Years ago, I read an excellent book on the history of finance, entitled Devil Take the Hindmost. In it, the author points out that major, sometimes systemic, financial scandals/disasters occur with almost predictable regularity. At least in the West. In the U.S., the 2008-09 subprime mortgage crisis is still fresh on many peoples' minds, and was preceded by the Enron energy debacle, a raft of failing thrifts during the S&L crisis, and on and on...

Traditional finance continues to demonstrate that when left to its own devices it eventually and reliably fails to deploy its various instruments of capital with any concern for the negative, even catastrophic outcomes, should the market move against their estimates. During the 2008 time period, it as widely, acknowledged after the fact, that the financiers who developed numerous credit default swaps and other derivatives couldn't even measure the risk they were introducing to the markets. The fact that this behavior continues isn't surprising, given the unresponsiveness of many elected officials to the needs of their constituents. But are people finally starting to catch on?

I hope so.

I remember being incensed reading an article online earlier this year (no longer available) in which Goldman Sachs analysts suggested that speculation in crypto currency would likely lead to another collapse in the housing market. Pretty rich coming from the people who helped cause the last one. Not to mention that crypto is apparently largely fueling American's epidemic of opioid abuse (Look here for the hit piece: https://www.cnbc.com/2018/04/13/how-bitcoin-and-cryptocurrencies-are-fueling-americas-opioid-crisis.html)

It's about to be business as usual here again, as the US is rolling back many restrictions imposed after 2008 to limit bad behavior by large banks. I mean, it'll be different now. Surely we can trust them not to fuck it up this time, right?

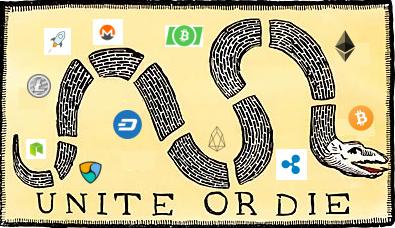

But there appears to be hope. It could turn out that more people are catching on to this shell game, are beginning to view cryptocurrency as a legitimate means of financial empowerment, and could choose not to participate in a system they are unable to change or understand. The article below offers some encouragement.

Also, if you haven't seen the Declaration of Currency Independence, consider doing so. And if you're really passionate join the growing community of signatories online in the Discord channel.

http://currencyindependence.com/