Introduction

Legal agreement by which a bank or a similar organization lends money to an individual cannot be encouraging because the rate of interest and particular time at which the sum off money being borrowed can be excessively high.

But with Block66, the mortgage industry does not look bleak as they bring about an implemented change thus acting as a starting engine for brokers and lenders. Block66 has a promising prospect of becoming the world's most sophisticated platform for brokers and Kendra to operate efficiently to the satisfaction of both parties.

What is Block66?

Block66 is a blockchain decentralise application that enables legal agreement by which money is loan and service is offered from lenders to a wide range of borrowers. Loans between lenders and vetted borrowers seem difficult at retrospect, this is due to the fact that there was no transperancy, flexibility and connecting different parties around globe was pretty complex. Block66 offers a new platform to enable transparent and automated finance where lenders and brokers can easily access themselves in the marketplace. This innovative will ensure success in a growing market.

How will Block66 stabilise agreement between lenders and brokers?

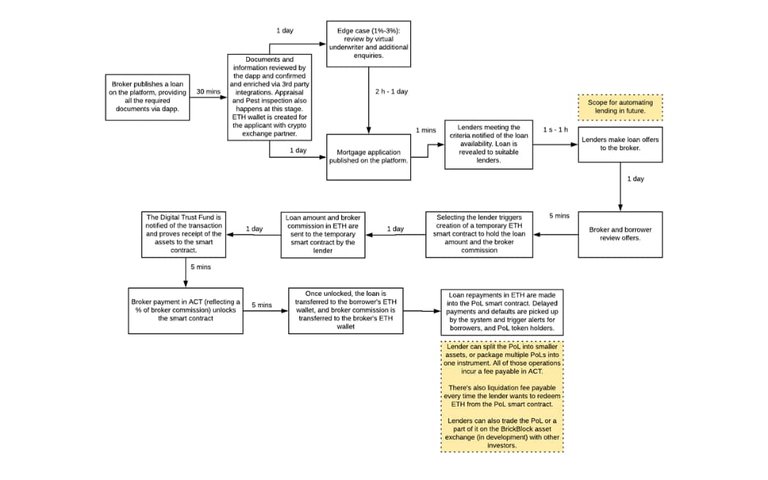

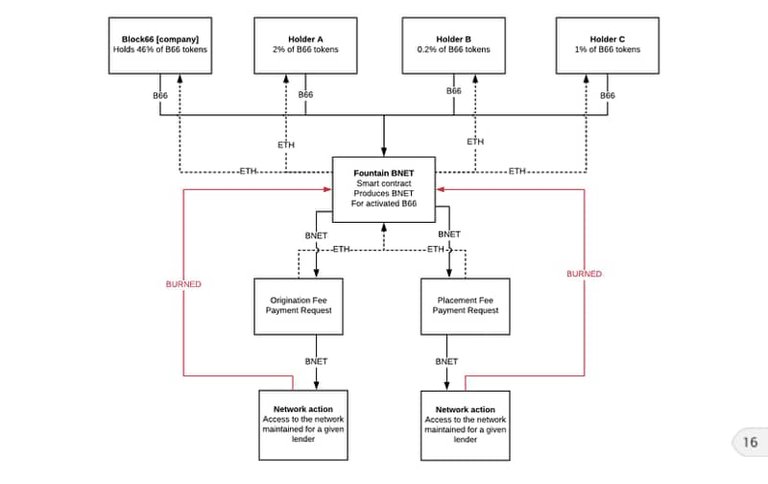

The world finance is experiencing a decline in a steady state. This effect affects regular investors into a system that would be at a speculated time their loss. Therefore large scale organization would definitely want to make canny moves by placing usury rates to any individual involve in mortgage. But with Block66 connecting different networks around the globe with little interest rate and low risk. With Block66, organizations no longer have to be crest fallen or show signs of wobble over the issue of mortgage. Block66 provides (proof of loan) PoF tokens for borrowers to reinvest which raise the percentage of increase for the lenders. This is an objective to ensure the situations between brokers around the world connects and distribute funds at a sustainable percentage. With this enterprise, funds are distributed effectively at low risk and there is transparency between different organizations.

.jpg)

Current problems in the contemporary market.

Not until a decade ago, it was discovered the mortgage industry lacks transparency. That is whenever there is a situation of financial crisis, the ingrained mortgage lenders tend to significantly tightened their lending criteria, disabling household borrowers from meeting with standard underwriting criteria.

High fees, capital requirements, and lack of a transparent trading marketplace serve to restrict the majority of investors from trading MBS vehicles. Institutions and a small percentage of private lenders connected with the mortgage brokers ecosystem are the only active investors in the space. Significant amounts of capital remain locked-up or deployed into other instruments.

The non-prime market segment is currently heavily serviced by non-traditional lenders, mostly family offices and high net worth individuals, who are provided with lending opportunities brokers. In all parts of the world, this market is heavily segmented, non-transparent, and slow moving. There are also many examples of fraud, and consumer misrepresentation.

What makes block66 unique?

Block66 provides new technological blockchain for borrowers and lenders to enable a promising stability of strategic growth in the modernization of conventional mortgage. They provide malignant growth with unique fascinating potentials to actualise the specific increase of assets in the mortgage industry. The fact still remains, that different economic systems in the world are becoming connected and similar because of the influence of Block66 capability to create an edifying system which deals with the complexity of high interest in loan but to ensure the flexibility of other ventures into improving commercial partnership and agreement.

Adapting finances that are available can be a daunting prospect around the world but with Block66 it is ensured that sustainable loan are placed between a lenders and brokers at a considerable rate. Basically, loans in Block66 can be represented in tradeable tokenize securities, providing an efficient liquidity mechanism. They also provide attractive investment for investors in the mortgage industry whereby cyrptocurrencies can be use in lieu of documents, fees and other criteria. Since Block66 runs a blockchain technology with acts as an intermediary between brokers and lenders, this thoroughly eliminates the need for a bank account to attain a transparent and reliable platform whereby there is confidence between brokers and lenders in getting best offers that are achievable.

Conclusion

The platform solves problems for a range of different persons and organizations, and for a range of different reasons. The team hopes that through theirs and the community’s efforts the mortgage lending space can be opened up to all manner of investors whilst assisting with the origination and facilitation of loans the world over. Since they implemented to run a strategic decentralized application platform, the networking between interested individuals in the mortgage industry will have a connection that is attainable around the globe. With this it is safe to say the future doesn't look bleak with Block66

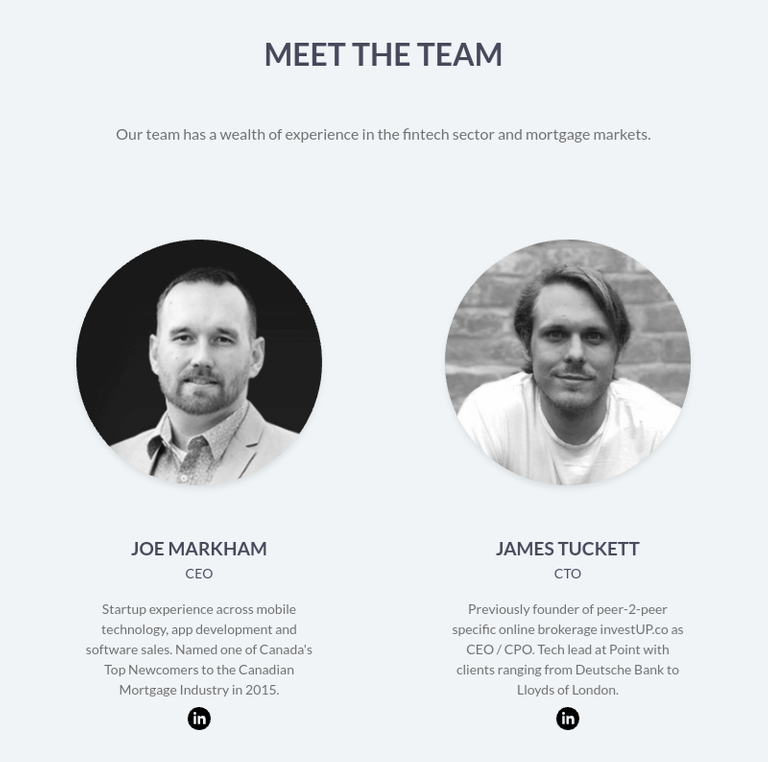

Meet the Team

For more information and resources, kindly check out the following:

Block66

Block66 Whitepaper

Block66 Facebook

Block66 Twitter

Block66 Medium

Block66 YouTube

Block66 Linkin

beta.bounty0x.io username: officialgbade

The future of mortgage lies on the blockchain indeed ! Block66 will definitely revolutionise the industry with its seemingly unique approach towards mortgage finance. Very straight forward and informative piece , great job @officialgbade

Thank you very much mate.

And also do well in visiting their website for more information

Nice one @officialgbade

Thanks man, for more information and resources do well in visiting their website

Great write up man @officialgbade

Thanks man, for more information and resources do well in visiting their website

Awesome piece. Mortgaging can be tasking. This would go a long way. Nice write up

Thanks and I since appreciate your words.

Kindly visit their website for more information.