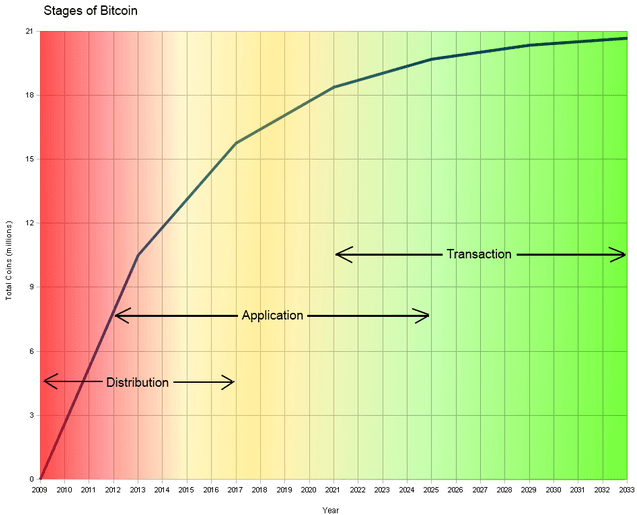

A theory of Bitcoin's likely lifecycle, in three distinct stages: Distribution, Application and Transaction.

No, they are not "denial," "anger," and "acceptance."

They are:

- "Distribution"

- "Application"

- "Transaction."

The three stages overlap, but each one dominates over a given period of time. The beginning of a stage's period of domination is in line with a change of Bitcoin creation rate.

Stage 1: Distribution

- Spans from 2009 until 2017;

- Dominates from 2009 until 2013, at which point the creation rate halves;

- Represents the period of time of most rapid Bitcoin creation;

- Includes the first two creation (supply) rates (50 and 25 Bitcoins per block);

- Responsible for the creation of 78.125% of all Bitcoins (16,406,250);

- Inflationary during its period of dominance (until 2013);

- Bitcoins are created, sold, and re-sold, as value fluctuates wildly, with each cycle increasing the number of Bitcoin holders.

Stage 2: Application

- Spans from 2012 until 2025;

- Dominates from 2013 until 2021;

- Represents the period of time of most rapid Bitcoin application development;

- Includes part of the first creation (supply) rate and all of the next three;

- Covers the development of applications that provide services which are unambiguously cheaper and more efficient than similar services relying on other technologies;

- Quickly transitions from inflationary to deflationary during its period of dominance as Bitcoin applications gain marketshare.

Stage 3: Transaction

- Spans and dominates from 2021 onward;

- Represents the period of time where nearly all important applications have already been developed;

- Includes all rates of Bitcoin creation (supply) beyond the first three;

- 90% of Bitcoins are in circulation at the beginning of this stage;

- Bitcoins are exchanged for increasingly valuable goods and services;

- Bitcoins are rarely exchanged for fiat currencies;

- Pure exchanges that have not diversified their services no longer exist;

- Money transfer service providers that deal in fiat currencies no longer exist.

Posted by GoWest at 9:50 PM on Monday, October 17, 2011

This article originally appeared at: TheBitcoinTrader blog at: http://www.thebitcointrader.com/2011/10/three-stages-of-bitcoin.html

Nice write up!

Though I am not sure if there is really a link to the available supply.

Indeed, nor is that amount, the "available supply", truly known or obtainable. A theoretical maximum perhaps, but not true available supply. I wonder what % of theoretical supply is available? Over 90%? 80%?