Investing in cryptocurrency:

Cryptocurrencies can be extremely profitable if you invest at the right time and on the right currency. This is very important because not all the cryptos are created equal. Some of them made a lot of people rich and some others failed even before starting. So before investing in one of them, think it twice, chose them carefully and always make a very informed investment decision.

Before investing in a cryptocurrency:

- Try to learn about cryptocurrencies, how to make money with them and what are the risks associated with cryptocurrencies and how to avoid them.

- Inform yourself as much as possible about the currency you want to invest. (If you are planning to invest on ICO’s beware of scams)

- Determine your strategy (Short term or Long term?)

- What is your buy/sell strategy? Are you going to buy when there’s a peak down and sell when it peaks up?

- What’s your take profit objective and your stop loss? (I suggest to focus on small consistent profits rather than big but rare profits and always keep loses small as possible)

- How much risk are you willing to take? (Never invest money that you cannot afford to lose)

- Always diversify your portfolio. I suggest to never invest more than 10% of your capital into a single cryptocurrency.

The best cryptocurrencies to invest 2018

Bitcoin (BTC)

Launched in 2009, Bitcoin became the first publicly traded cryptocurrency and marked the beginning of a new era in the development of the global financial system. BTC constitutes approximately 45% of the total cryptocurrency market capitalization and is currently the most expensive coin. The number of bitcoins is hardware-limited to 21 million and it’s the most trusted cryptocurrency among all. The creator is considered to be Satoshi Nakamoto, but no one ever seen him.

It is the oldest cryptocurrency and it still dominates in the market. So, if Bitcoin continues to increase like it did in 2017, then investing in Bitcoin might be a good idea for 2018.

Bitcoin is still one of the best cryptocurrencies to invest. Even though the price has plunged in recent times, it has managed to still remain one of the forces to reckon with in the crypto world.

Many people believe that the first remains the best and this will cause Bitcoin to remain relevant for a long time. Others who are not as excited about Bitcoin will just go ahead and discredit the currency.

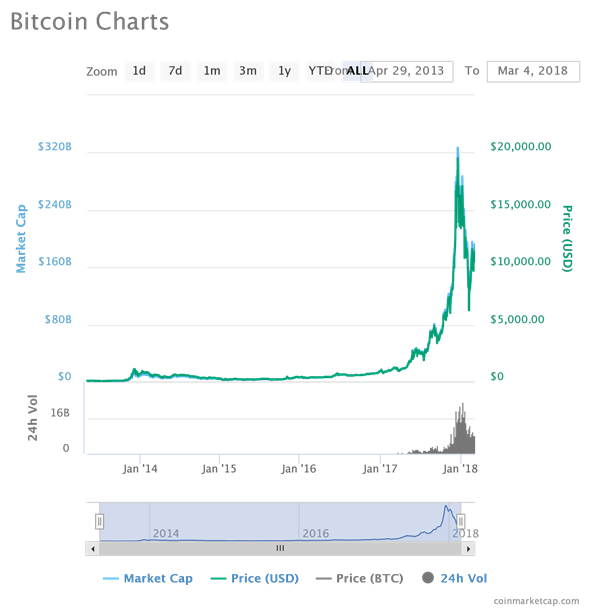

The price of Bitcoin changes a lot every day and has seen many highs and lows over the last few years. Take a look at the following chart and you will see just how much the price changes.

The price of 1 Bitcoin has gone from around $76 (07.09.13) to as high as $20,000 in December 2017. But then after Bitcoin reached its highest point in December, the price of Bitcoin dropped to around $6000 in February 2018. It’s crazy!

With the price changing so much in such a short space of time, how do you know what is the best time to invest in Bitcoin?

Well, we can find the answers by looking at some important past events — when the price went up or down by a large amount.

• One major event was when Bitcoin split into two cryptocurrencies: Bitcoin and Bitcoin Cash. This happened on August 1st. Investors who knew about this invested their money before the split and made huge profits, almost doubling their investment!

• The price of Bitcoin dropped to around $10,000 in January 2018, almost half of the $20,000 it was worth in December 2017. Many investors became worried at this point and started selling their Bitcoin. This caused the price to fall to around $6,000 in February 2018.

• If you made an investment in Bitcoin when the prices fell in February 2018, you would have already made about 100% profit on your investment.

Bitcoin Investing

If you want to invest in Bitcoin then you need to stay up to date with the latest news and trends around Bitcoin. When news is released about a new technical improvement, you might want to think about buying Bitcoin. If there is a huge fall in price of Bitcoin, then that too might be a good time to buy Bitcoin because you can buy it a low price.

If you have already decided to invest in cryptocurrencies, then it might be a good idea to start by investing in Bitcoin. Even though you have missed the first major opportunity to invest, investing in Bitcoin could still be a good idea.

It all depends on whether you believe in the future of Bitcoin. If you believe in it, you should think about investing in it. If you don’t, then I recommend that you stay away from it. It’s the same with any investment!

If you want to invest in bitcoin, there’s not just one way to make money with it. Here are some ways to make money with Bitcoin:

- Bitcoin Trading (Buy low/Sell High or Buy & Hold)

- Bitcoin Mining

- Bitcoin Lending

Dash (DASH)

Formerly known as Darkcoin and XCoin, Dash was launched three years ago, on 18 January 2014. It offers all capabilities of bitcoin but also spices them up with instant transactions (InstantSend), private transactions (PrivateSend) and decentralized governance (DGBB). When using Dash, it is possible to send money almost instantly and remain completely anonymous with the help of a Tor-like technology.

Dash utilizes a two-tier system. Miners, who write transaction to the blockchain, belong to the first tier. Masternodes that enable the advanced features (Dash-specific add-ons), belong to the second tier.

Ethereum (ETH)

Ethereum is the second most popular cryptocurrency after bitcoin, which is a great success considering the pioneering status of BTC. It is worth more than 50% of all bitcoins in the world.

The distinctive feature of Ethereum is the smart contract functionality. It helps to provide additional security and to reduce transaction costs. Stored in the Ethereum blockchain, smart contracts are the exchange mechanisms that can carry out the direct transaction of value between untrusted agents. This technology is one of the reasons behind Ethereum’s success.

Ethereum is well-known for volatility spikes. On 24 June 2017, the currency briefly crashed from $319 to 10 cents only to rebound later that day.

Ethereum is a cryptocurrency proposed by Vitalik Buterin, which was a computer programmer. It had been established in July 2015 with roughly 12 million pre-mined coins.

Ethereum saw a huge spike last year since it grew over 13,000% in value which makes it a phenomenal investment alternative for cryptocurrency fans.

Ethereum is one of the best to purchase, sell and exchange in 2018. As stated by the Coinmarketcap, Ethereum is the most market capped crypto on the marketplace after Bitcoin.

Are you asking yourself, “Should I invest in Ethereum?” or “Is the price of Ethereum already at its peak?”. Well, the truth is, nobody knows! However, the following information should help you decide whether investing in Ethereum is a good option for you.

Below are the key events that have most affected the price of Ethereum in the past:

Ethereum received an investment of around $150 million in May 2016. As a result, its price went up from $1 in January 2016 to around $14.80 in May 2016.

However, On June 18th, 2016, members of the Ethereum community found out that Ethereum had been hacked. Around $60 million worth of Ether (Ethereum’s currency) was stolen due to a flaw in a wallet. This caused the Ethereum price to drop from the high of $21.52 on 17th June 2016, to $9.96 on the 18th June 2016.

Unlike Bitcoin, Ethereum is not just a digital currency. It is a more advanced blockchain project. This is because Ethereum offers something special — by using Ethereum’s platform, developers can build their own cryptocurrencies.

Imagine that you would like to build a blockchain-based solution for managing the supply chain of your business. Well, thanks to Ethereum, you don’t need start from the beginning. Instead, you can just build an application on Ethereum’s blockchain. Ethereum makes it much easier for new blockchain projects to launch.

So, is Ethereum your next cryptocurrency to invest in 2018?

I recommend that you think about adding Ethereum to your list, as I think it could be one of the best cryptocurrency to invest 2018.

Julian Hosp, a blockchain expert, said that the market cap of Ethereum could rise to $200 billion by the end of 2018. If Hosp’s prediction is correct, the price of Ethereum will nearly double to $2000. Hosp’s reason behind the prediction is based mostly on the ICOs (Initial Coin Offerings) that decide to use the Ethereum blockchain in 2018.

Ethereum also plans to improve their technology a lot this year, with new protocols almost ready to go. So, watch out for Ethereum!

IOTA (MIOTA)

IOTA is a relatively new cryptocurrency, which is advertised as a new generation blockchain. It is optimized for the Internet-of-Things. Unlike heavy and complex blockchains, IOTA was developed with the intention of making it as lightweight as possible.

Instead of using blockchains, IOTA relies on tangles. The latter are based on the Directed Acyclic Graph (DAG) technology that does not differentiate between regular users and validators that approve the transactions. Therefore, to commit a transaction himself the user first has to confirm two other transactions. That’s the foundation of a decentralized IOTA system.

This is to allow businesses and individuals to comply efficiently with money laundering and taxation laws while still having the ability to transact with a cryptocurrency. Thanks to its distinctive blockchain structure, trades made on IOTA are entirely free whatever the ticket size of the payment.

This is a very useful feature particularly for a cryptocurrency that aims to become a payment mode that’s embraced by startups and tech corporates alike. Considering all these factors, IOTA is among the cryptocurrencies to watch out for in 2018 since it intends to integrate itself with payments that are mainstream. IOTA also intends to get heavily integrated into the Internet-of-Things (IOT) ecosystem so that is another space worth watching out for.

Litecoin (LTC)

Litecoin is one of the alternative cryptocurrencies, created after the initial triumph of bitcoin. You can think of Litecoin as bitcoin on steroids. The main difference between two cryptocurrencies is that Litecoin can confirm transactions much faster. Litecoin is not controlled by any central authority, has almost zero payment cost and carries out transactions at four times the speed of BTC.

Investing on Litecoin it’s a Bitcoin-like experience but without the huge costs

Well, like Bitcoin, it also saw an increase from $4 to $358 in 2017. In a similar fashion, 2018 saw it crash to almost $100, but the coin persists.

One reason for its worldwide adoption is that Litecoin constantly betters the technology of Bitcoin. If Bitcoin completes a transaction in 10 minutes, Litecoin will do it in two minutes, 30 seconds. The cap of Bitcoin is fixed at 21 mln, Litecoin has its maximum at 84 mln. They have also advanced on to greater achievements. In 2017, this currency completed a Lightning Network transaction, transferring a fraction of a Litecoin in one second.

Ripple (XRP)

Ripple is a company, providing global financial solutions. It was a logical step for them to launch their own cryptocurrency. According to its creators, Ripple is the world’s fastest and most scalable digital asset. It can boast almost immediate transactions, ability to process 1 000 deals per second (66 times more than Ethereum) and unmatched stability.

Ripple is currently the world’s third largest cryptocurrency by market cap.

Ripple has been in the news for its widespread adoption by several businesses. Even reputed institutions like MIT now accept Ripple as a valid form of payment. Even a startup named Omni recently elevated its Series C and D funding of USD 25m completely using Ripple instead of conventional monies.

Launched in 2011, Litecoin is modeled on the Bitcoin frame and was the notion of a Google employee named Charlie Lee. The USP of Litecoin is the fact that it means that a block every 2.5 minutes thus making it a much faster means of processing trades.

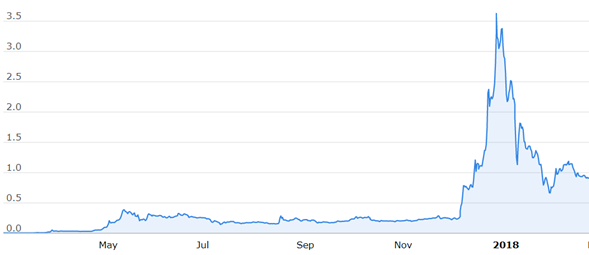

Ripple, was one of the best performing cryptocurrencies in 2017 with growth of around 36,000%! Yes, you read that right. It grew from almost $0 at the beginning of 2017 and reached $2.4 in December 2017 — as you can see in the following chart.

Like all other cryptocurrencies, the price of Ripple has also decreased in 2018 — it is currently set at $0.908.

I know what you’re thinking — you missed a great opportunity by not investing Ripple in early 2017. While that’s true, Ripple could still be a good option to consider as your next cryptocurrency to invest in 2018.

Even though the price of one XRP is a lot lower than the price of one Bitcoin, XRP is still the third largest cryptocurrency by market cap. Right now (03.05.18), it has a total market cap of around $35 billion.

So, what is it about Ripple that has made it so popular for investors?

The main reason for Ripple’s popularity is that it is not just a digital currency, but also a payment system. Ripple uses blockchain technology to make international payments securer and faster.

If you tried to make an international bank payment today, it would take around 2-10 days for the transaction to process. The same payment, when done using Ripple, takes a few seconds. How awesome is that!

But there’s more good news – many large financial institutions like American Express, JP Morgan and Santander are already using Ripple’s technology. Also, Ripple has been working with the Saudi Arabia Central Bank, China’s LianLian International and other banks from around the world.

So, if you’re wondering how to invest in blockchain, then Ripple might be the best answer.

Based on what I just explained, Ripple’s future in financial industry could be a good one. You should watch out for Ripple and learn more about their partnerships. Look out for new partnerships too — if Ripple signs a contract with another large bank, then it could increase the price of XRP.

The investors, who understood the services that are offered by Ripple, have made a lot of money. After a fantastic 2017, Ripple could just be the best cryptocurrency to invest 2018.

Note: Now might be a good time to invest in Ripple, as its price has dropped 70% lower than it’s all-time high of $3.4 in January 2017.

How to invest in cryptocurrency

Short-term cryptocurrency investment or Long-Term?

As earlier mentioned, cryptocurrency is just like the traditional asset to invest in. You can choose to buy it and hold it for a very long time or sell almost immediately. How you invest depends on what you want from the market although, long-term investments are known to be more viable. Also, timing determines whether to hold a crypto for so long or sell.

Consider the case of Bitcoin. It entered the market in 2009 and for a very long time, the price rose slowly but steadily, until 2017. Bitcoin saw an astronomical increase, seeing its value almost peak at $20,000, and then it plummeted without any warning and we have been waiting for its rise ever since.

Does this mean that the best cryptocurrency to invest in is a fledgling currency which has achieved a modicum of fame and is at a reasonably low price? Well, not really. But, it’s worth giving a try.

Let’s go through some of the attributes of cryptocurrencies and questions to ask before making a long-term investment:

- Do you plan to sell the cryptocurrency after a period of time or after it peaks at a price?

- Do you aim to sell your cryptocurrency asset at once or gradually?

- Is there anything that’ll make you sell off your cryptocurrency abruptly?

- What’s the maximum loss you’re willing to incur?

- How much profit are you hoping to make?

- Do you have the patience to read market analysis and follow news reports?

These should set you on course and help you make the right decision. In case you aren’t satisfied, this should do the trick.

Long-term investment strategy

A long-term investment is one where you expect a cryptocurrency to perform better over a longer period of time. Simple! Normally, the minimum time for long-term investment is 6 months to 1 year. Although, some people plan to hold onto their investments for 5-10+ years. It’s up to you how you choose to invest; you can either make your full investment in one go, or you can invest at different times.

- You should make long-term investments if you have idle funds and you are willing to leave it like that for a long time.

- You believe in the future of the cryptocurrency

- If you have sufficient evidence that supports the growth in the long term, go for long-term investment.

- Long-term investing makes your life easier as you don’t need to watch the market all the time

- You believe that some cryptocurrencies will give a better return in the long-term

Things to consider when investing in a cryptocurrency long-term:

• Is their technology better than their competitors?

• Do they have a strong team of founders and developers?

• How good is their roadmap/plan?

• Are they solving any real-world problems?

If you really believe in the cryptocurrency you invest in, you should learn to hold on to your investment even when the prices drop. If you ‘panic sell’, then you could lose money and regret selling.

Short-term investment strategy

Short-term investments are made over shorter time periods in the hope of making quick profits. So, just how short is a short-term investment?

Short-term investments can take seconds, minutes, days or even a few months.

- If the company just launched their ICO you can enter the market cheaply.

- If you feel confident with cryptocurrency trading: Reading charts, making fundamental/technical analysis using indicators and determine short and fast price movements to make a quick profit

- If there’s a very low market capitalization, don’t think of buying for long.

The cryptocurrency markets today

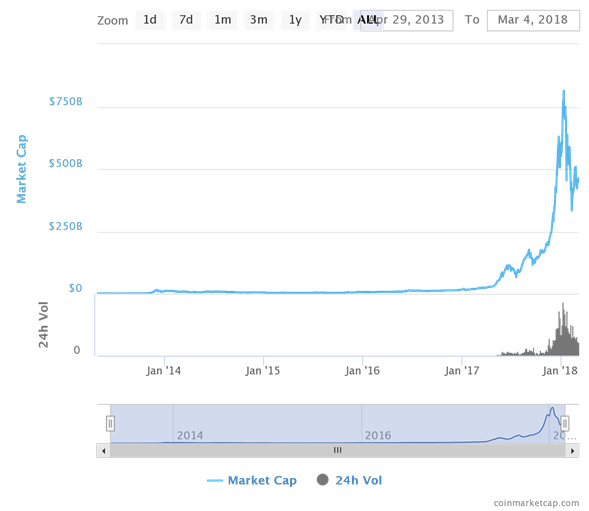

The following chart from CoinMarketCap shows the growth of cryptocurrencies over the last few years.

It all started with Bitcoin in 2009 where a Bitcoin was worth a couple of pizzas. If you would have bought one bitcoin in 2009, right now you would have $300 million dollars’ worth of Bitcoin.

Litecoin and Ethereum quickly joined and fiercely competed with Bitcoin for a share of the market. In about nine years, we’ve had several cryptocurrencies come on board but none has enjoyed the surge Bitcoin enjoyed in 2017. The price increased by almost 4,000%, having a market capitalization of about 450 billion dollars.

We have also had about 3,000 new crypto coins in the market with each of them claiming that they’re the next best thing after Bitcoin. Unfortunately, many of these coins go extinct before they even launch. In fact, a study carried out by Deloitte showed that 92 percent of Blockchain projects which were launched between 2015 and now failed. This makes it important to carefully consider what cryptocurrency to invest in before putting your money. The ICO’s (Initial Coin Offerings) can be as profitable as risky. This is why you need to peak them very carefully with as much information as possible about them and always diversify your portfolio.

Where is Bitcoin Legal?

Bitcoin is legal in the following states and territories: the EU, Croatia, Czech Republic, Germany, Poland, Romania, Slovakia, Slovenia, Switzerland, Denmark, Estonia, Finland, Iceland, Lithuania, Norway, Russia, Sweden, Bosnia and Herzegovina, Bulgaria, Greece, Italy, Malta, Portugal, Spain, Turkey, Belgium, France, Ireland, Luxembourg, Netherlands, United Kingdom, Australia, New Zealand, Nigeria, South Africa, Zimbabwe, Canada, United States, Nicaragua, Argentina, Brazil, Chile, Colombia, Cyprus, Israel, Jordan, Lebanon, India, Pakistan, China, Hong Kong, Japan, South Korea, Taiwan, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam.

The following countries banned the use of cryptocurrencies in general: Kyrgyzstan, Bangladesh, Bolivia, and Ecuador.

Conclusion:

Now you know what are the top cryptocurrencies to invest this year. While cryptocurrencies can give you huge profits, you must be prepared for one thing: to lose money. Remember, your predictions won’t always be right and not every coin is going to be profitable!

Nobody truly knows what is going to happen to the price of a cryptocurrency, or any other investment. So I strongly recommend to always diversify your investments but not way too much. Invest on a few but strong and promising coins rather than a lot of mediocre ones. Also, remember: Never invest more than 10% of your capital on a single currency.

Do you know what most of the expert investors say? You should only invest money that you are not afraid to lose. It’s great advice, so always remember it!

I hope that you now know which investment strategy will work best for you, and that you have a good understanding of what makes a good investment.

Which of the cryptocurrencies I mentioned is your favorite? Do you have a pick for the best cryptocurrency to invest 2018?

If you liked this post and would like me to post more in-depth content about strategies to make money with cryptos & investing in general. Please vote up! Thanks for reading :)

Congratulations @fahrew543! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!