The demographic of the investors in crypto is vastly different than virtually all other forms of investments.

While there are young people who invest in stocks, housing, gold, and other long term investments, crypto is often linked with young, geeky guys who were living in their mom's basement before they gained wealth through these digital assets.

This can be good, considering we could potentially continue to have a huge transfer of wealth in the coming years, but could also mean we could continue to see markets that act differently than markets that have existed for a much longer period of time. While this isn't necessarily good or bad, it does mean that we're in a much less predictable market, which can make things a little risky.

While Bitcoin seems like a relatively safe investment in the field of crypto today, it once was a huge long shot. Sure, the technology was there, and those who could see its potential saw it as a great investment, but I'm sure the vast majority of people who were investors early on didn't even expect it to get as big as it is today, let alone what we could see within the next decade or so. Even if Bitcoin doesn't survive for whatever reason, it will likely be the spark that allows these digital assets to become the preferred method of currency for future generations.

Even as prices continue to go down in a bear market, the legitimacy of crypto in general is constantly growing, and as some are saying, it's getting impossible to ignore. While these assets are still very volatile, investing in projects with more development seems to become a less risky decision as time goes on.

Of course, one should not invest more money than they are willing to lose, especially in a market that is as volatile as crypto. However, considering the gains that can be achieved, and the presence that this community now has on the entire world, it seems like the risk/reward ratio is much more favorable now than it ever was.

The interesting thing about crypto, however, is that it is really unlike any other investment that is out there today. We have things like houses and cars that are useful regardless of their price, and we have things that can be used as a form of payment to get whatever one's heart desires.

I think we can agree that something like the US dollar isn't a great "investment", as it is constantly losing perceived value every year, and it no longer receives the value that gold gave it for so many years. Like Bitcoin, it's value lies in its usage, while bitcoin has even more to offer in terms of scarcity and potential usage. We obviously have something like gold, which can be used as a currency and has a more legitimate claim of value than Bitcoin.

However, what Bitcoin and other crypto currencies have that other assets don't have is convenience. Sure, gold has been used as a currency in the past, and continues to retain its value. Things like livestock have been used as currency in the past as well, but it becomes more convenient to hand somebody a piece of paper or a token than dragging an animal around.

Our technology is advancing at an exponential rate, and just because something has been true for one's entire life doesn't mean it can continue to remain true.

I believe value for future currencies will be less about carrying an actual inherent value and more about carrying the most important value of our current society: convenience.

Before I was born, the mobile phone's only real form of value was that it could do something that could already be done, but in a portable way. One would argue that it was less convenient because it's usage wasn't as polished as the phones that came before it, and so people still opted for what they were used to, not to mention the price of this technology was higher than most could afford for such a luxury. As time went on, the technology became more advanced, production became cheaper, and more people started to to utilize one of these clunky, revolutionary pieces of equipment.

2007 was the year I got my fist mobile phone. I was in middle school, and very few kids my age had their own cell phone. Most of our parents had them, but considering they only used them to make calls, the children often had the phones that were more advanced. I saved up whatever money I could get my hands on for quite some time, and my prepaid cell phone bill, which was used only for texts, was the first consistent payment I ever had to make. My phone had one of the better cameras out there at a whopping 1.3 megapixels, and no selfie cameras were present.

2007 was also the year that the first iPhone came out. I'll let you look how far we've come in that field by comparing the first iPhone to the iPhone X.

Yes, that phone costs $1000, but look at what it is capable of doing. Many people live a very large portion of their life on their own personal screen. The value that our phones now have is impossible to measure, but I think we can agree that it's worth the money. Almost every industry has completely evolved to accommodate our dependence on not only the advancements in technology overall, but specifically what goes on within our smartphones.

Why the rant on smartphones? I think it is the unit that represents what the internet is to us in today's society.

I think these crypto currencies can be the same. The coins can represent how blockchain could become one of the main pieces in our society.

Crypto isn't just about making transactions, just as a cell phone isn't just about making phone calls. For example, the platform of Ethereum is similar to the combination of the internet and an app store, except less streamlined at this point, but also provides more potential.

Ultimately, the blockchain has the opportunity to disrupt any given industry if the minds can come together to make it happen.

Of course, if one coin could disrupt the entire e-commerce business, that's where the most value would come, considering how much money is flowing through this system in modern society. However, it is unlikely that anything of this magnitude can be achieved by one single coin, and it will likely be dispersed among a variety of coins that can serve as payment options across their own platforms.

This opens up large potential value for any project that can capture a large amount of an industry that is considered obsolete relative to what can be achieved on the blockchain. Given the idea that payments will be managed in a variety of ways, this is likely where the largest return on investment can be achieved. Projects that allow for a variety of applications to be run on their network could see a share of all the activity of these projects provide, but this also can be a goal that is too lofty for one network to handle.

Taking all of this into consideration, I would consider there to be 3 different realistic outcomes for the world of crypto to reach mass adoption.

The first outcome is that we will be able to utilize exchanges, atomic swaps, and any current and future technologies to be able to have a large amount of projects stay alive and relevant, with many utilizing their own currency or migrating from the network they currently are on. While this could be very difficult, there wouldn't be a need to have giant networks congested with what would become massive volume from a variety of projects that are using a variety of transaction values. This could be a very confusing world to live in at first without a doubt, but if we adjusted we would be able to have a much more decentralized world where consumers choose how they want to do transactions and what networks they want to use, as they would have many options to choose from. While this would be great if we were able to adjust, I don't consider it a likely scenario, as I don't think all of these projects would look to start from scratch and build their own network when they can just build their system on something that is tried and tested. I also don't think this is something that the masses would be able to adjust to, but at the same time, I still think it is something that we could achieve if the masses valued decentralization more than they do now. Anyway, if this was the result, that would mean that platforms such as Ethereum wouldn't be as vital to the crypto ecosystem, if they even remain relevant at all. This would mean that market share wouldn't be as top heavy, and smaller projects now could have immense increases in value.

The second scenario that I would consider is that as opposed to having all of these projects run on separate networks, we would see the successful projects, whether this is a large amount or small amount, running on top of a smaller amount of networks, using things like Ethereum, EOS, Waves, or Skycoin, just to name a few. This would mean that you could see some nice returns on some smaller coins, but ultimately you would likely see the networks that they run on top of outperform these smaller projects while also being a much safer investment. Of course, there are scalability issues involved here, and the networks that would succeed would have to be top notch to be able to handle everything involved with dealing with a variety of projects and massive combined volumes. While this seems like a likely scenario from a development standpoint for the smaller projects, I'm not sure if the legitimacy of any of the current network projects can handle this type of weight.

Finally, we have what I consider to be the most likely option, which is that we have a somewhat balanced combination of the two. This would mean that we would have multiple networks doing what Ethereum is doing right now, while also having a variety of projects do their own thing and run independently. This is pretty similar to what is happening now, it would just be on a larger scale. We would continue to have terrible projects do little work and just run on another network trying to make a quick buck, but would also have very legitimate projects running on top of these platforms, utilizing the improvements these larger networks have developed over time. We would also have projects with more ambition or ones looking to to do things differently branch out and possibly migrate to their own network, and you would be able to take advantage of both. While this scenario seems like the most balanced and most likely to me, I also think that it makes it more difficult to differentiate the projects that aren't really solving any problems or making any legitimate developments from the truly great projects. The only solution that I can think of for this is that we are likely in an ICO bubble right now, and will see these poor attempts die out over time as the legitimate projects rise to the surface.

So what does this mean from an investment standpoint? Should you be investing in the top 10 coins, thinking they are the most stable? Should you get into every shitcoin you can, hoping that a few can do 1000x and make you rich?

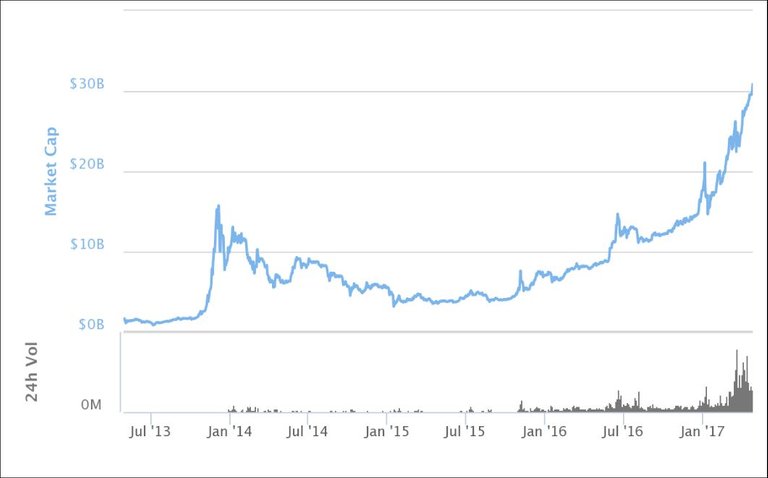

As far as the top 10 coins go, or even the top 100, I would like you to look at the historical data of the top coins from throughout the years. You might be surprised by the stability or instability of what coins were in the top. If you don't feel like looking it up, here's a quick summary: most of them failed.

Of course, things like Bitcoin and Litecoin survived, but those that were just trying to capitalize on the relative boom of the crypto market in the past didn't do so hot. Of course, had you invested in some of the top performers, you still would have seen an increase in your portfolio overall, but nothing comparable to what we've seen in huge bear markets over just a very short period of time.

Therefore, I wouldn't suggest thinking the top coins are safe, nor would I suggest that spreading your money across a large number of shitcoins could yield higher returns.

Ultimately, I think the takeaway here is that the projects that are in constant development mode and expansion mode, regardless of their position on CMC, are the projects that you should be invested in. I wouldn't consider any coin a safe bet, and I think any coin in the top 5 or 10 could be almost worthless in 5 years. I also think we could see a coin that isn't in the top 10 be the number one coin in 5 years.

Basically, I don't think the current price of a coin makes a difference at all considering how early we still are in terms of reaching mass adoption. If a project that can change an industry has been working hard, still is working hard, and has plans to continue working hard, I think it's a good pick. Whether the coin's market cap is in the thousands, millions, or billions doesn't fully dictate its chance for survival.

The whole crypto market carries a risk that should not be ignored, but the extent of the risk lies on the developers and not the current success of the project. If you have 10k and put 1k into 10 different projects with various market caps that you consider great projects, I would argue that is almost always going to be both safer and more lucrative than putting that 10k into one single project, whatever it may be.

But remember, this is the wild west, and nobody is safe.

Do your own research, think for yourself, and make your own decisions.

Always.

Amazing post, great value in your experience and knowledge.