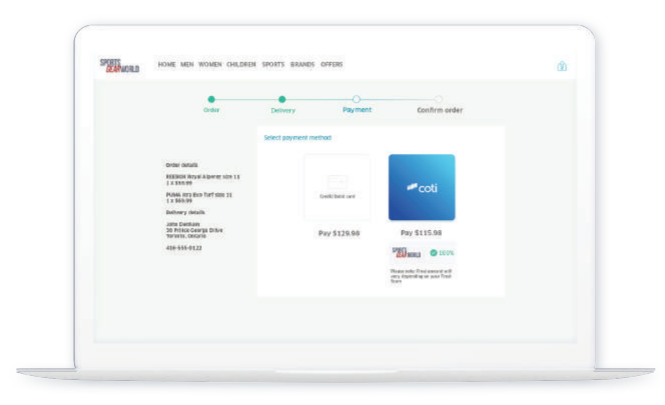

COTI tech company, by creating a base protocol called Trustchain introduces a behavioral trust scoring algorithm and a decentralized POS method to resolve disputes between network parties. This automatically eliminates the unsure practices of untrusted middlemen, as the entire transaction processes will be based on this protocol. The COTI platform is robust, with a full payments ecosystem consisting of a Coin, a wallet, a debit card and an exchange.

Having completed a functional partnership with Processing.com, COTI launches into the market with an established base that grants access to 10,000 merchants. COTI’s team of experts includes team includes top management and R&D talent, veterans of the financial industry and Blockchain experts. The team of advisors and backers includes Greg Kidd (early investor in Twitter, Square, Coinbase, Ripple), Mr. Steven Heilbron (former CEO of Investec bank), Dr. Matthew Mcbrady (former CIO of Blackrock), founders of Processing.com and other reputable individuals.

Blockchain is a trustless system that decentralized control, making it impossible for undue imposition from any particular entity. Considering the size and developments going on in the financial solutions industry, especially with payment processes, it is obvious that the current systems aren’t sustainable in future days. Among other emerging developments on the blockchain, the COTI protocol is indeed a forward movement towards a more sanitized payments industry.

Currency of the Internet (COTI), a payments transaction network supported by a digital currency that is headed up by CEO Nir Gazit and CTO Adam Rabie, was designed specifically to address the deficiencies mainstream digital currencies pose. It touts an instant, scalable, secure and low-cost alternative to legacy payments systems through its cryptographically-secure digital currency.

Headquartered in Toronto, Canada, with team members, investors and advisors located around the world, COTI’s vision is for the venture to become the “Currency of the Internet” by being the first digital currency to achieve widespread adoption in payments.

COTI, which is planning is token sale in the near future, supports payments in the way that the traditional, centralized payments networks do. While the major card networks routinely process in the order of 2,000 transactions-per-second (TPS) and have peak capacity of tens-of-thousands of TPS, Bitcoin’s network processes in the order of 5 TPS. (Note: For a grahic on TPS in relation to Bitcoin see this link).

Moreover, while the card networks protect buyers against fraud and user errors, Bitcoin transactions are irreversible and offer no buyer protection mechanisms.

COTI boasts that it can process 10,000 TPS, is Anti-money laundering (AML) compliant and has a community-powered mediation system to ensure a person’s payment track record is clear to see. This is creating enormous potential opportunities for people in developed and developing countries where around 2.5 billion people have in recent year been estimated to be excluded from financial services.

site https://coti.io

whitepaper https://coti.io/en/files/COTI-technical-whitepaper.pdf?v=b56b9faa828

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://www.forbes.com/sites/rogeraitken/2017/12/23/bitcoin-beyond-how-digital-currencies-can-solve-consumer-payment-needs/