14 November 2017

Though Bitcoin Core (BTC) no longer holds unassailable sway over the crypto markets with 52.4% of the market cap, this is still over $207bn, meaning any investors pulling out of trades are compensated by those coming in, and the attention is switching to the BTC alternatives.

The Korean influence

Since 8 November and the suspension of SegWit2x, that has included Bitcoin Cash (BCH), responsible for 29.75% of trades, as against 38.72% for BTC. In contrast to Bitcoin Core, the main BCH traders have been Korean (47%), who also dominated the Ethereum Classic (70%) trading. Here, though, we are already down to 4% of all trades.

But influence is not dominance

The Koreans may be the prime traders in other altcoins, but the spread (except for Ripple/XRP),is much more varied among major tokens. You have to go to minor players such as QTUM to see the Koreans dominating once more (74%).

It seems clear that an unusual amount of BTC owners switched over to altcoins such as ARK (78%). That's still only 0.4% of all trades, though.

At last Bitcoin Gold: well maybe not

The newly live Bitcoin Gold (BTG), 0.33% of all trades, increased volumes by 15 times the pre-November 8 figures on 11 November when it closed at $427, then settled back to about three times as much in volume at prices of $249 on 13 November and even lower at $197 on 14 November. Its trades seemed evenly matched between BTC and USD owners, indicating both new and old investors.

Revising the probabilities

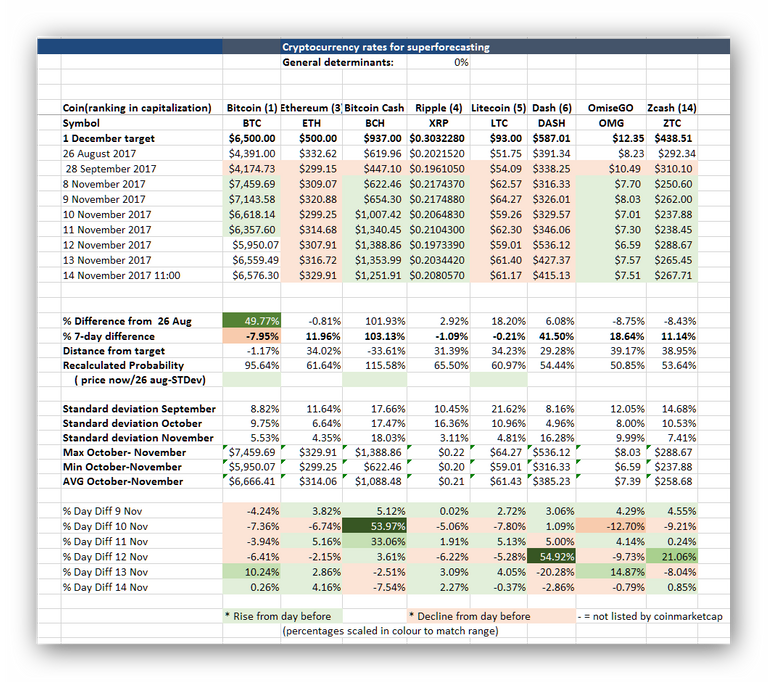

Having abandoned price changes as the overall determinant of the probability that the cryptocurrencies will reach a 50% gain by 1 December. I recalculated these on a new basis today. This sets the current price against the starting price on 26 August, but deducts from the tallyNovember's standard deviation so far in closing prices.

As a result, BTC, now 1.17% over the target, goes down to 95.64% likely to end 1 December with a 50% gain. BCH was 33% over target on 14 November, but its recalculated probability puts it only 115% likely (some 15% less) to end up at $937 on 1 December.

Background to tokens followed

I've profiled the seven tokens I am tracking here.

I've also profiled other less popular tokens

Excel version

Click here for an Excel 1997-2003 version of this table with records key records, free for download.

There's also an Excel version of the shorter summary screenshot used above.

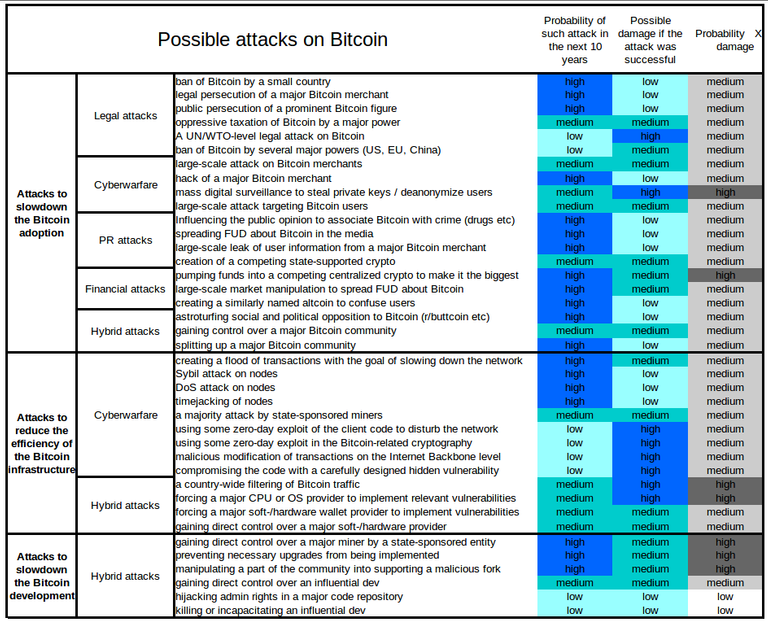

Can you include this risks in your analyse?