Many People Invest in crypto market without any knowledge and fail or loss every time. So, these people flow rules for earning and profitable trading.

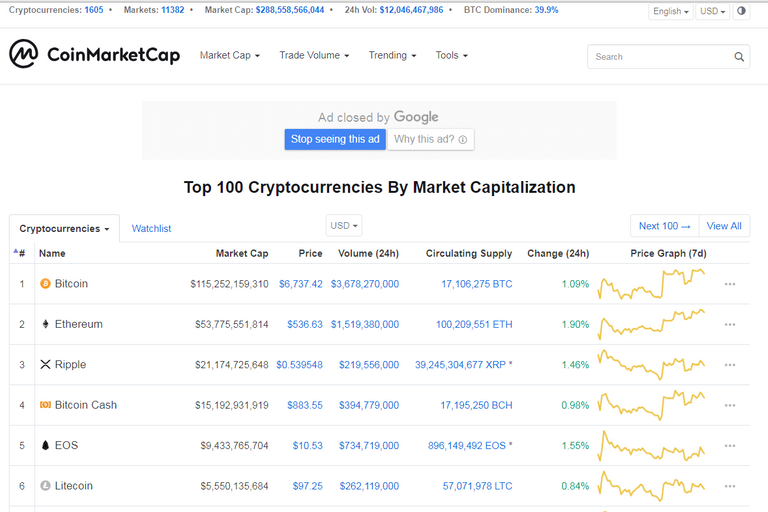

According to leading cryptocurrency price aggregator, CoinMarketCap, there are more than 1,600 digital currencies available as of this time. In reality, there are probably many more than that in existence, as not all of them will have made their way to the price monitoring site.

While many of these cryptocurrencies are attempting to innovate and seek out a niche in the crowded marketplace, others are simply fronts for developers looking to make quick money off gullible investors—still others are outright scams. How does an investor take advantage of the incredible opportunities within the digital currency space while at the same time protect herself against these bad bets?

Following the due diligence checklist below is an important part of the process.

1- Business model

2- Team

3- ICO Profit

Bro with all due respect, there are many many things to consider when it comes to investing, but those 3 things have very little to do with profit if they crypto is already out on the market. What does the ICO profit have to do with anything when the coin is on the exchange? I know countless companies that showed great promise with their ICO's and when they finally came out the price crashed or just stayed at the same number.

I hope you don't get discouraged since I see you're new here like me. But do some proper research, write some better articles, cause honestly, this one is quite useless

Thanks for guide me

Hi Dear Join My Facebook Group 'Crypto' And Share Your Links! Thanks :)

Crpto investment is a risk work.I read your blog like and thanks for sharing

nice post mate!