RBC Capital’s Mitch Steves today returns to the topic of Nvidia (NVDA) and crypto-currencies, something he explored in two research pieces earlier this week.

In the report, Steves raises his price target on Nvidia shares to $175 from $150, to reflect "data center confidence," he writes, and "potential upside to consensus estimates."

Steves's note is one of several in just the past couple of days. Nvidia shares today closed down $10.34, or 6.5%, at $149.60, hit both by the general sell-off in the stocks, and by a negative report from notorious short-selling firm Citron Research.

Steves’s first piece, on Tuesday, used the computations of the crypto-currency Ethereum as a kind of thought exercise to show how Nvidia’s power efficiency in its GPU chips could be a competitive advantage.

He followed with a piece the next day that sought to set the record straight on what Steves believes are misconceptions about Nvidia and Advanced Micro Devices’s (AMD) chips’ use in Ethereum and Bitcoin.

Today’s missive ponders the question of whether such “mining” crypto-currrencies is a “billion-dollar” market, or zero.

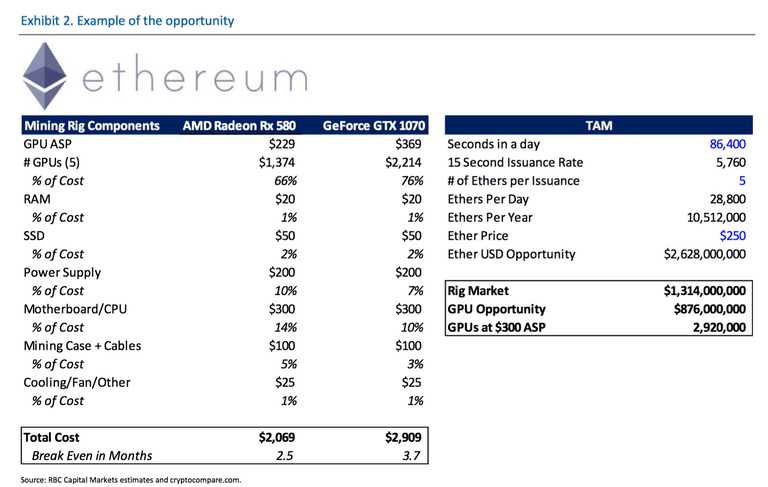

He comes up with $875 million as the market for mining Ethereum with GPU chips, after calculating likely workloads for Nvidia and AMD chips.

Here’s the basic facts he used to arrive at that estimate:

The number of Ethers issued per day is 28,800 (10.512M per year), which suggests that the theoretical revenue opportunity is $2.628B (annually) at a price of $250 per Ether If we assume that each miner wants to make a 100% return on his investment, this would mean the total dollars spent to create mining rigs would come in at $1.314B GPUs represent approximately 66% of the cost of a standard $2,000-3,000 mining rig This would result in a GPU opportunity of ~$875 million (2.92M GPUs at $300 ASP) Finally, we note that this is only for Ethereum. If other crypto currencies become profitable (mining for Zcash or other currencies) the opportunity would be larger To re-emphasize, the assumptions do not reflect the reality of Ethereum long-term. The amount to be mined will be flat and the algorithm is set to change (see question #2 Could the TAM Go Away?).

Those numbers are summarized in the table presented at the top of this post.

There are other currencies, and there are other tools, such as application-specific integrated circuits, or “ASICs,” as he discusses at some length. The more general answer for the GPU offerings is that, "as long as GPU mining is profitable demand should continue to exceed supply,” in Steves’s view. Right now, mining Ethereum is profitable, he notes.

It could all “drop to zero” if crypto-currencies plummet in value to the point where it’s uneconomical to spend the thousands needed for a rig to mine them, he writes.

For those not in the know, such a rig costs $2,000 to $3,000 and is made up as follows:

The component costs break down roughly as follows: GPU cost 66%, RAM 1%, SSD 2%, Power Supply 10%, Motherboard/CPU 14%, Case/Cables/Fans 6%. Finally, you'll need an operating system (such as Windows) along with a mouse/monitor to install the necessary software.

Even though AMD chips are the top product for acquiring Ethereum according to Steves, he makes the case for Nvidia chips if AMD prices continue to sell significantly above retail prices:

What GPU is Best for Mining Ethereum? The quick answer is: AMD. If an individual can acquire an AMD GPU at retail price the returns are the highest. The issue today is that AMD Rx 580s are being sold at a premium to retail prices today – out of stock. This creates a significant issue as 1) the longer a person must wait the less likely the miner will be able to turn a profit (potential decline in block size, potential algorithm change etc.) and 2) a common mining rig requires ~4-6 GPUs multiplying the issue of both cost and time.

Good post!

Thank you, I will be posting regularly on this content