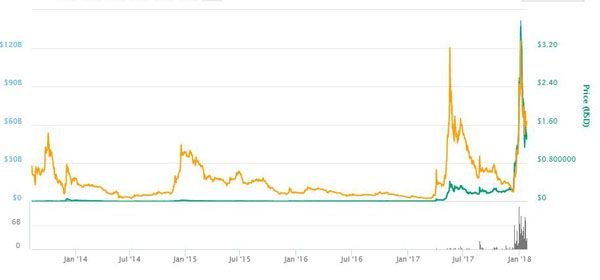

Ripple was first conceived in 2004 by Ryan Fugger while working for an exchange trading system. Over the years it has transform from Ripplepay in 2005, opencoin in 2012, to ripplelabs in 2013. In 2014 it became the world’s biggest cryptocurrency replacing litecoin. In 2014 German bank Fidor adopted it for their international transactions. The same year, it’s price increased by about 200%.

The price had remained relatively stable till 2017, when it recorded its highest volume trade at $899,821,406.17. This represented a growth of 36,000%. The question now is that with its price at $1.31, as of today, are we running out of time to buy it cheap?

Why Ripple?

Ripple (XRP) is the only digital asset with a clear institutional use case. It was designed to solve the global payment and liquidity challenges that banks, payment providers and corporates face. This remains multi-trillion dollar problem. To solve this problem, speed, cost and scalability are of extreme importance. Ripple is clearly the winner when you line up the top digital assets for these attributes.

Top Info about Ripple

- The XRP Ledger is not centralized: Last year Coinbase announced it would be adding more coins to its exchange. Most people dismissed Ripple as a candidate because it was not a decentralized coin. Centralization implies that a single entity controls the Ledger. While Ripple contributes to the open-source code of the XRP Ledger it does not own, control, or administer the XRP Ledger. The ledger is decentralized.

- Understanding the difference between XRP, XRP Ledger, and Ripple: XRP is the digital asset native to XRP Ledger. While XRP Ledger is an open-source, distributed ledger. Ripple is a privately held company.

- Rate of adoption by financial institutions: Banks have been the major adopters. Examples include Santander, Unicredit, UBS, Royal bank of Canada, CIBC. And the National bank of Abu Dhabi. This year, 2 major payment providers, MoneyGram and Cuallix have their pilot use of XRP in payment flows through xRapid to provide liquidity solutions for their cross-border payments’

- Security and the use exchanges: The software that maintains the Ledger is open source and executes continually on a distributed network of servers operated by a variety of organizations. Since XRP Ledger’s inception, the engineers have worked to make the Ledger more resilient and resistant to a single point of failure through decentralization.

- Transaction monitoring: The Company cannot freeze transactions and all transactions on XRP Ledger are publicly viewable.

- Creation of more XRP: About 100 billion was created before the company was formed. A large part of that was given to the Ripple company

Prospects for 2018

As expected the Ripple team is taking a bullish position on 2018. Raghu Battula, Sr. Director of Engineering said:

The No.1 goal is to make sure we rapidly scale out RippleNet and the core products behind it — xVia, xCurrent, and xRapid — to meet our enterprise customers’ needs and provide a frictionless experience. We’re building this out in a way that’s highly scalable, fast and reliable for our customers

No.2 is to hire a lot of smart people. I’m looking to hire engineers who have built scalable financial systems.

No.3 is the culture, as we’re growing rapidly, it’s important to make sure we continue to live our core values that make up the larger Ripple family. From an engineering perspective, this means we’ll continue to have a fast-paced culture and rapid innovation in the blockchain space and try new ideas.

During this week’s Cryptocurrency rout, I wondered if the price would drop below $1. XRP recovered at about $1.2. I personally believe XRP has already achieved conventional investors and would be difficult to go below $1 (some people think the bottom is actually $0.8)

Thanks for reading.

Disclaimer: prospecting investors are doing so at their own risk.

I am a skeptic when it comes to ripple and would love to pick your brain a little. I own it, but just to balance out my portfolio.

We have all these cryptos that basically make banks unnecessary, so why buy the bank coin? I do believe banks will not give up easily, but I feel like a crypto needs mass adoption to succeed. Do you think people will flock to this coin, rather than (completely) decentralized coins and if so, will it be by choice or force?

You are absolutely right... the banks won't go easily. The Banks might want to use ripple as some sort of insurance against other cryptos. People will just stick with their banks if they start charging reasonably for transactions. The ripple management had this in mind when appointing Zoe Cruz of Morgan stanley to its board.

I think it would be a mixture of choice and force.

The crypto purists are totally against Ripple. However as your post stated, it is the only crypto with a clear institutional use case that is being adopted. Sadly, banks are not going away any time soon. Right now Ripple has huge potential.

Banks will use ripple as insurance. Thanks for reading.

If nodes need to be approved and if all approved nodes are held by Ripple Labs, it's centralized. Simple as that.

The time to buy XRP was in March before this crazy bullrun, the time to sell was at $3. Current investors might get an exit or two this year, but the long-term value of the XRP token is 0.