Amid the frenzy around the Initial Coin Offering (ICO) phenomenon that has raised billions in crowdsales this year for new projects, many of them being fancy websites and white papers — there are serious entrepreneurs focused on building transformative technology. Many investors have been eying on Filecoin, but now are frustrated by Filecoins policies. Here are some of the reasons:

Initial Public Offering

Call it Initial American Millionaire Offering because only accredited American investors with at least $1M in net assets can invest in Filecoin. Until July 24th, $52M raised in an advisor sale was reserved for people close to Protocol Labs, IPFS and Filecoin. I'm still confused about the relationship between these three entities.Unknown price to incentivise early investors

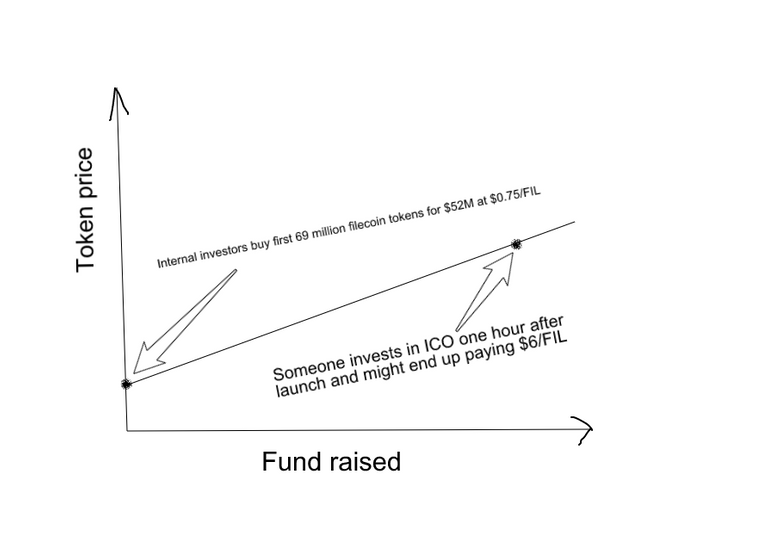

As more fund is raised, investors will receive less tokens for every dollar invested. It is a scheme to incentivize early commitment and amass money. This is the pricing scheme:

- Filecoin eyeing $700M+ raise

Filecoin needs that much for development? This is insane. For comparison, Siacoin is already in use and has a market value of just over $270M. Dropbox is valued at $10bn. It won't be easy to beat cheap, scalable Amazon S3 storage service. Filecoin is at least six months away from production, the locked investment could generate returns if invested in other cryptos.

Dig deep

The analysis Filecoin doesn’t want you to read is a great write up and analysis about Filecoin ICO. Filecoin reddit subreddit is filled with rant about unfairness.