Financial services are the economic services provided by the finance industry, which encompasses a broad range of businesses that manage money, including credit unions, banks, credit-card companies, insurance companies, accountancy companies, consumer-finance companies, stock brokerages, investment funds, individual managers and some government-sponsored enterprises.

Financial transactions rely heavily on the endorsement and support of large financial institutions, with substantial transaction fees paid out to these institutions. Monopolistic financial institutions have in fact raised lending rates for borrowers and reduced the interest income for lenders.

The core model of a credit agency is to share the costs of non interest-earning elements and bad debts by charging the "good guys" who can pay back the money. For borrowers, it brings an additional cost.

From the credit agency's perspective, a lot of time and efforts are wasted in verifying the credit of borrowers who do not meet the agencies’ risk criteria, which leads to wasting resources and decreasing efficiency.

A centralized credit model entices many financial institutions to deviate from their primary purpose— serving customers. Aiming for profitability, they deduct lenders while squeezing borrowers, and expand their profits by extending their customer base.

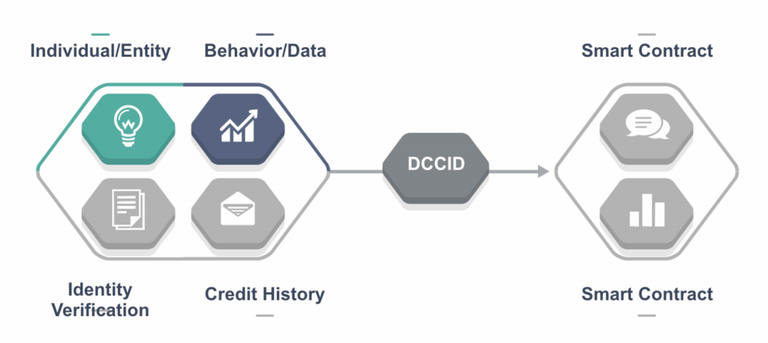

Distributed Credit Chain (DCC) is the world’s first distributed banking public blockchain with a goal to establish a decentralized ecosystem for financial service providers around the world. By empowering credit with blockchain technology and returning ownership of data to individuals, DCC’s mission is to transform different financial scenarios and realize true inclusive finance.

DCC is a decentralized open credit platform. Any platform with traffic and scenarios can submit its own Dapp applications to DCC, provided that these submissions are based on Distributed Credit Chain standards.With a global distributed banking ecosystem, DCC aims to break the monopoly of traditional financial institutions and to return earnings from financial services to all providers and users involved in such services so that each participant may share the return of ecological growth. distributed banking will ultimately be a way to truly achieve an inclusive system of finance.

The Open Platform on Distributed Credit Chain is a centralized system which serves as a data provider and market. The transcation market serves data collaborators, AI risk control algorithm providers, credit structuring institutions, and other institution partners. Through this platform, institutional partners can check, screen, contact and reach cooperation with other partners based on their needs through DCC, while using the services on DCC .

The Open Platform interfaces with DCCmarket contracts. All cooperating institutions can publish their labor costs through this platform. After analysis and processing, these data will be sent to users and institutions as their price basis for choosing the services they need. The real-time quotes will smoothen the exchange of information across the institutional service market .

The Open Platform will provide a blockchain browser to view all node operations, block loan request, transaction flow and other blockchain basic information on DCC.

The distributed credit chain can be applied in many scenes in financial area, among which a DApp serving the personal loan market has been launched and in use, the others are under developing and will come soon.

For more information about the project :

Official website - http://dcc.finance

Whitepaper - http://dcc.finance/file/DCCwhitepaper.pdf

Facebook - https://www.facebook.com/DccOfficial2018/

Twitter - https://twitter.com/DccOfficial2018/

Telegram - https://t.me/DccOfficial

written by :juv3ntus1 ( https://bitcointalk.org/index.php?action=profile;u=2039680)

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

http://dcc.finance/