The last couple of weeks I've been diversifying my crypto holdings a bit to buy up things like PIVX, BitShares, Ethereum, and some random ones I found interesting or wanted to take a chance on like Ark and Golem.

My problem is I can't let go. When something goes up in value (and I should sell), I keep thinking about stories of those who sold in the very, very early days of a now successful cryptocurrency. For some short term profit, they lost out on life-changing value. I know the fiat financial system siphons off value through inflation, and I think cryptocurrency is the future of finance. That's why it's hard for me to let go. When I could make a profit, I often just hold until it goes back down again.

The last few weeks have seen some unprecedented pumps. Maybe pump groups are coordinating their actions. Maybe some institutions are testing market liquidity. We may never know. Either way, where there is volume and rapid change in value, there is opportunity for those who know what they're doing. I may not be one of those people.

The biggest challenge for me is I can justify a buy action or a sell action at almost any moment. If it's going up, I tell myself I should sell and take some profits off the table. I also tell myself to keep buying until the exponential lines cross into the sell territory. If it's going down, I think a buying opportunity has arrived, and I can improve my long term position through dollar cost averaging. I could also argue it's time to sell in order to get out and buy back later at much lower prices to end up with a stronger long-term position.

Even with all my indecision, one thing does seem to work well:

Buy and Hold.

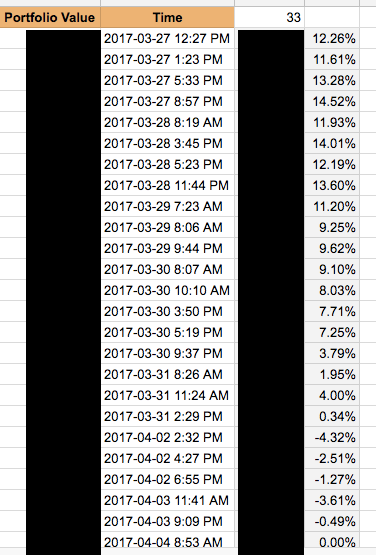

I put together a spreadsheet recently so I can be my own bank and track the various altcoins I'm playing with. One thing is certain, there's a lot of volatility and, at least recently, the crypto market is booming. You can see to the right here how quickly and by how much my holdings have been going up (though I've hidden the totals).

Part of me thinks I should just invest in a number of coins I think have a long term future and forget about them. Another part of me thinks I should follow this simple strategy from @sponge-bob where you effectively create your own balanced crypto currency mutual fund.

What are some strategies you use?

How are they working for you?

Luke Stokes is a father, husband, business owner, programmer, voluntaryist, and blockchain enthusiast. He wants to help create a world we all want to live in.

There are two simple reasons why you should just buy and hold:

Most people are not good at timing the market, and generally lose money trying to do so.

Day trading eliminates the main benefit of investing, which is that the gains are passive. By buying and holding, you can dedicate your time and attention on other things, while letting your money work for you. When you attempt to day trade, you're putting more work in, and in all likelihood you aren't even getting any higher returns anyway.

Very well said. In some ways, it's like a fun hobby though. Maybe you pay a little for the excitement. When I do time the markets just right and increase my holdings "for free" it sure feels good though. Maybe it's that high that keeps me thinking I should be "doing more" to increase my holdings instead of just watching opportunities go by.

What you're talking about is a gambler's high. It may feel good, but certainly isn't good for you in the long run...

Yeah, that's also a good way to describe it.

I certainly agree with your statement, but a small portion of funds set aside and dedicated to those high risk-high rewards plays can still be fun without jeopardizing your existing investments. Since coins can be traded in such small amounts it wouldn't be unreasonable to take a small portion of gains to play with.

All that being said, my objectives are probably different from every person who reads this thread. If you are in it exclusively to make money what demotruk describes is spot on (especially point #1). My objective is to explore new technology and if I'm lucky maybe make some money in the process. Anyone who is thinking of investing anything should ask themselves what they want to get out of it and use the answers as a template for how to construct their portfolio.

It's possible to gamble responsibly, and some people will be better able to handle that than others. But it's very easy for it to turn from responsible gambling to a problem.

I will say, with the high accessibility of crypto and relatively low fees, I think we are seeing a lot of gambling moving from traditional gambling sites, to crypto day trading.

That's a fair assessment and I agree with you, I did not mean to come off as encouraging gambling just that before doing anything all investors should work towards their own goals and spend time establishing what they are and how they are going to achieve them. This includes doing research and asking themselves if they are predisposed to addictive behaviors.

Luke - let me simplify this for you. Speaking as a former full time daytrader in the equities market.

You cannot short-term trade and think about long-term possibilities at the same time.

Remember, the gains you take on those short-term pops you can invest for the long-term and thus be free rolling the position as you take out your initial investment. Closest to best of both worlds you will get ;-)

I think that's a great way to think about it. Thanks!

Love this insight that's really good advice. Thanks, man!

I agree this is some of the best high level trading advice I heard .... but then to build on that, from your experience, what's the best way to know a good security (stock or crypto whatever the proper universal term is) to invest in for the long term? Should it be based on research, knowledge, momentum.....technical analysis? For example...for me personally, I am fine holding long term for both bitcoin and ether and possibly litecoin.... but I know I could be making some gains in the short term with the volatility of the crypto market and possibly even get in early, like the OP said on a newer crypto which I also am a supporter for, such as PivX, under a dollar now .... I guess diversifying is key and I do have a good mix of things with my basis being in bitcoin and ether .....just put some more in litecoin too ... but like I sold ether a bit at its high also (half of my eths) got a profit cause it was clear it was gonna come down a little and I just today and yesterday bought most of it back ..... but I guess you're right in the long term I probably put a lot of time and attention into selling and buying back for less and I am also taking a risk..... when passively I can just leave it there .... pretty much what I do with btc except for when I trade but I keep my core like portfolio with a set amount of btc and anything outside of that I don't allow.myself to trade unless I have pending transactions from coinbase 😊 ... thanks OP great question I am new to trading in general have watched a shit ton of videos the last few months but I feel the same way you do ... I bought pivx at both 33cents and91 cents somewhere along the well actually sold some at 42 cents bc I got nervous lol ... as of now I'm not touching my pivx just building on it in case I have some reason to take some out ......

Few days ago my friend wrote an article: Is Holding Rational? - maybe you will find it useful and informative. I have also nominated his article in "Nominate a Friend" by Steemvoter Guild.

Thanks, Noisy! That's a great article. Lots of good information there.

Great article @lukestokes. Upvoted and followed. I'm buddy of @hilarski , and also part of the crypto group you've been added to by Randy. Welcome and good luck bro!

Thank you! I appreciate the encouragement. :)

Ah, shoot man! So sorry for not replying earlier! I don't know how I missed this. I did upvote it, and I'm really surpised I didn't give a full reply as well. I almost always reply to stuff like this. Maybe I read it on my phone and planned to reply on my laptop later (I do that once in a while) and forgot. I totally didn't mean to blow you off. Followed now.

Ok, this is one that we all deal with but you can profit huge by enjoying the ups and downs in price movement. I love my Pivx but I always buy it on the red candles and sell on the green candles. Each time accumulating more Pivx. This goes for all Crypto that you want to hold over long term. I just sent you a private invite on FB.

Thanks Randy. :)

Yeah, I'm not so great at trading / investing either, and I've come to the same conclusion - invest based on fundamentals for the long term and don't get caught up in the volatility roller coaster.

When you do see huge increase, like we saw with Dash, it just might be prudent to take some profit while holding a percentage. Decide how much of a minimum position you want to maintain and sell the rest for a tidy profit.

Another thing to consider is that even a small position could yield huge gains in the long run, so weigh that in your minimum hold amount.

You could also divide your crypto portfolio into ranges, where each range represents a different criteria for when to take profit and how much gain items in that category must make before you consider selling any of your position in it. If you think about your goals ahead of time and not in the midst of a volatile swing I think your decisions will be more rational than emotional.

Anyways, those are just a few items off the top of my head, not that I'm advising you. I know you're wiser that to take anything I say about investing as wisdom :)

That's some great stuff! Thank you.

Supposedly the best strategy in investing is to drip feed into shares or in our case crypto. They call this pound / dollar cost averaging. I haven't done that and also you should never listen to my investment advice because I suck at trading :) Looks like you are making nice profits overall, just not the 1000% that some have made

Yeah, a consistent regular buy does seem like the way to go to even things out a bit. I've talked a lot about doing that, but haven't set it up yet.

I too wrestle with the same decisions that you outlined above. Riding trends can be fun and exhilarating but buy and hold has worked for me in terms of separating a bit of that emotional element of trading (which gets me in trouble more often than not).

I like to trim back any positions that have a large gain, essentially taking my initial investment and playing with house money for the rest. This helps to manage the downside risk that the low-cap altcoins are famous for.

"thirds rule strategy"

https://steemit.com/thirdsrulestrategy/@cassidyandfranks/dash-thirds-rule-strategy

https://steemit.com/thirdsrulestrategy/@cassidyandfranks/ethereum-eth-thirds-rule-strategy

https://steemit.com/crypto/@cassidyandfranks/sbd-thirds-rule-trading

Good strategy, but what timeframe do you use? How long do you wait to separate out the thirds? If you're wanting to buy and the price is just going up, do you then buy at the higher and higher prices or do you just sit and wait, only having bought one third of what you intended to buy?

Try to think for a beginners or newcomers fist time to buy and invest.

Let's say:

a minnow has $300

a dolphin has $3000

a whale has $30,000

If you can visualize and view that by just adding a zero or taking away a zero to what ever total you may categorize yourself. Just imagine if all the fishes in the ocean followed "thirds rule strategy" and divided their investments into 1/3rds and used this measurement. Setting each buy order in thirds and setting each sell order in thirds, eventually it will allow every fish to hit their 1/3rd and would slowly but surely end up in the GREEN. Kind of like set it and forget it. Let the chips fall as they may. I have a saying..."don't be TOO greedy".

P.S. After each 1/3rd is filled, Rinse and Repeat either buy back lower(same amount of coins sold) or sell back higher (same amount of coins bought), left over balance needs to be transfered into Cold Storage Wallet as your trading Profits that way you can keep track. Rinse and Repeat.

P.S.S. If you look at my SBD post, imagine all 3 sell orders filled!!! Now I can set low orders and buy back my SBD but cheaper. Buy in thirds and Sell in thirds.

If you are unsure just sell some gradually and take some profits.

Remember a couple of weeks ago when you awoke on a saturday morning with that high you felt when the price of steem went to the moon. How about that moment knowing that your steem power investment, if it could go up, meant that it could go down. I then realized that I had some liquid steem. Pushed half of it in SD. After a week or so, I doubled it. Took my profit and put it in steem power. Try to work your portfolio such that on one hand you win and on the other that you don't lose. Pick a direction then slightly hedge in the opposite direction. My position is long steem power, but I use SD to hedge. Steem power still has value, for curation rewards, wither the price of steem is up or down.

Yeah, I've also been using SBD as a hedge. I generally built it up a bit and then buy STEEM when things are at a local low. This last time I ended up selling it on the market when someone pumped SBD to over $6. That was fun. :)

I can definitely relate to this.