Writing my previous piece (https://steemit.com/crypto/@ryanpumper/how-to-spot-accumulation-in-a-coins-market-cycle) it is interesting to share how news, twitter pushing and tradingview can short-term influence irrational decision making from the novice trader and trigger a mild overreaction in our detailed study case.

As above so below.

How it goes in the small so it replicates on the greater scale.

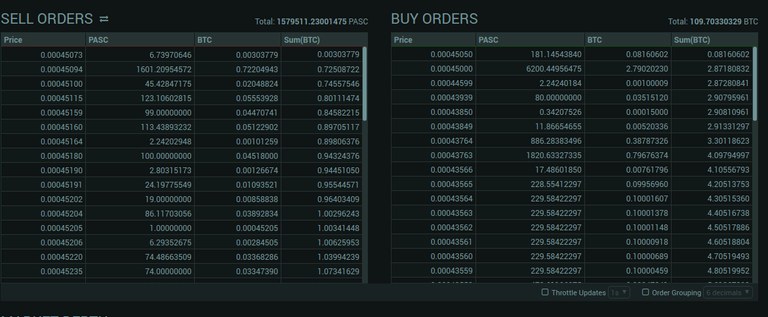

Lets take a look at the orderbook of PascalCoin yesterday 19/6/17.

Order book on publishing of previous article

The usual suspects spread the message same day and (I am not associated) !

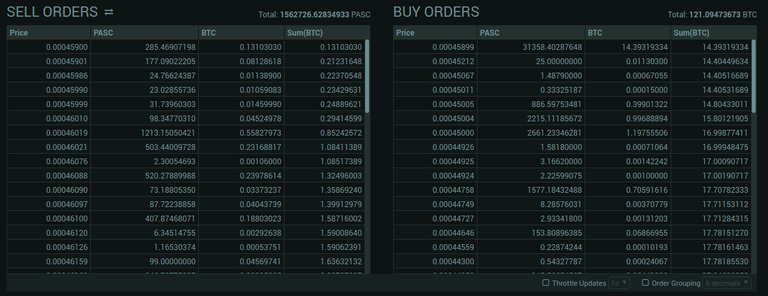

Order book accelerating 30 minutes after publishing

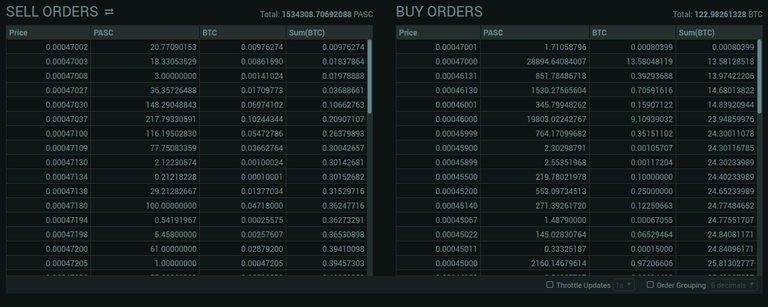

Order book short term distribution phase entry (more on distribution in the next article)

18 hours later

From no interest to shifted interest to no interest in no time :)

How is this possible?

Well, we must always remember the average unskilled trader loves to execute multiple trades on a daily basis… and each trade they execute leaves behind a certain form of residue known as ‘price action’… and it is this price action that attracts even more unskilled traders to contribute their trading volume towards a particular coin and push its price even higher.

Amateur traders are, as a rule, blind to the ‘bigger picture.’

For this very reason, I do not have the slightest problem with being very sharing and open as the fundamentals of the market won’t change!

To them, nothing outside the frame of 24hrs has any meaning, and this is why those that are skilled are practically getting away with rape in broad daylight.

The exchanges love amateur traders and hope, very dearly, that they remain amateur traders because, as you know, exchange platforms earn a fee each time you execute a buy or a sell. So do you think an exchange platform would prefer you to execute only a few trades per month, or hundreds of trades DAILY?

So amateur traders are not only making sure that skilled traders grow richer with each passing month due to their inability to let the market do the heavy lifting instead of the other way round, they are also keeping the exchanges flush with revenue.

Put simply, amateurs are the cash cows of the market.

Now, you have to understand that without that volume being CONTRIBUTED to the market – no one profits. Without volume being EXTRACTED from the market – no one profits.

A skilled trader will understand the bigger picture and increase his turf in those circumstances!!!

Nothing is like it seems in crypto!!!

Hi, got a few questions:

thanks :)

Lovely questions jingis.

Crypto takes care that this utility remains liquid. Even though these days it feels like the Hoover dam broke and I was left in the valley. But I assure you as I did 2 years ago that dam that broke in the last half year is just the small dam in front of a much bigger one that is about to crack in a few years and it will make the recent frenzy look like childs-play.

Thanks for the answer, I'm looking forward to your next posts!

Ryan would you like to join a Crypto Altcoins group on Telegram?

Hey Ryan thanks for sharing. Really enjoy reading all your insight in the market, also your all your old content. Will you be doing weekly altcoin picks just like in the past? Or is that something of the past. Anyway I am really happy that you are publishing fresh content again. :)

Thanks for your words reyesinc.

To be honest I am still orientating with Steemit and what works best with publishing here. However, I am much more philantropic these days just not able to shut up ;-) so weekly picks dont know yet life is much different these days.

Hi ryan, nice to see you on steem!! i am also on your telegram chat (crypto-pirate), i hope to see and read a lot of great articles from you, regards!!

Hi Ryan, can I join your Telegram chat?