The premium on the Bitcoin Investment Trust has been rising the last few days...

And that may mean good things are coming for bitcoin.

For those that aren't familiar, GBTC is the Grayscale Bitcoin Investment Trust.

It holds a stash of bitcoins in a secure location and the ticker symbol goes up and down as the price of bitcoin changes.

As you might imagine, at times it can vary wildly from the underlying price.

Just recently the premium on it has start to spike.

That means the value of GBTC has started to trade above its asset valuation.

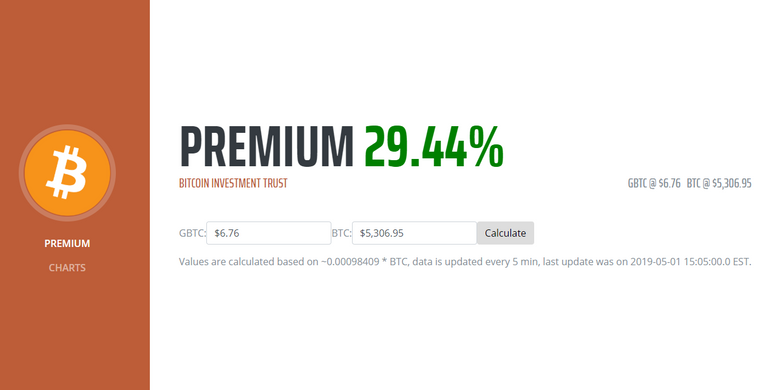

Currently the premium on GBTC is trading right around 30%...

(Source: https://www.neotechdevs.com/gbtc/)

That may sound like a big number but it actually traded at close to a 100% premium back in December of 2017.

During the height of the last mania phase.

A few days ago the premium was barely hanging on to the 20% number.

Now, just in the last few days it has climbed up to 30%.

Why does this matter?

It is interesting to note because GBTC is the closest thing to a bitcoin ETF for US based investors.

For that reason there are a lot institutions in it.

They don't mind paying a premium when they don't have to worry about custody of the cryptocurrency and they can buy it with ease from their traditional brokerage accounts.

On top of that, many institutions have rules about buying things on unregulated exchanges, such as a cryptocurrency exchange.

This would be a way around those rules while still having some exposure.

With the premium drifting up like this, one could assume that these institutions are either covering their short positions or increasing their long positions because they are expecting a rally very shortly.

We saw the premium spike just before bitcoin rallied from $4k up to $5,600 several weeks back.

I think we may be about to see something similar happen again now....

Stay informed my friends.

-Doc

Spike baby spike! 👍💰👍

Looks like that rising premium in GBTC was a pretty good tell after all!

Right on Schedule

It's funny how the institutional money always seems to know ahead of time...

Hilarious.

My favorite is when the SEC subpoenaed Coinbase and friends to check for market manipulation, and in doing so they massively manipulated the market, and the manipulation came before the official announcement of the subpoena.

So funny :D

Of course. Status quo on wall street. It's funny that they claim the bitcoin market is manipulated thus disqualifying it from an ETF when the oil and precious metals markets have always been manipulated yet they approved those ETFs?!

Also noticing the premiums on any KRW pairs, which happened in 2017 basically all year. I think history will repeat itself

Which exchanges and which pairs are you referring to specifically?

Which exchanges and

Which pairs are you referring

To specifically?

- jrcornel

I'm a bot. I detect haiku.

Poetical.

I forget which ones but I was looking for arbitrage ops the other day and noticed plenty of premiums on KRW

There are some on bithumb but that is because many of the wallets over there aren't functioning, including steem.

.

Posted using Partiko Android

There seems to be something missing...

Congratulations @jrcornel! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

You can view your badges on your Steem Board and compare to others on the Steem Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!

Vote for @Steemitboard as a witness to get one more award and increased upvotes!

Thanks.

I had not seen this move! Very interesting indeed despite the cautious nature of the financial markets this week. Institutions have been given a “go ahead” sign to allocate to risky assets with the Fed maintaining low rates and economic data looking healthy so you may be on to something!

Posted using Partiko iOS

GBTC premium tends to spike before and during up moves in bitcoin. There are some false alarms though, so no guarantees, but there does appear to be some sort of correlation. If this signal turns out to be true I would expect to see bitcoin moving up past $5,300 in the next couple of days.

Interesting! Have never paid attention to this. How much volume does GBTC have, do you know? 30% premium is a lot, so expectations of the investors need be towards fairly large gains, probably over a long timeframe.

I'll watch it more closely from now on, thanks a lot for bringing it up!

Posted using Partiko Android

It does about 3.8 million shares per day. At $7 per share, that is about $27 million in dollar volume per day.

Thanks.