Introduction

The global economic meltdown revealed the incapability of the traditional banking system to handle the matters of finance: it haphazard decisions and miscalculated risk-taking left the world at the cusp of total financial disaster.

However, in 2008, Satoshi Nakamoto launched the Bitcoin: a cryptocurrency backed by blockchain technology, with the aim to foster a decentralized peer-to-peer exchange and payment system that functions independent of central authourity.

Blockchain technology, guaranteed privacy of user and user's data, safety of funds and transparent exchanges in a decentralized environment, free from custodians and central authourity.

This provided an escape plan from the recession and ushered in a new era of banking known as DECENTRALIZED BANKING

Ten years down the line, Bitcoin has prompted the emergence of other cryptocurrencies, with blockchain technology addressing the financial duress of the world with it unique immutability, private and secure infrastructure which is a direct alternative to failing the traditional banking system.

BLOCKCHAIN TECHNOLOGY TRULY IS THE REVOLUTIONARY TECHNOLOGY

However, despite the massive feats recorded by cryptocurrencies in addressing the financial constraints of the world and providing an ecosystem for mistrusting peers to safely trade directly with one another without having to rely on a custodian to oversee the proceeds of the trade, it has yet left a lot to be desired.

Problems

There is no doubt that cryptocurrencies are a solution to the failing banking system. Cryptocurrencies offer so much in contrary to the politicization and monopoly that plague the banking systems due to governmental involvement.

Cryptocurrency exchanges are the point of entry to the cryptocurrency market. However, in recent times different pitfalls and constraints has plagued the exchange that has limited it's potential and would in the nearest future disrupt the mass adoption of cryptocurrencies.

Cryptocurrency exchanges require high technical know-how in order to interact sufficiently with it's ecosystem, coupled with its rigid requirements which do not allow for accommodation of more cryptocurrency projects and assimilation of new users.

Present cryptocurrency exchanges do not support industry development as they do not reward users for their involvement in their progress of the industry.

Although blockchain technology and cryptocurrencies boast of decentralization, most exchanges are centralised and take all decisions regarding addition and removal of tokens, which has a bad effect on the industry.

Decentralized VS Centralized Exchanges.

Decentralized exchanges are cryptocurrency market entry points, which do not store users private keys or data, the decision-making power is distributed to involved parties rather than with a central authourity.

It functions on a peer-to-peer system of exchange, rather than storing user funds on the exchange platform and transactions are not controlled by an escrow service or central authourity, they are entirely based on smart contracts.

Centralized Exchanges involves intermediaries or escrows, which act as middlemen to facilitate trading on a cryptocurrency platform in exchange for payments known as trading fees.

Centralized exchanges function like the traditional banking system, because user funds are stored on their platform and they exercise autonomous control over the assets as well as the decision making.

Centralized exchanges poses many risks compared to decentralized exchanges: Centralized exchanges can be manipulated by governmental authourities to the disadvantage of users and users are always at the receiving end of whatever decision is made, as centralized exchanges do not allow users involvement in the decision making of the ecosystem.

However, decentralized exchanges are not also left out, decentralized exchanges only allow crypto-crypto trading and allow the addition of tokens to their exchanges without verification and as such dubious projects get enlisted and swindle users of their assets.

These two exchanges, do not have a structure for rewarding users for their involvement in maintaining the network, decentralized exchanges allow users a measure of decision making, however a reward system is absent to encourage users to continue in their input to the development of the industry.

The Solution: CoinCasso

CoinCasso is a multifaceted hybrid exchange platform that incorporates decentralized management into a centralized exchange to provide incentives for users.

CoinCasso is the first of its kind it is the first and only cryptocurrency exchange platform to share profits with its members.

CoinCasso strikes a balance by rewarding its users for their actions in developing and maintaining the crypto-sphere by sharing profits from its project.

CoinCasso being a hybrid ecosystem combines the vast advantages of both centralized and decentralized exchanges to completely cater for the deficit of both exchanges.

Coincasso Featured Products

-Mobile Wallet App

The CoinCasso mobile App is the first of its kind: it is the first blockchain application with a virtual card function, which employs resources on the wallet to allow for fast transactions between users and merchants without the need to manually convert cryptocurrency to FIAT currency.

The App is fully integrated on the CoinCasso network and can be incorporated on all smart devices. It's functionality is not limited to digital assets only as FIAT currency can also be transferred between users on the CoinCasso platform as well as to the entire crypto-sphere.

-ATM Network

The ATM network is unique in that it eliminates the need of a bank to facilitate exchanges within the CoinCasso ecosystem.

The ATM network affords users on the platform the advantage of making payments and withdrawals as well as exchange of FIAT and cryptocurrencies in seconds.

-POS Systems Integration

This feature enhances the use of cryptocurrencies as means of exchange at point of sale terminals. Users on the CoinCasso ecosystem can make payment for good and services over the counter as the unique software design facilitates the quick completion of transactions in seconds.

CoinCasso Core features

24/7 Users Support.

A powerful number of transactions per second with the possibility of increasing this amount in times of overload.

Currency FIAT, Corporate/ Personal tokens supported.

Trade margin.

Optimised UI/UX.

Trusted ICO/STO Provider.

9 Types of order in a trading.

High-Security Level.

Profits and bonuses for CCX holders.

CCX Token

CCX token is an ERC-20 compatible token, it is the official token of the CoinCasso ecosystem. The CCX token is built on the Ethereum blockchain, which enables it to be fast (compared to other alternatives) and employed for payment processes without constraints.

The CCX is a means of exchange within the CoinCasso ecosystem providing the possibility of trading and exchange of services between users on the platform.

The CCX token is unique, although it functions in the same way as token on other exchanges, however it empowers owners of tokens to participate in the decision-making of the network; they can dictate transaction fees, and decide if token holders should have a share in the profit made by the company.

CCX-Power.

CCX-POWER are frozen CCX tokens kept in a verified wallet by the user for a limited time. They grant users access to participation in the decision-making of the company and enables users to receive a profit.

CCX-POWER can be converted to CCX token through a controlled process that checks the manipulation of CCX price on the exchange.

CCX-POWER is only available to authenticated users and provides users with the voting power to decide which of the available tokens they want listed on the exchange.

Asides impacting the introduction of new tokens and fees, CCX-POWER holders enjoy loads of benefits, such as:

Up to 50% discount for transaction fees.

Influence the implementation of new ideas and plans.

Larger commission on affiliate programs.

Voting right to decide changes in operations within the exchange.

The profit shared amongst the CoinCasso users would be generated from the following projects:

PoS - payment terminal.

CoinCasso Pay Wallet App.

A network of ATMs.

CoinCasso Exchange 2.0.

Quick exchange.

Payment gateway.

CoinCasso Advantages

-Quick buy and sell

CoinCasso allows for the initiation of transfers between fiat and digital currencies.

-Fee Structure

The enable the accommodation of large volume of transactions, CoinCasso ensures low transaction fees for users on its platform, with standard commission rates as low as 0.25% for each transaction.

-FIAT currency

CoinCasso only accepts PLN, USD, EUR, GBP for now, but has an accommodation in its architecture to add more FIAT currencies in future.

-User Safety.

CoinCasso treats the safety of user funds with high priority, and as such KYC is require from every prospective user after registration which comes with an advantage of increased withdrawal limit.

CoinCasso archives all transaction records on the platform, which can be shared so as to enhance transparency of the platform.

2FA verification is required from user in order to access the platform. 95% of digital assets belonging to user.

-Acceptable tokens.

CoinCasso oversees ICO of companies and support trusted ones. CoinCasso aids new cryptocurrencies by listed their tokens alongside the CCX token is trading pairs.

-Affiliation/Partners.

With promotion of its ecosystem being pertinent, CoinCasso hosts an affiliate program for verified users who stand to benefit from their participation in generated profits just by recommending the coincasso platform.

-API(Application Programming Interface) Integration.

CoinCasso architecture is wired via API to allow for the interaction and exchange of data between softwares.

API on CoinCasso oversees:

ATM network - user - wallets - exchange

Tickers

Internal and External payment gateway

User

Robots trading (in the last stage)

User to User transfers

Order Book and Trades

Mobile app - user - exchange connection (limited by the amount of funds)

Merchant connection

-Payment Gateway.

The CoinCasso exchange is fully compatible with API, which makes it interoperable with all websites, so as to make employing of cryptocurrencies as a means of payment easier.

Token sale and Use of Funds

Total tokens created: 100m CCX

Total tokens available on main sale: 70m CCX

Total tokens held by company: 20m CCX (could be released for future development.)

Pre-sale: 5%

Marketing Partners: 3%

Bounty program: 1%

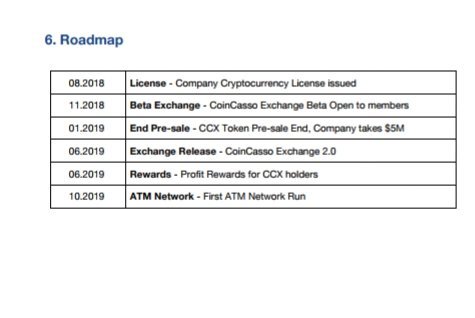

RoadMap

Conclusion.

CoinCasso ultimate aim is to provide lasting solutions to exchange and trade services, by creating a hybrid exchange platform connected to a network of ATM's for users controlled by a central unit which grants users the right to be rewarded from the profits realized and also gives them the power to decide the services offered and which token should be listed or delisted.

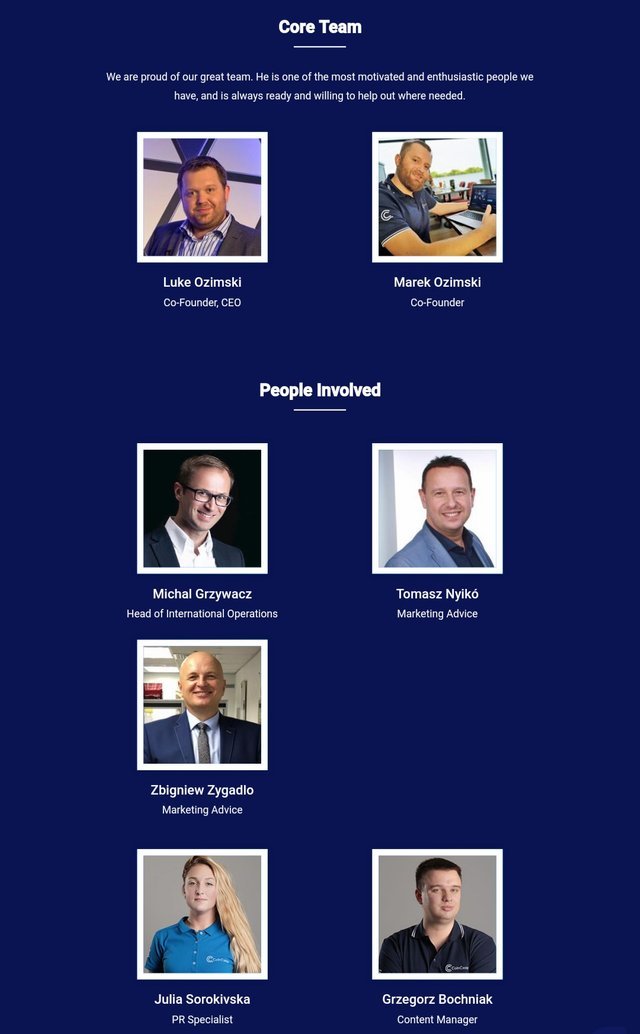

Team

For more information on the CoinCasso project:

Author: Effiong Godwin

BountyOx Username: godwinfyoung

Congratulations @godwinzzyzx! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

You can view your badges on your Steem Board and compare to others on the Steem Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPDo not miss the last post from @steemitboard:

Vote for @Steemitboard as a witness to get one more award and increased upvotes!