I wanted to go live to talk about this and I still might, but thanks to a sick kid, it's on Steemit.

Losing Losing Losing

The most stressful part of a bear market isn't the losing, though many think it is. The most stressful part of a bear market is indecision. FUD sneaks in begins shaking your confidence. You strain to "HODL" and don't know whether to believe the latest of bitcoin obituaries. You start to worry you'll lose your capital and weigh out hypothetical gains. You've got McAfee maniacally laughing and whispering $1million in 2020 on one side and every major news outlet screaming $0 on the other, but you're not sure which is the devil and which is the saving grace.

Bitcoin and I are BFF's

A while ago, I got into Bitcoin. I bought in not because of the promise of unimaginable wealth like so many do. I bought in because I wanted to be part of decentralizing the world, I wanted to be part of people having alternatives to central banking - a revolution in itself, even while banks still stand. I bought in following a crash in spring. I thought it would recover, but I wasn't sure you know? I'd dabbled in stock investing, but was by no means a trader. I bought 1 Bitcoin and it was a financial sacrifice to do so as a broke college student.

Should I Stay or Should I Go

The week I'd bought, in early April, I was sent my very first Bitcoin obituary while having money in crypto. RIP Bitcoin. I mean, I'd seen them before and it always sorted itself out but... It went up a bit, and I considered cashing out, it would cover the fees and I'd break even. Maybe I should get out. I stuck it out.

By November, we were flying high. I'd been in the market 6 months and Bitcoin was at over 10x where I'd bought in at.

Following the holiday season, the market started a bear trend, losing over 70% of it's value. Manipulation they say. An exchange was hacked, losing a significant amount of money, FUD from Asia, and the tumble continued. Still up ,but watching that USD value go lower and lower is painful. Is the market dead? Should I take what I've got and run? Many have, maybe they're the smart money?

Make a Choice

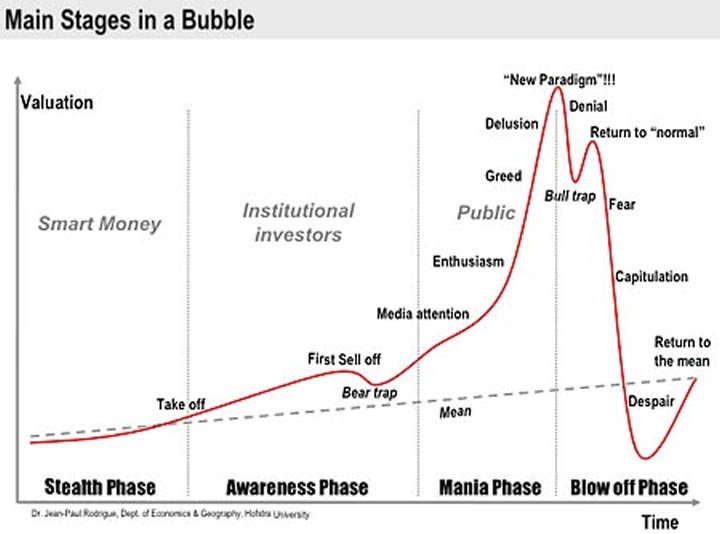

Some of you, you're thinking we're the same. You're thinking you got in Spring last year and we've gone through the same things. You recognize the chart we see below because it's everywhere right now and you're feeling "despair".

We're not the same because your today was years ago for me. Today is decision day for you. Everyday in a bear market you wonder, you sit on the fence and stress, going back and forth, but no one tells you to make a choice.

I got into crypto in 2013. That first crash I bought after? It was $266 to just $54, a loss of over 80%. The second crash was $1150+ back down to the $200 range, another loss of over 80%. I can't tell you exactly when the market will improve. I can't tell you that we'll be fine next week.

I can tell you that winning in an investment is about having the stubbornness to buy or hold on when everyone else is scared.

Fuck It, If It Dies, It Dies...

One day of deciding "fuck it, if it dies, it dies, it's only money" back in April 2013. One day of committing to the revolution, not to tear down banks and fiat, but to the measured revolution of having an alternative to them. 5 years later and there have been a few of those days. There have been months when I haven't even looked at the USD price of Bitcoin. There have been times when I avoided forums like this because of the panic shaking my resolve.

If I can tell you anything, it's to make your decision. Stop sitting on the fence, wavering back and forth.

Are you in or are you out?

Here's the very first Bitcoin obituary I got and I still look back at it sometimes when the market's shitty. It reminds me that my decision day was 5 years ago.

"The Bitcoin Bubble Has Burst" by Robert Nielsen:

https://whistlinginthewind.org/2013/04/12/the-bitcoin-bubble-has-burst/

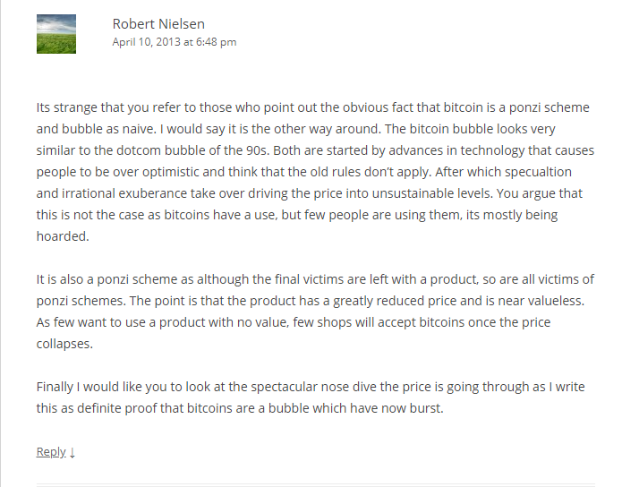

When I reread this now, I consider this comment of his on a post he cites in that one:

Here's the post he was replying on, "The Bitcoin Conspiracy" by Bitcoin0Conspiracy:

https://bitcoin0conspiracy.wordpress.com/2013/04/10/the-bitcoin-conspiracy/

This comment could be taken from any one of a number of present articles on Bitcoin, nearly verbatim. The thing about this is that things cycle. FUD in particular, which is why I created my FUD Picker meme. We see patterns on charts repeated over and over, each time bigger than the last with similar actions having reduced impact. It's the same on stock charts. The best analogy for why Bitcoin is so volatile is that it's still a TINY market. The same rock tossed in a puddle won't have nearly the same relative impact when tossed in an ocean. Right now we're a garden pond, as adoption grows, the same FUD will have less impact. Surviving these things makes them have less impact the next time around. The same goes for your mind. Each time you deal with a bear market, you're better prepared for the next. Deciding to stick it out doesn't just impact you making it through this one, it helps you through future ones too.

Decide what you are going to do. Get off the fence and take a break from looking at prices if you need to, but don't continue letting every price variation make your resolve vary too.

No one will ever be a millionaire over night. Sit back and relax guys. You took some risk to make money as well all do. Hopefully in the LONG RUN the fruits of your labour pay off handsomely.