So you’re all pumped, you’ve bought your first bitcoin, ripple or whatever crypto is hot these days, now what?

In this post we’ll go through a few storage options for your crypto and make recommendations for how you can protect those sweet and tasty cryptocoins you have!

Where to store your cryptocurrencies

The common name for cryptocurrency storage is “wallet” (did you expect something fancier?).

A wallet is a piece of technology (could be a software, hardware or even paper) to store your cryptocurrency. If we go further on the “real” definition, a wallet doesn’t store the coin perse, it just stores the private key(s) that have ownership over the unexpended transactions of an address. You can check out my post on how Bitcoin addresses work for more information.

Private keys are the most important thing you want to keep safe, these are the “keys” of your own “vault” that keeps your crypto safe. If anyone steals your private keys, they will have ownership of your cryptos.

TL;DR : A wallet stores your cryptocurrency by storing your private keys in a secure way.

There’s many ways to classify the types of wallets, the online/offline availability is the most comprehensive:

Hot Wallets

These types of wallets have access to the Internet, being on your computer or web-based, almost all the time. They carry the risks of an open internet connection, so they’re less secure. On the other hand, they are more user friendly and faster to use.

Cold Wallets

These wallets are more secure because the storage is offline; there’s no way to steal your private keys except in the case of physical robbery.

Other basic classifications you should know:

1. Web wallets

2. Local Wallets (Mobile or Desktop)

3. Hardware Wallets

Web Wallets (Hot wallet)

Web wallets are on online exchanges like Coinbase, Binance, etc. If you make a transaction on an exchange, they will send the crypto to these web addresses. If you want to buy or sell on the exchange, you must use these wallets.

These kind of wallets are the least secure of all the options, because they store the private keys on a centralized server, making it a target for hackers. There has been news in the past about exchanges being hacked and private keys stolen. It’s highly recommended that if you aren’t going to keep trading on a daily basis, you should transfer your crypto to a more secure wallet.

Software Wallets (Mobile or Desktop — Hot wallet)

Software Wallets are downloaded and installed on your computer or mobile phone. They are usually called “light clients”, and are the most common crypto storage.

These wallets may be a bit more secure than the exchanges, and notice I wrote: “may be” because it will depend on the security and vulnerability of your device where you’ve installed the wallet. If your computer is infected with a virus, trojan or malware, it could steal your private keys from your computer.

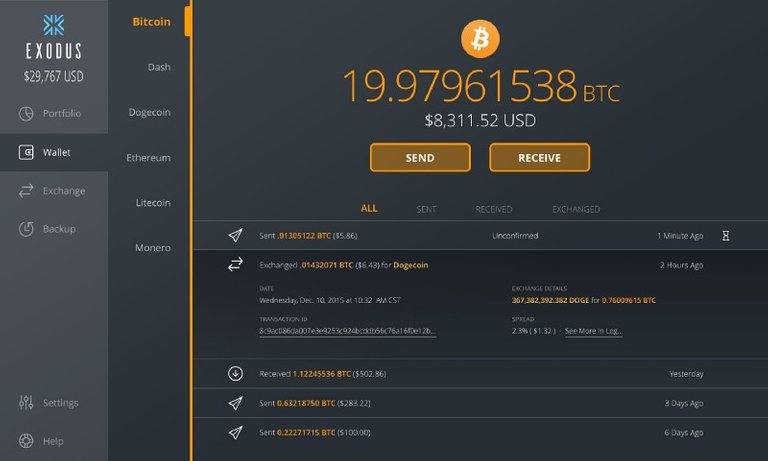

These kind of wallets are easy to use and have a nice user experience. Exodus, or Electrum are some examples of Software Wallets that you can download and play around with.

This is the Exodus Wallet

Hardware Wallets (Cold wallet)

Hardware wallets are the most secure storage nowadays. The security relays on the offline storage of your private keys.

A Hardware wallet is usually a device similar to an usb pen drive, with a small screen on a side and a cable to connect your PC. This device generates and stores the private keys inside and there’s no way to take them out.

You can receive cryptos while your hardware wallet is disconnected from your computer, but when you want to send funds from the hardware wallet, you must connect the device in order to sign the transaction with your private keys.

Another cool thing about hardware wallets is that they have their own little screen and buttons, for you to “navigate” and generate the private keys through that screen. This is important because if your computer is compromised, with a keylogger for example, every button you press on your computer will be logged, but with the hardware wallet it won’t because it’s another device and can’t be infected.

One thing to keep in mind is it’s important to remember your Mnemonic code words (more about this below), if you lose your hardware wallet you can back it up with these words.

The most popular hardware wallets are Nano Ledger and Trezor.

Here’s a Nano Ledger in action!

Paper Wallets (Cold wallet)

Paper Wallets are very safe as well because they store your private keys offline, in a more “vintage” way… on paper! This paper will contain the copies of the public and private keys of your wallet, usually in a form of a QR code, so you can quickly scan them and add the keys into a software wallet to send some funds.

One disadvantage is that paper and ink can degrade and paper’s relatively fragile.

On https://www.bitaddress.org you can generate a paper wallets, is worth to see how it generates it by asking to move around the pointer to get enough entropy (see my post on how bitcoin addresses are created).

This is a Bitcoin paper wallet

TL;DR: Web wallets are the least secure option, because they store the private keys in a server. Software wallets are a bit more secure but it all depends on the security of your device.

Hardware wallets are the best option to store your crypto safely, they store the private keys offline. Paper wallets are as secure as the hardware wallets but having your private keys on paper can have some risks of degradation and broken paper.

Mnemonic Code Words

When you download a software wallet or when you setup your hardware wallet, they give you a set of random words, usually 12 to 24 words. This sequence of words represents a random number that is used as a “seed” to generate all your private and public keys.

It is very important to safeguard this set of words — in the case someone steals your device where you have the wallet or if you forget your password, you can recover the whole wallet with these words. In fact, this words are the most important thing to backup and keep safe!

We’ve covered the most common crypto wallets classifications, but there’s a lot more to look at, in the future I’ll be covering the technical aspects of a wallet and how it works “under the hood”.

Thank you for reading and keep your crypto safe!

Great post, thanks for sharing!