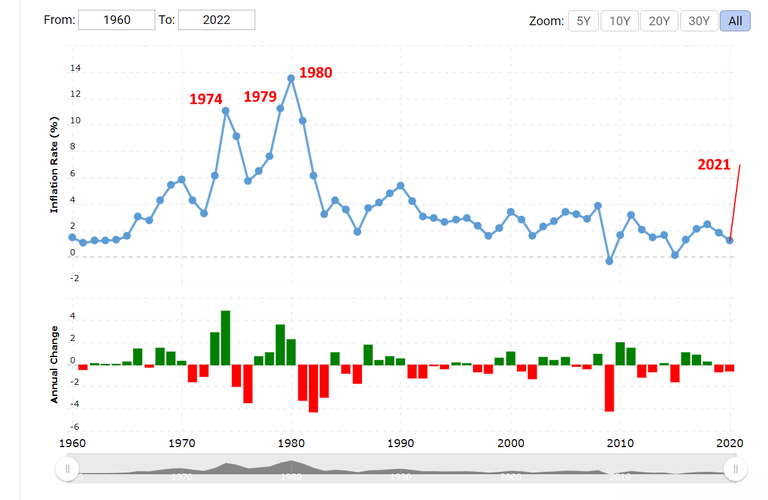

graphic courtesy of macrotrends.net

Without a doubt, there are those that have considered the high inflationary environment a time to make more aggressive investments. With the governments response to the covid virus we are seeing the highest inflationary rate since 1980.

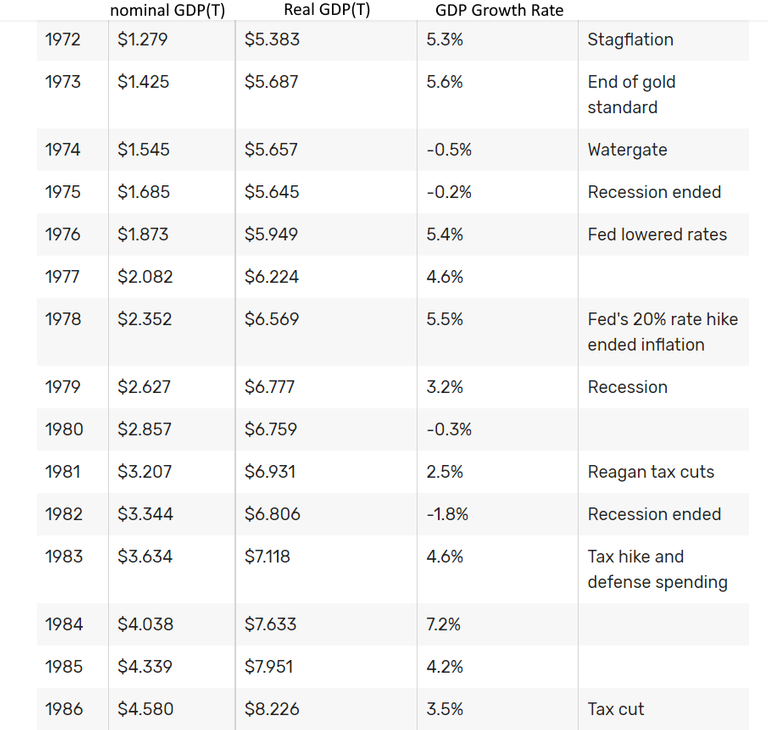

In 1978 the Fed's increased rates by 20%, then in 1979 and 1980 we faced the highest rates of inflation in 60 years and went into a recession. If the Fed's raise rates too high they will with certainty cause another recession, yet they state rate increases are on the way.

Note that in 1976-1978 we experienced good GDP growth and in 1983 GDP was again good. This suggests a 2-3 year window in which inflation jump starts the economy.

graphic courtesy of thebalance.com

The Fed's are running more of a bluff to raise rates to bring stability to the economy. They just won't do it to an extreme because they no full well that it will cause a nasty recession. Inflation is not going to decrease dramatically anytime soon.

With little relief from inflation, more aggressive investments will still look attractive and that includes cryptocurrency. China and Russia's stance on cryptocurrency, however, has not been favorable. Yet, the most impactful decision on regulation will come from the United States with information coming as soon as February. Unfortunate for bitcoin holders, countries are considering have their own digital currency known as CBDC or central bank digital currency.

If bitcoin, tech stocks, and real estate are overpriced where do investors go? The only certain thing is that investors will not let their money turn into nothing because of inflation.

These are my opinions and I am not a financial advisor.

It's obvious that they tried to hide and slow the incoming inflation which was inevitable with the stopless money printing which made the bubble even bigger (stocks to GDP ratio higher than ever).

But this time increasing the rates will not work - like back then raising 20% - and that is why they are thinking about 0.25% - 0.5% and even reaching 2% after 2 years.

And the main reason it wont work is because that the GDP decline will most probably continue (unlike back then) and the fears of hyperinflation become bigger than ever.

If we add to that the old financial crisis that was not resolved - and it is going to resurface as a even bigger "perfect storm" in the balance sheets of banking sector.

I agree with you that what happened in the past can happen in the future.

Which makes sure that will make investors move to hedge inflation.

But the portait seems much different than back then, us is more like a falling empire unlike a rising one back then. Thus we expect the worse so we do not get surprised.

About crypto ? It can be inflation hedge in theory but we have to see if the correlation with Nasdaq continues and how it reacts to 10-year Treasury yield.

It's gonna be shaky for sure, let's hope shaky up.

For institutions we have seen that they dont hesitate to sell-off in order to patch some losses.

For crypto believers is just a discount market ahead and a good period for crypto farming!