Bitcoin powered above $4,000 yesterday, reaching $4,178 on Bitfinex, although the rally has stalled somewhat today, with BTC clinging to the psychologically important 4k level.

BTC is currently trading at a two week high.

And the green candles were not confined to the leading crypto, with Tron, Litecoin, Stellar and Neo enjoying double-digit percentage gains.

Litecoin in particular has moved up 22% in the past seven days to trade at $38. Smart economy blockchain NEO advanced a similar amount and is currently riced at 0.023576.

Sixth-placed XLM is 6% higher at $0.12 today making the outperformed among top alt coins.

Helping to shift sentiment in a positive direction was relief that the proof of keys stress test saw no serious fallout despite the alleged exchange failures as related by Trace Mayer.

Chris Burniske from placeholder.vc tweeted some comments about interest from the mainstream being at rock bottom, which he took to be a good sign that the pain from the crash was nearing its end.

Then there was Clem Chambers from investor network ADVFN saying that bitcoin would boom in 2020. Ok, that's a year away but it nevertheless was taken as a bullish call by market participants.

On the adoption front, there was news from Epic, the makers of the hugely popular game Fortnite, that a game store had activated Monero. That turned out not to be the case but the initial story was widely reported.

Also the announcement that DX Exchange was bringing tokenised securities trading to the masses went down extremely well, with favourable coverage from Bloomberg and others. The DX exchange went live today in a tie up with Nasdaq that has enabled it to offer trading in leading big tech stocks such as Apple, Alphabet and Facebook.

The exchange is based in Estonia and its launch further enhances the country's position as a tech-friendly jurisdiction

Hot on the heels came the news yesterday that Coinfloor, the Uk's oldest crypto exchange, has spun off a company called CoinFLEX to trade crypto futures.

The company is based offshore in Hong Kong and will be the first firm to bring a physically settled bitcoin futures product to market, beating Bakkt and stealing a march on the cash-settled instruments from the likes of BitMEX, also based in Hong Kong.

In an interview on Bloomberg, chief executive Mark Lamb pointed out that the CFTC regulated bitcoin futures available in the US account for only "1 to 2% of the BTC futures market". The other 98% is offshore, mostly in Asia. Choosing a non-regulated approach offshore allows CoinFLEX to hit a global audience.

BitMEX is currently one of the largest players in the crypto derivatives market and offers its customers leverage of up to 100x. CoinFLEX is initially taking a slightly more conservative approach of 20x.

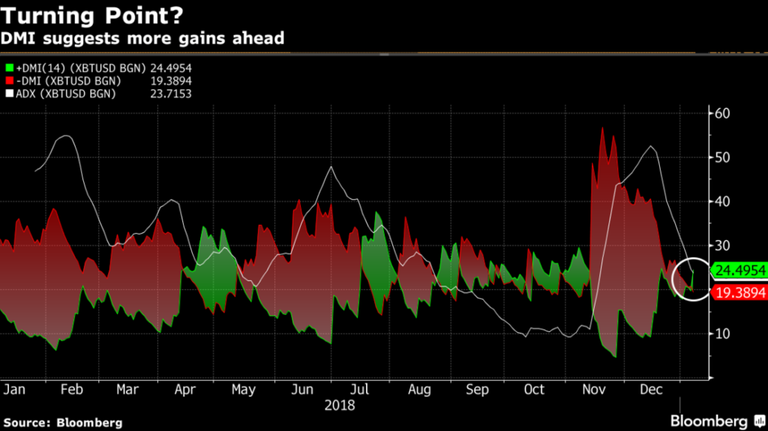

On the technical front the Directional Movement Index is positive for the first time since mid-November at 24.49 ( https://www.bloomberg.com/news/articles/2019-01-07/bitcoin-pushes-past-4-000-as-technical-gauge-turns-positive )

Posted from Coinintelnews.com with SteemPress : https://coinintelnews.com/bitcoin-rallies-above-4000-coinfloor-btc-futures/

Warning! This user is on my black list, likely as a known plagiarist, spammer or ID thief. Please be cautious with this post!

If you believe this is an error, please chat with us in the #cheetah-appeals channel in our discord.