Cryptocurrency trading comes with a steep learning curve given the many sources of contradictory information making it challenging for new investors to enter the space.

Despite this information overload, or perhaps because of it, interest in cryptocurrency trading has blossomed.

In the first six months of 2017, the cryptocurrency trade increased more than ten times. Currently, there are well over fifteen hundred different cryptocurrencies and over ten thousand different exchanges. The total cryptocurrency market reached $800 billion in January 2018 and is estimated to pass the $1 trillion mark by the end of the year.

The path through trading can be a convoluted and time-consuming process, which means missed trading & arbitrage opportunities leading to lower Trade Expectancy.

Traders use multiple reference points to research news and prices. Factors such as time lags and pricing variances make all the difference between a successful and an inferior trade. They track their portfolio progress, manually looking for patterns to scale or drop.

They review their portfolio’s most up-to-date holdings and input payments they may have forgotten they made, which is all manual.

AiBB’s core commitment is to simplifying this process. With a goal to intelligently process and consolidate information using our advanced AI platform.

This providers our traders with a single and comprehensive reference point to facilitate

WE SOLVE PROBLEMS

PRICE VOLATILITY

Price volatility happens in two circumstances: first, when there is a lack of accurate assessment of the underlying value of a security and second: where there is a lack of market depth.

The first problem can be resolved through better information and investor education in the crypto-currency market and the second problem can be resolved via increasing the volume of investors.

This can be achieved by introducing more market players into this space so that no one big investor can dominate the particular cryptocurrency and engage in price manipulation.

BUYING CRYPTO

Prior to even buying crypto, people have a notion that because there is no physical element to it, they can not convert it into hard cash in their bank account.

And they’re partially right! The process to fund crypto is to wire transfer (3-5 business days), e-transfer (instant usually) or use a credit card (limited amounts) to send your money to a 3rd party broker or crypto institute. To withdraw you need to wait a minimum of 5 days for it to hit your bank account.

We fix this by partnering with various exchanges and acquiring an EML (electronic money license) to convert crypto to FIAT on the application easily and faster than ever before.

POOR VALUATION OF MARKETS

It’s difficult to properly value investments in a brand new space. Fear of over valuation must be met with reliable data. Early adopters navigated their way through these markets with limited tools and resources. They were self-educated and their investment transactions were made based on speculation and emotion rather than calculated, informed and educated decisions.

The cryptocurrency industry faces this challenge: investors require the right tools to allow them to build and grow a broad portfolio while ensuring a natural growth rather than risky speculation on over- or undervalued investments.

TOKEN LOSS AND TRANSFER TIME

Transfering cryptocurrencies remains a stressful with a large margin of error.. Users can check and recheck the address, but one wrong character and assets could be sent to an unknown contact.

It is also a very time-consuming process which can take up hours, where users try to mitigate risk by sending a small amount first and then sending a second round.

MISINFORMATION

The current ICO market often relies on the intelligent evaluation of a future product. Most companies lack a product, the technology, a proper team or a vetted revenue model, and many are raising money based only on a white paper alone.

This model has allowed very astute early adopters to thrive but is not conducive to growing interest and investment in cryptocurrencies. The market should be driven by promise, not fear.

FRAGMENTATION

An unintended ramification of decentralization is fragmentation, where market information is published in multiple places by multiple people at multiple times -- and isn’t always correct or up-to-the-minute.

Decentralized markets must rely on authorities that can assess all the fragments and make that information accessible to all. This transparency is a benefit if the centralized library is trustworthy.

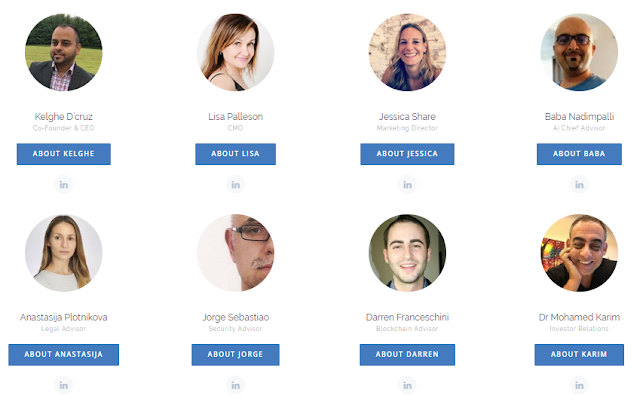

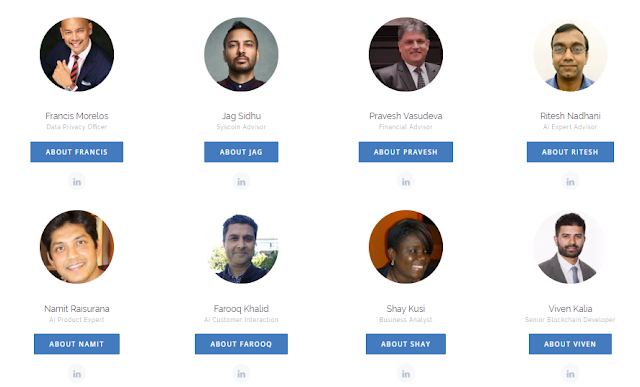

Our Team

We’ve hand-picked a diverse team with the experience to get AiBB into the hands of traders everywhere, to nurture the trading community, and to grow opportunities in crypto for all.

Website : https://aibb.io/

Whitepaper : https://aibb.io/Assets/AiBB-Whitepaper.pdf

Linkedin : https://www.linkedin.com/company/aibb/

Medium : https://medium.com/@AiBB

Reddit : https://www.reddit.com/user/AiBBio

Facebook : https://www.facebook.com/aibb.io/

Twitter : https://twitter.com/aibbio

Telegram : https://t.me/aibbsale

Ann Thread : https://bitcointalk.org/index.php?topic=4849610

Profile Bitcointalk : https://bitcointalk.org/index.php?action=profile;u=2253915;sa=summary

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://aibb.io/Assets/AiBB-Whitepaper.pdf

Congratulations @kamilmil! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!