price has steadily increased ~

In the middle, because Tesla's share price rose too fast, it paused for a while and rose again after the deal resumed. . the reason is simple. The current share price is still a few dozen dollars more than Elon Musk's $420. If it is really privatized, it will sell the appropriate net profit, profitable business, how not to be fired~

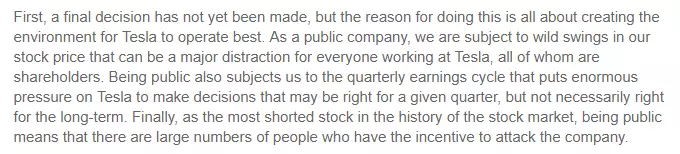

On Tesla's official website, a notice from Elon Musk was issued detailing the reasons for wanting to privatize Tesla.

Elon Musk believes Tesla is the worst stock in history. Every time there is a storm, some people will attack Tesla, which will distract employees.

In addition, in order to make the quarterly earnings more attractive, Tesla had to make some short-sighted decisions, which is not conducive to the company's long-term development.

Last year and this year,

Tesla has always been the shortest stock for short selling

In fact, in the first half of this year, Tesla's market declined due to insufficient production capacity of Tesla and a large delay in delivery.

At the peak of the day, Tesla fell by 30% of its market value in a month. .

The situation was so severe that Elon Musk had to stay up late at the factory to increase the capacity of Model 3 to 5,000 vehicles per week.

A few days ago, Tesla had just released the second quarter of 2018, which is much better than the wolf in the first quarter.

Tesla may achieve sustainable profitability for the first time in the second half after rising income, rising gross margins, cost restructuring, reduced spending and difficulties in solving production problems.

According to Tesla's estimates, by the end of this month, it will be able to produce 6,000 Model 3s per week, and will achieve 10,000 Model 3 targets per week in 2019. Not only that, but as production increases, the cost increase model 3 will be further reduced. . .

After the release of this financial report, Tesla's stock will suffer short-term losses.

However, there are still many analysts who insist that Tesla is pessimistic. Although Tesla’s indicators have improved, the quarterly loss value has once again reached a new high.

If the bears want to make money, they will continue to stay in Tesla's news.

For these short sellers, the mask is obviously unbearable, and even if the stock is repaid at a 20% premium, it is necessary to break the short.

In early May, Elon Musk was ambitious.

He will burn the short seller soon

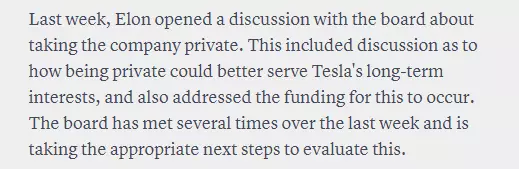

This time, Elon Musk is not empty. According to foreign media reports, Tesla’s directors held several meetings last week on the privatization proposal.

In other words, Elon Musk's Twitter has not risen, he is really ready to release news.

In fact, Tesla's current investment is large and production is small. Despite the promising prospects, it is difficult to bring dividends in the short term, which is far worse than Apple and Microsoft.

Therefore, Tesla has any negative news, which will cause its stock to fluctuate greatly.

In this case, don't try to make the financial report look better, but it's best to delist the privatization and do some long-term plans that are more conducive to Tesla.

In addition, Tesla was not the first to do so, and Dell did the same thing five years ago.

At that time, Dell's personal computer business fell sharply, while personal computer profits were very small. Dell's market capitalization has shrunk from $100 billion in 2013 to more than $20 billion.

At the time, investors had no confidence in Dell and it was difficult to support Dell's transformational investments.

As a result, Dell's founder, whose stock price rose, collaborated with private equity giant Blackstone Group to privatize Dell for $24.4 billion.

After the delisting, Dell began to change, open business services, strengthen software investment, and develop cloud transformation.

In 2015, DELL acquired US data storage company EMC for $67 billion, creating the largest technology acquisition in history. EMC owns 80% of VMware's shares, and Dell indirectly becomes VMware's largest shareholder, all of which make up for the software. Short board. .

After the PC introduced the XPS series, it gradually improved.

Five years later, King Dell returned and plans to re-list.

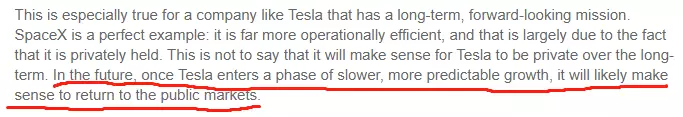

Elon Musk has the same plan. After Tesla's future growth and profitability are stable, it may be better to return to the stock market.

Congratulations @wecha! You have completed the following achievement on Steemit and have been rewarded with new badge(s) :

Click on the badge to view your Board of Honor.

If you no longer want to receive notifications, reply to this comment with the word

STOP