Crypto prices have been getting absolutely crushed in 2018, but could the price action be slightly more than just profit taking?

After a large run up like we saw in 2017, it wouldn't be much of a surprise to see some profit taking as many people were sitting on very large gains.

However, what we have seen to date has been one of the largest profit taking events in the history of crypto.

Is it possible that, more than just profit taking, we are seeing a change in investor sentiment across the board?

Is it possible we are on the verge of another global recession and crypto prices are simply a leading indicator of what people are beginning to feel is coming?

Crypto prices:

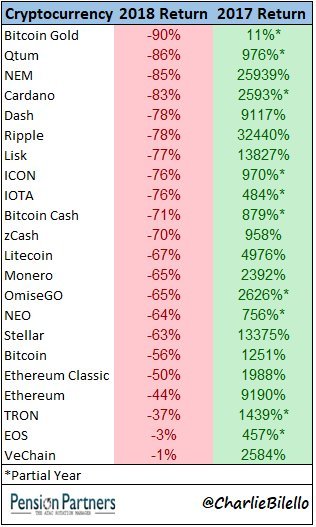

Take a look at this chart of the gains in crypto prices from 2017 vs. 2018:

(Source: ~~~ embed:1012665007249731586) twitter metadata:Y2hhcmxpZWJpbGVsbG98fGh0dHBzOi8vdHdpdHRlci5jb20vY2hhcmxpZWJpbGVsbG8vc3RhdHVzLzEwMTI2NjUwMDcyNDk3MzE1ODYpfA== ~~~

As you can see prices have been absolutely crushed in 2018.

Many say that cryptocurrencies represent the ultimate in "risk-on" behavior. Meaning that people are much more likely to invest in them in times of excess, when there is excess money floating around.

Times of excess could be described as times when when stock markets are soaring, unemployment rates are at very low levels, and QE has pumped trillions of extra dollars into the financial system... hmm.

Past trends (US numbers):

Since World War II the US has experienced a ression once every 5 years on average.

The Great Recession, the US's last major recession, officially ended in June of 2009.

That means, we are now over 9 years since the last recession in the US, almost double the average length of time between recessions.

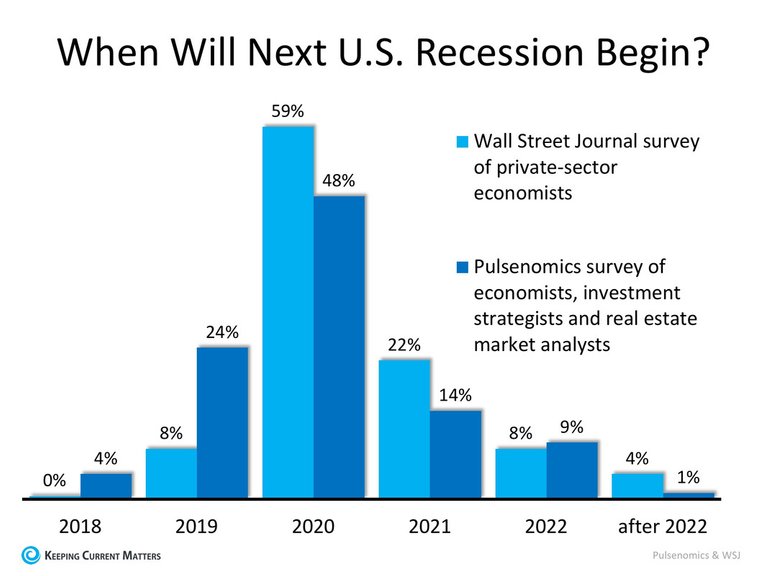

Oh, and there's also this:

(Source: https://www.keepingcurrentmatters.com/2018/06/28/next-recession-in-2020-what-will-be-the-impact/)

Economic expansions don't historically die of old age, something triggers them. However, the point is that we are now well above average for economic expansion time frames, meaning that the likelihood of a recession coming is likely increasing.

Commodity prices:

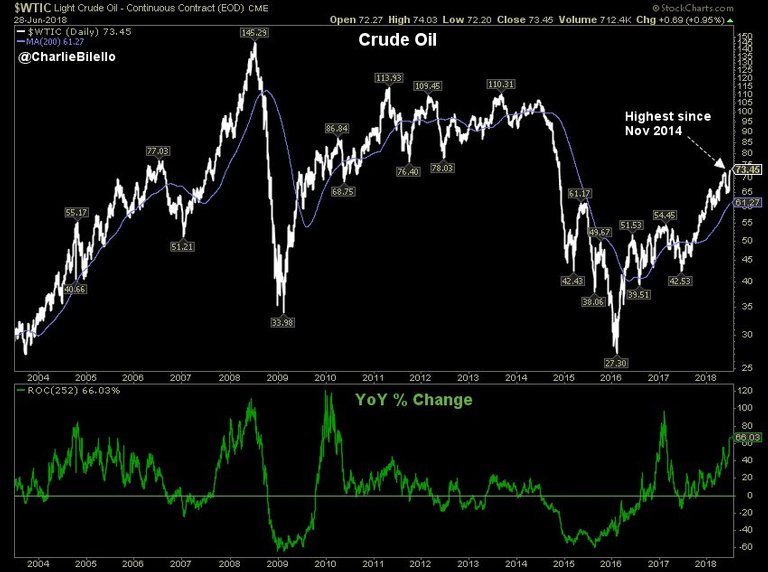

Before the Great Recession, we saw the price of oil catch a major bid.

It was around $28 in 2004 and ran up to about $80 in late 2006, just before the recession officially started.

Could we possibly be seeing the beginnings of something similar happening right now?

(Source: ~~~ embed:1012668261597630464) twitter metadata:Y2hhcmxpZWJpbGVsbG98fGh0dHBzOi8vdHdpdHRlci5jb20vY2hhcmxpZWJpbGVsbG8vc3RhdHVzLzEwMTI2NjgyNjE1OTc2MzA0NjQpfA== ~~~

Oil is at its highest price in over 4 years.

Bottoming around $28 (again) and running up to the current price of about $74, again over the course of about 2 years.

If history repeats we would see a pullback in oil prices soon and then a massive surge at the start of a recession, which may send the economy further into recession, before prices ultimately plummet.

Yields:

In the US, we have been raising interest rates after the historically low levels seen during the Great Recession.

Generally, rising interest rates eventually cause business activity to retract at some point.

However, the most interesting thing to me is what is going on with the US treasuries.

Take a look at the 10-year yield vs. the 5-year yield:

(Source: ~~~ embed:1012669972932448256) twitter metadata:Y2hhcmxpZWJpbGVsbG98fGh0dHBzOi8vdHdpdHRlci5jb20vY2hhcmxpZWJpbGVsbG8vc3RhdHVzLzEwMTI2Njk5NzI5MzI0NDgyNTYpfA== ~~~

The yield on 10-year bonds is 2.84 while the yield on 5-year bonds is 2.73.

That .11 difference is the lowest level since... you guessed it... the Great Recession.

An inverted yield curve is considered a strong sign of an impending recession and we are the closest we have been in over a decade to seeing an inverted yield curve.

*If you are not familiar, an inverted yield curve happens when the shorter term yield passes that of the longer term yield. Meaning that the 5-year bond pays a higher interest rate than the 10-year bond.

In general, it is a pretty rare event, and the US is drifting ever closer to seeing it happen.

Final thoughts:

Most of the stats here are based in the US, though what happens in the US tends to spill over globally.

Most of the crypto selling probably has to do with prices running up too high, too fast. Though, the lack of buying now may be a sign of an impending recession.

Several economic indicators are flashing impending recession, specifically the yield curve.

If a recession were to happen, crypto prices will likely find it difficult to move higher unless there is some crypto specific development driving prices.

However...

There is one major caveat in Bitcoin's favor as it relates to a store of value...

In times of economic turmoil, people will be looking for places to secure their wealth.

As morbid as it may seem, the next US recession might be just what bitcoin needs to break the current downtrend.

Stay informed my friends.

Image Source:

https://news.bitcoin.com/recession-horizon-downturn-bitcoin/

Follow me: @jrcornel

Crypto will languish in the US until people need it, or can afford to speculate again. As you imply I think the US is a lot closer to needing a new currency (crypto/bitcoin) than to being in an economic position to speculate on investments.

Im not cheering for global economic turmoil but the writing is on the walls. The US debt is unsustainable, Germany, Japan, more of the same, the result of any of these dominoes tipping is a total global economic collapse, unlike anything we have ever seen. Yes such a collapse would be good for crypto holders, of whom I am one, but I wish there was some other way.

I think you are right, but what I am talking about is more of a traditional run of the mill recession, not "the big one" like you are referring to. I think the debt issues won't come up for a while yet.

Recession? You should work for CNBC. They always have an analyst that predicts a recession on a Daily Basis. They can be wrong for years, but when it finally comes, they crow about how they were the first to predict it. 🧐😂🧐

Earnings are too strong 💪 for a recession in the next 12 months. BTC is just languishing because it’s utility has yet to reach its full potential. When better policing is put in place; then more businesses will accept it and institutional money will flow in like a tidal wave.

Just remember that I get all the credit for predicting the next surge 😂🤑😂

While that is true, I think a recession within the next 2 years is probably fairly likely at this point. Remember reported earnings are backwards looking. :)

I agree corndog, they do keep saying things over and over until they are right. A broken clock is right 2 times per day.

Everybody talks about the upcoming recession, especially inflation. I'm not much of an expert on this, but a real fact is that economy goes in cycles, and that we are quite a long time in a bull market. Also it is a fact that crypto is now real, and have established it self on the world stage in 2017. So this will be first time in history to have recession with crypto around :) Will be interesting to see what hapens.

Yes it will. Will bitcoin and other cryptos act as a store of value or will they get sold off like everything else?

Great perspectives and a good analysis - in the long term, crypto could rise if BTC is seen as a true 'store of wealth' - and as BTC goes, so do the majority of cryptos. I do like your comment about investors potentially seeking 'value' in blockchain cryptos -- now would be the time to start promoting Steemit as a value-linked crypto -- lots of opportunities to educate and create great content at the same time -- BTC isn't the only place to HODL --

Agreed. There seems to be a lack of marketing for steemit and steem though for who knows what reasons. Perhaps when steemit is out of beta they will eventually market it?

China has the trump card and whatever trump decision it will only gets worst we have to accept the fact that China already lose appetite from the American's debt and whose going to pay that trillions of debt owned by China if nobody is willing to buy so.

Predicting Future is really good but it's better to be prepared than sorry, if ever unfortunate occur we have to accept the reality and what can we do about it.

Good motto is hope for the best, but prepare for the worst.

This might actually be very true. The way these cryptos are dropping is very discouraging. I hope things change in the future and i certainly wish it is not a future speculation for recession as indicated above.

I appreciate the research you've provided and input from everyone here. Thank you!

Truth is, I believe the build up in late 2017, was just a set up (strategic preparation), demo'ing to the unlearned, how manipulative assets like BTC and STEEM, crypto in general, can be. And, proof that investing money one can't afford is at his own peril.

In a sense, it was a subliminal-symbol demonstrating: a build up before the fall..inevitable recession, as you suggest.

I think it was by design, and only a surprise to those who don't know the 'rules' of the 'game'.

Smh, as I've heard some less-than scrupulous whales refer to crypto as such.

In late 2017, I can remember many whale-posts pumping the helium ballloon with HODL 'hot air'...knowing that those who didn't know how to 'play the game' would be HODL to just that...slimy hot air.

Thanks for this post. The 'big' economic advisors have been hurling recession for a few years now; and, quite frankly most would agree that the U.S. never genuinely emerged from such. A trillion-dollar debt growing every day?...rme...smh...

Best regards.

Peace.

If they say it long enough, they will eventually be right. Though, in their defense, I think we are within a year or two of a recession here in the US.

Believable...and won't be surprised if another war isn't fueled to avert an outright depression.

Peace.

I see what you're saying and presenting... however, the crypto space is a new industry sector/technology that is actually causing economic growth. Historically new technology has always allowed 3rd world nations to leap frog 1st world countries. I'm leaning towards wealth leaving america (and all 1st world countries) and finding a home in countries that have been early adopters of crypto businesses. HODL on.

Which new technologies are you referring to that have allowed countries to leapfrog 1st world countries?

Fire, Gun Powder, Combustion Engine, Electricity, and now Blockchain.

@jrcornel, Bitcoin started running it is bull don't worry we recover loss soon

hii @jrcornel, really this data showing something Negative this year as compared to last year, and now this time is struggling for Bitcoin.

But i think Bitcoin price will spike sooner or later. and every investors will be in Profit..

Support @vikas4233 with your upvote and comment..

Thanks for this, resteemed. Crypto is a liquidity sponge and an indicator of problems with this level of outflows.

Sir, thank you so much for sharing this information among us and every one of your content is very valuable I follow every one of your content and I like very much like today's content is very nice and bitcoin news has reached us so much thanks for you

I don't thinks so.. let's hope for best to come yet.

hello I hope that Bitcoin and other crypts will act as a store of value soon.

Thank you @jrcornel for the article. It's a good time to invest in Steem, it's a pity to watch this period with an empty pocket)) Summer has always been depressing for business, I do not know how it is in the rest of the world, but in countries that left the former USSR this is so. Summer comes, everyone prepares for holidays, cities are empty, everyone is eager for the sea. These are millions of families. These are potential investors. During this period, the flow of living money shifts in another direction. People are not up to investment, they saved a whole year for travel and living near the sea. This is a simple example of a decline in sales. I trade polyethylene pipes. Summer for installation of pipelines is an ideal time. If they do not pass through the sown fields. But, no, when the autumn rains begin, then the peak of sales will begin. As an option, this recession is a manipulation to bring into the game large investors, in the common people it is called a contract.

I Buy! BTG! RSI:14 BTC-Amazing! Its A Bet! MostLost = Most Gains! or keep it safe.

Didn't the price of Bitcoin soar when the markets crashed?

(Would the assumption be that...because investors are looking elsewhere....then main economic markets are doing well?)

There was a negative correlation between bitcoin and the stock market for a while, where it was stronger when the market was weak, acting similar to gold. However, that correlation was pretty weak and hasn't been around for the last 2 years or so.

see you my article friend

https://steemit.com/steemit/@ste2303/trading-analisys-for-bitcoin

what do you think for bitcoin?

Hey @jrcornel

Amazing post man!

I am admirer of your post!!😍

Can you help me?? Man..

Please take a look on my post also.

https://steemit.com/utopian-io/@hadim123/beautiful-nature-respect-and-protect-it