So up until about 5-6 weeks ago many were panicking about the enormous price drop in cryptos since December but more seasoned traders and investors knew this was a buying opportunity, and who knows when and if it'll present itself at these prices again. The FUD seems to have calmed down and the markets seem to be starting to react as they should to counter the great panic selling of the hard crypto winter.

I'd like to present my case and I'll begin with Bitcoin. it is slowly approaching the 10k mark and has remained in solid territory as far as two of my favorite indicators are concerned (RSI and Bollinger bands). We're steadily approaching key psychological level of $10K USD and I hope to see this happen soon with a big green bullish engulfing candle on the daily chart soon.

Bitcoin is the market leader and others tend to follow but we've seen some mixed performances in alts which is good! Bitcoin seems like it has less effect on the overall market the last several week which is good. Each crypto should appreciate or vice versa based on its own merits. My strategy is sort of based on Warren Buffet's "buy when there is blood in the streets" and there was definitely plenty of blood to go around. I also use sentiment of others to detect good times to buy and also bollinger band analysis and RSI. Lots of people on steemit who do technical analysis like elliot waves which is fine, but it's not my bag.

My point is, when people are panicking about the price of any crypto, take steem for example, and the viability of the platform itself and the currency value, I was scooping it up as I did in the fall around a dollar. Was it a good pickup recently? well the price that I averaged my buy of 522 steem was $2.20 I believe, and now steem trades around $4. OPPORTUNITY! Caught that falling knife and now those buys have doubled in value.

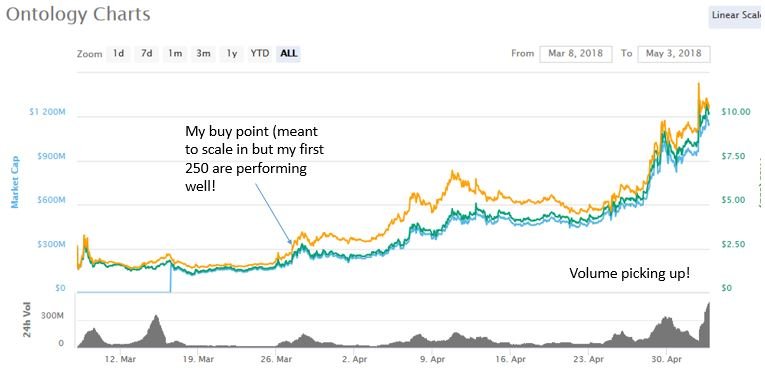

Which leads me to another big winner winner chicken dinner for me recently and my latest addition to my almost 20 types of crypto--Ontology. I noticed a beginning uptrend and bought 250 of them around $2 and now they're trading over $10! Nice 4 bagger so far and it looks like it's got more room to run. I only wish I'd bought 500 or more but I didn't have that much fiat to spare.

And finally we have a huge winner--EOS. Gosh I wish I hadn't sold 80% of what I'd bought at under $1.75 or so average (1000 of them when it hit $8 months ago, but I still hold some and their value is skyrocketing). I can only imagine what we'll see in the next few months. It could be the next big big one!

So I'm not letting go of any of my holdings any time soon. I'm in this for the long haul and I wanted to point out that there have been 3 times in the past year when people buy high and panic sell which saddens me. I'm not trying to give advice, only showing that patience in the market pays off. Another Buffetism, "The stock market is a device for transferring money from the impatient to the patient..." Yes this seems to apply to cryptos too. Look at all the folks who bought at the top and sold when it dropped so far.

So next time you're losing hope, maybe keep a cool head. If it's money you can afford to lose, which is the only money you should invest in such volatile assets, give it time unless you see some bad scammy stuff going on with one of your holdings.

That's why I'm not afraid of falling knives, I keep my buys moderate to small and fairly frequent so if I get temporarily burned on a buy, I can always average down and usually I end up better off for it. Look at my steem account value if you don't believe me. I've not invested but about 60% of 5 figures here in USD and most of my earnings have come from appreciation of value of my buys. Yes some of it is from authoring but it's a small portion compared to the hard earned money I've put in it.

So if there's a moral to this rambling story, things are starting to look better and if you look at what happened last spring and consider that this is a very early stage technology, the sky is the limit. I've had plenty of could've would've should've regrets in investing and lost money on stocks and such at times because I didn't follow my plan and wasn't patient.

It took me a long time to discipline myself to just ignore the market when I don't feel like seeing how much I've lost on paper. But I must remember a loss is not a loss until I sell. And that's usually near the turning point and I regret selling. I've done it many times but I've learned from it.

So cheers to a budding uptrend in the general crypto markets. Let's keep our fingers crossed and our eyes open for great opportunities! You won't get rich overnight, it may take years, but it could happen! It could change your life! Or you could lose a lot of money if you aren't diligent. Speaking of diligence, I must end on this note.

this is not investment advice, only a snapshot of my experience through this hard past few months. I am not a financial advisor and I don't suggest you follow my strategy because it's my money to lose and even if I lose it I can still pay my bills. Don't invest more than you can afford to lose, always do your own research, and if you're unsure, then consult someone who knows what they're doing (a competent financial advisor). Don't just take some guy on the internet's word for it. No matter how great the benefits may appear to be in the future>

Happy investing and an early happy friday to you all!

~Cryptokeepr

Great stuff man - I've been trying to do the same although I'll admit that I get torn between opportunities in the equities markets too. Without a doubt though, your use of Warren Buffet's buy low, sell high investment strategy is spot on. If you approach crypto as long-term investments, and not short term trades, it's a whole new world - but folks sometimes forget that!

Yeah that was my mistake with the EOS I was holding, I lost sight of the long term target in favor of hoping to increase my position size by selling at what I thought would be near a high when I thought it was just gonna drop back down to under $3 temporarily (then I was gonna buy even more than I had been holding). Well I waited too long and here we are at about 18 bucks lol. Oh well, I still have some which is better than none.

But yeah, long term is a good way to go and some days and weeks I just have to look away, not worry about the current prices, and look to the future.

Investment Banks should let their fingers out of crypto! You think greedy big profit Banks are good for decentralization? I think not, because they want to take control and make profits that's all what they want... They are scared to loose control, that's why they want to be a part of crypto. I give a damn on Goldman Sachs, JPMorgan Chase...

Oh I have no doubt they're getting involved because they see it as a threat. Unfortunately, as with many things, there's not much we can do about it...they'll do what they're gonna do.

Someone mentioned in a post I read recently that there was a huge amount of short interest in BTC right around when it was testing the critical support level near $6k and I would be willing to bet a decent amount of that was traders that work for JPM / other investment banks and their ilk.

They move / control much larger markets than crypto (think commodities like gold and oil) so they have enough firepower to move the price of any given crypto around as they please if that's what they truly want to do.

Wow! You have been really inspired with this post.

I confess, I’m an Elliot Waves TA user which I also combine with bollinger bands and Stochastic RSI as well with MACD, and FIBO.Elliot Waves can give you a future scenario while the others give you and Indication...

Then, you have to use of all available TA tools in order to draw your strategy.

So, you are doing TA as well my friend

Yep it's basic TA for sure. I got into learning about it when I started trading stocks some years ago. EW analysis seems to be the go to TA indicator for a lot of crypto traders and I do follow some people who use it. It's just like other methods, it's just a different type of tool (and there are many many TA tools now, seems there's a new method developed every other day now).

Honestly I got tired of short term trading and have adopted a longer term strategy but I still like to do this type of thing from time to time for fun and to see which way the indicators say things are heading.

The cryptoworld is just beginning. Those who think it will end bad must be so scared of the huge potential it has. It's better be wise now that sorry later.

Yes a lot of people seem to think that missing out on BTC when it was cheap was like missing a once in a lifetime opportunity...but it isn't--BTC is a great thing but I think someday it's going to lose its dominance to another coin. And when that happens there will be new crypto millionaires (those who bought into the right thing at the right time).

My hope is that one of cryptos that I hold will be the one that helps to give me an early retirement some day...but until then I'm not gonna quit my day job lol.

I usually don't win with people I know either way.. If the price is correcting, everyone I know thinks I'm an idiot (without realizing shorting is a thing) and if it's going up I need "to exit immediately because its a Ponzi scheme". No one ever cared what I did before trading, but now that I'm having success in cryptocurrency everyone I know comes out of the woodwork to be a hater.

Haha I can definitely understand where you're coming from. I don't really talk to many people including family, friends, or coworkers about crypto for some of the reasons you've mentioned here. One reason I don't talk to people I know personally about cryptos and my gains so far is I'm afraid they'll just jump in blindly at the wrong time then be mad at me for telling them about it (even though I don't tell people they should go buy something). There's also definitely a lot of people out there who stick their nose where it doesn't belong.

As far as overall sentiment goes, I usually take what's being circulated in the media and what people are saying online on platforms like this as a way to gauge when there's a lot of fear and uncertainty. Most people I encounter face to face don't know about cryptos or aren't involved with owning them...

I really agree with them jumping in at the wrong time thing.. I could see people I know convinced Ripple is a good idea on the 3.00 runup because "lol banks are safer"... then when it went bad I could see them blaming me somehow, or saying "if people would quit buying into ponzi schemes like bitcoin, the true blockchain technologies like Ripple would have a chance to reach 10.00!!!!"

Till January 2018 I was a total disbeliever about the sanity of trading cryptos. Then I came to steemit and I started reading articles about cryptos, some good, some bad. Slowly I entered the crypto train. I am telling you this because the article above is one of the best that I have read. Congrats and keep the good work.

Well thanks for the compliment! Trading cryptos can be very difficult because they're so volatile and so reactive to the news cycle (even if the news isn't exactly truthful or accurate).

January was definitely a shocking month for a lot of people, especially those who got in near the top of that last spike. I saw some of my holdings increase five to tenfold in the last couple of months of 2017 and then it all came crashing down and seemingly there was no bottom. Seems like we're at the beginning of a new cycle--I'll be curious to see how it plays out!

Congratulation cryptokeepr! Your post has appeared on the hot page at 03/05/2018 23:15:25 with 30 votes.

Thank you for your continued support of SteemSilverGold

I bought EOS when it was around $1.50 CDN. I haven’t sold it. I know people who think it’s eventually going to be mumber 2 only behind Bitcoin in market cap. If that happens, EOS may allow me to retire young.

Great article, thanks for sharing. I've smashed the upvote button for you!

Also, if you are looking to get some tokens without investing or mining check out Crowdholding (https://www.crowdholding.com). They are a co-creation platform were you get rewarded for giving feedback to crypto startups on the platform. You can earn Crowdholding's token as well as DeepOnion, ITT, Smartcash and many other ERC-20 tokens.

I've never heard of Crowdholding but will definitely look into it. Sounds interesting. I'm always down for earning reward in whatever form they come in.

Thanks for sharing that with me!