One reason crypto prices can drop so drastically is because of the uncertainty and confusion on how the government plans to regulate cryptocurrencies. Prices can drop 10% in the blink of an eye if a government official has a negative comment. Fortunately, there could be more clarity about the U.S. market after June 13.

https://moneymorning.com/2018/05/29/june-13-is-the-next-important-day-for-the-cryptocurrency-market/

Bitcoin ‘Halving’ 2020: What Will the Price of Bitcoin Be?

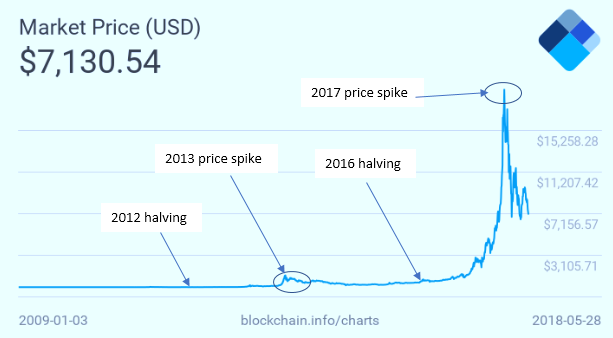

The historical pattern shows Bitcoin prices booming one year after each previous halving. However, history doesn’t always paint a complete picture when it comes to the cryptocurrency market. Case in point, the anticipated Consensus price rally failed to happen this year even after many leading experts made bold predictions.

http://bitcoinist.com/bitcoin-halving-2020-what-will-the-price-of-bitcoin-be/

Ripple Re-Brand To See XRP Listed On Coinbase, XRP Could Rise Over 200%

At the moment, XRP is in the midst of a battle between authorities and Ripple, with authorities (and some disgruntled, ex-investors) claiming that XRP is a security, as a result of Ripple owning a majority in the share of it. Moreover, Ripple know that in order to see XRP generate some real value and become a truly adoptable cryptocurrency

https://cryptodaily.co.uk/2018/05/ripple-re-brand-to-see-xrp-listed-on-coinbase-xrp-could-rise-over-200/

The "Axis Of Gold" Just Got Stronger

Russia, China, Iran and Turkey are forming a trading and financial network revolving around gold and are acquiring massive amounts of physical gold to support it. They are steadily moving toward a gold-based balance of payment system.

https://www.zerohedge.com/news/2018-05-27/axis-gold-just-got-stronger

When Franklin Roosevelt Dropped a Bombshell on Gold

The global reaction in fall 1933 was calm bewilderment. Second of four excerpts from “American Default.”

https://www.bloomberg.com/view/articles/2018-05-23/fdr-s-bombshell-on-gold

Bitcoin: DOJ Probe To Decimate Liquidity

If DOJ successfully identifies problematic trading activity, reported volume will decline. I expect a swift correction when liquidity decreases, not unlike what happened in 2008 in the mortgage market.

https://seekingalpha.com/article/4178485-bitcoin-doj-probe-decimate-liquidity

Bitcoin Price to Bottom at $5,700 in Short-Term Before Recovery: Analyst

In summary, my best guess… slowish bleed down to $6800… then a steeper slide to $5700, then a leveling out of the drop… then a flat zone. This is an educated guess based on volume profile and fundamental data framing the rate of movement,”

https://www.ccn.com/bitcoin-price-to-bottom-at-5700-in-short-term-but-recover-analyst/

If bitcoin is a bubble, the ‘panic’ stage is near: economist

According to the late Hyman Minsky, the U.S. economist whose theories on financial fragility came to the fore during the 2008 financial crisis when a surge in private debt accumulation led to the collapse in the housing market, an asset bubble has five stages; displacement, boom, euphoria, profit-taking, and panic. Using this framework, Joost van der Burgt, a policy adviser at the Federal Reserve Bank of San Francisco, said that if bitcoin BTCUSD, -0.84% is indeed a bubble, it’s likely at the beginning of the profit-taking stage, which means panic might be around the corner.

https://www.marketwatch.com/story/if-bitcoin-is-a-bubble-the-panic-stage-is-near-economist-2018-05-31

Bitcoin Price is Being Manipulated, Says Forbes Macroeconomist

According to Peter Tchir, there is an ongoing manipulation of bitcoin price. What the macro and fixed income expert isn’t sure of is whether such price manipulations are against the law. Whether the activities meet the legal definition of manipulation or can lead to a criminal indictment remains to be seen, but I’d be shocked if there wasn’t manipulation of prices occurring. Never forget Rule number two of the Three Rules of Bitcoin – ‘There are no rules!’

http://bitcoinist.com/bitcoin-price-manipulated-forbes-macroeconomist/