In the fast-paced world of cryptocurrency investments, staying ahead of the game is crucial. Recent fluctuations in traditional financial markets have sent ripples through the cryptocurrency space, leaving investors eager to identify promising opportunities. As we navigate the unpredictable Money Road, here are five crypto stocks that deserve your attention:

1. Visa Inc. (V)

Modernizing Cross-Border Money Movement

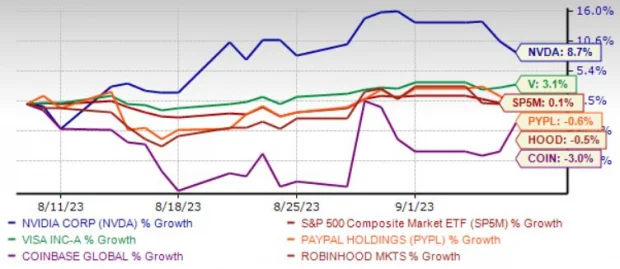

Visa Inc. is making significant strides in modernizing cross-border money movement by expanding its stablecoin settlement capabilities to the high-performing Solana blockchain. This move is expected to enhance the efficiency of global transactions. Visa's average revenue growth rate of 12.8% for the upcoming year, ending in September 2024, signals a promising outlook. While it currently carries a Zacks Rank #3 (Hold), its recent track record suggests potential growth.

2. NVIDIA Corp. (NVDA)

Surpassing Expectations in Q2 2024

NVIDIA Corp. recently reported second-quarter financials for 2024 that exceeded expectations. With adjusted earnings per share of $2.70, surpassing the Zacks Consensus Estimate of $2.09, and revenues of $13.51 billion for the quarter, far ahead of the Zacks Consensus Estimate, NVIDIA is on a strong trajectory. The management's projection of $16 billion in revenues for the next quarter, compared to the Zacks Consensus Estimate of $12.34 billion, further fuels optimism. With an average earnings growth rate exceeding 100% for the current year, NVIDIA is one to watch.

3. Robinhood Markets Inc. (HOOD)

Revolutionizing Financial Services

Robinhood Markets Inc. operates a versatile financial services platform in the US, allowing users to invest in a variety of assets, including cryptocurrencies like Bitcoin, Ethereum, and Dogecoin. With an average profit growth rate of 57.3% for the current year and a Zacks Rank #2 (Buy), Robinhood is positioning itself as a major player in the crypto trading space.

4. Coinbase Global Inc. (COIN)

Powering the Crypto Economy

Coinbase Global Inc. provides essential financial infrastructure and technology for the crypto economy in the US and worldwide. It offers a marketplace with a pool of liquidity for trading crypto assets and enables developers to build crypto-based applications securely. With an average revenue growth rate of 84.8% for the current year, Coinbase is at the forefront of crypto adoption. Despite currently carrying a Zacks Rank #3, it has significant growth potential.

5. Block Inc. (SQ)

Driving Digital Payments

Block Inc. operates an online digital and mobile payment platform, overseeing Square and Cash App. Users of Cash App can buy, sell, send, and receive Bitcoin. Additionally, Block's decentralized platform empowers developers to create decentralized finance applications on programmable blockchains. With an average profit growth rate of 68% for the current year, Block Inc. holds a prominent position in the cryptocurrency market.

In summary, these five crypto stocks are poised for potential growth and innovation in the cryptocurrency space. However, remember that investing in cryptocurrencies carries inherent risks, and thorough research is essential. Stay informed about market trends, regulatory changes, and the overall economic landscape to make informed investment decisions.

Conclusion

As the financial markets exhibit uncertainty, the cryptocurrency landscape remains a dynamic and promising frontier for investors. The five crypto stocks mentioned above offer intriguing opportunities, but it's crucial to conduct thorough due diligence before making any investment decisions. The world of cryptocurrencies is ever-evolving, and staying informed is the key to success.

FAQs

1. Are cryptocurrencies a safe investment?

Cryptocurrencies, like any investment, come with risks. Their value can be highly volatile, and regulatory changes can impact their performance. It's essential to do your research and consider your risk tolerance before investing.

2. What is a stablecoin?

A stablecoin is a type of cryptocurrency designed to minimize price volatility. It is typically pegged to a stable asset like a fiat currency, making it more predictable in value.

3. How can I buy cryptocurrencies?

You can buy cryptocurrencies through cryptocurrency exchanges, which allow you to trade your fiat currency for digital assets. Popular exchanges include Coinbase, Binance, and Kraken.

4. What is decentralized finance (DeFi)?

Decentralized finance, or DeFi, refers to a set of financial services and applications built on blockchain technology. DeFi aims to provide open and accessible financial services outside traditional banking systems.

5. What factors influence cryptocurrency prices?

Cryptocurrency prices can be influenced by a variety of factors, including market sentiment, adoption, regulatory developments, and macroeconomic trends. Staying informed about these factors is essential for cryptocurrency investors.

As seen in the example of Visa, visionary finance and technology companies are making moves to gain a share of the growing crypto market.