A Brief History of Blockchain technology and Cryptocurrency Exchanges

Blockchain technology came into existence when satoshi nakamoto released the whitepaper bitcoin : A Peer to Peer Electronic Cash System in 2008 that described a “purely peer-to-peer version of electronic cash” known as Bitcoin. Blockchain was to bitcoin what the Internet was to email. However only few people realise the potentials of this technology far beyond utilizing it for cryptocurrencies alone while in actual sense, Blockchain provided the answer to digital trust because it records important information in a public space and doesn’t allow anyone to remove it. It’s transparent, time-stamped and decentralized. However exchanges were an earlier part of bitcoin history as we have mtGox; one of the biggest bitcoin exchange at the time suffer a major hack which resulted in tonnes of bitcoin being stolen from the exchange. While subsequent exchanges have done little in the way of improving on the security of their exchanges partly as a result of archaic technology to combat this crimes. Many have being negligent when it comes to protecting the interest of their customers as it has being a sore fact that several exchanges do not report basic information such as the names of the owners, financial data, or even the location of the business. This factor contribute a lot to the reason why businesses and institutional investors are unwilling to navigate into the blockchain because they still view the industry as a largely unregulated entity. Amidst this claims, most exchanges still lacks the necessary ingredient needed to project a robust, secure and fast platform for cryptocurrency transaction when blockchain technology eventually gains mass adoption..

Some of these dieficiencies are

Security

As we have seen overtime that exchanges are a major target for hackers. It is impertinent to not loose guard of any activities that might constitute security breach. Some of which can be identified as unusual trading activities, background manipulations and many more

UnRegulated

As have mentioned earlier, most exchanges hardly reveal the true identity of their business, therefore leading to a complicated structure around most exchanges and hardly is their any background check on the members of the platform. But because most exchanges are private entities, revealing their true identity can set things in pace for an economy driven by trust; while this part has being taken care of by regulatory and compliance organisation such as SEC, only few or no exchanges are yet to fully comply.

Poor Liquidity

Cryptocurrency is a highly volatile commodity(guess you cant argue is not a security either). Well the known fact is that most exchanges have poor order books which means that traders find it hard to exchange their asset at the present market value; leaving many with lacklustre attitude towards patronising cryptocurrency including businesses and investors.

Lack of good customer support

How many of you after using an exchange gets a thank you message for using their platform. It shows the height of negligence most exchanges pays to this key aspect, feedback. What most exchanges fail to realise is that feedback can help them to improve their services and this is sorely lacking as well in most of the present exchanges.

This takes us to a new exchange who is taking this challenges a step further and that exchange is ONAM

What is ONAM

Onam is a compliant-built cryptocurency exchange platform. Onam aim is to build a secure, fast, scalable platform for businesses, traders and institutional investor to conduct their day to day transaction whilst using the blockchain.

Their Solutions to Present challenges

Onam exchange is building a platform that is adaptable for both present and future needs of all its users. Hence they are deploying some of the latest and state-of-the-art technology to find a solution to these issues as elaborated below

- Security

Onam having identified the loopholes in the present system of exchange will adopt machine learning technology on its platform inorder to detect unusual patterns before they constitute security breach.

However, in a bid to further the secure the platform and keep funds and customer information far from the reach of hackers, Onam will implement a full suite of enterprise-grade security tools as highlighted in the chart below

Anti-money laundering system | Anti-market manipulation system |

Ip whitelist | Anti-phising code |

Withdrawal confirmation | 2FA and U2F authentication |

Encrypted database | DDoS Mitigation |

Custodian services and partnership with BitGO | Hardware wallet integration |

- Regulatory and Compliance

As I revealed earlier, most exchanges hardly reveal their identity which makes trust a no-show for users of such platform. While their jurisdiction is to serve multiple users, Onam will register as an exchange under SEC-defined rule as follows

- Register as money transmitter in all 50 U.S states

- Obtain a Broker/Dealer License

- Register as an Alternative Trading System (ATS)

- Become a member of Self Regulatory Organisation (SRO)

- Enforcing KYC/AML laws

Source : Whitepaper

- Liquidity

Onam aims to drive high liquidity within its platform by incentivizing large market makers, miners and volume traders to use the platform . This means that users can complete transaction at the present market value. Also by using order books from multiple exchange, Onam aims to solve the issue of high price slippage and associated with low liquidity exchange. The aim is to create a truly rich and transparent order book

- Customer Support

Onam promise to offer users 24/7/365 customer service once a support ticket has being submitted. The response window is set at 15 minutesto resolve pressing issues. However, there will be a phone support for 6 month once the platform fully launches inorder to ensure all issues are resolved.

Can Onam Support businesses and Investors?

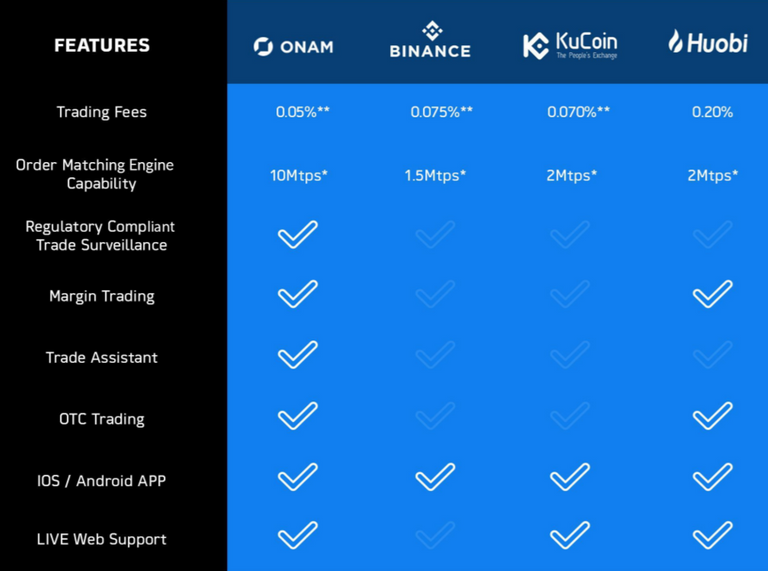

Yes! Onam exchange has a robust infrastructure that can process upto 10 million transactions per second with latencies as low as 40 nanoseconds, making the platform ready for mass adoption while the high liquid economy ensures investors and businesses can easily exchange their assets conveniently at the present market price and enjoy relatively low transactional fees; when compared with other exchanges, on every trade initiated within the platform. More info in the chart below

Exchange fee | Vs Other Exchanges |

|---|---|

|  |

Onam Exchange Overview

Advanced Order types

These features act as a complementary function to help traders balance their trade conveniently on a daily basisModular Trading Interface

Also a security feature of the platform. Therefore users can choose to customize their trading interface based on their preferences

Night mode | Day mode |

|---|---|

|  |

- Trade Assistant with Trade alerts and signals

This tool is powered by machine learning and it is designed to help traders minimize their risk trading on the platform by assessing their current position, account balance and user's personal tolerance

Other features are summarised in this chart below

(https://ipfs.busy.org/ipfs/QmVKK8QwS63DfyECtkhov4TBtWqmkKGJTGiA2XmyVm2MkD

Highlighting the Features and benefits of Onam Exchange

- Advanced threat prevention, intrusion detection

- Matching engine capable of processing 10 Million transaction per second with latencies as low as 40 nanoseconds

- Real time maket surveillance, supervision and compliance

- Secure with machine learning algorithm to detect and flag unusual activity and manipulation within the system.

- A truly rich and transparent order book

- Strong regulatory framework to support businesses and institutional investors.

- Fast and reliable customer service response.

- High liquidity by incentivizing large market makers, traders and miners to use the platform

- Advanced threat prevention, intrusion detection

Summary

Onam exchange prides itself as an exchange which meets the needs of custodian handling institutions like BitGo and that is why their partnership means a lot for both parties.

BitGo offer custodian services to businesses and institutional investors and covers key areas such as institutional-grade policy control, 100% cold storage with multi-signature feature in bank grade vaults for more than 75 cryptocurrencies. This partnership gives us a hint of what to expect from Onam as they aim to be the backbone for businesses and investors to thrive on the blockchain.

Use Case

- High Volume Trader

Mike is a veteran cryptocurrency trader and handles many client on his trading desk. But lately due to the bearish nature of the market, he finds it hard to reconcile his account balances at the end of the day; but his real problem lies in the high transaction fees and low liquidity on the exchanges where the cryptocurrency is trading.

However, he could use the Onam exchange by using better tools to analyse and manage his trades and also enjoy high liquidity on the assets that are listed on the exchange while he only get to pay low transaction fee when completing a deal. Now mike can forget his past troubles and make gains on a platform like Onam with the added benefit of getting incentivized!

He can pick any asset from this list of cryptocurrency once the platform launches. More assets will be updated as time goes on

Roadmap

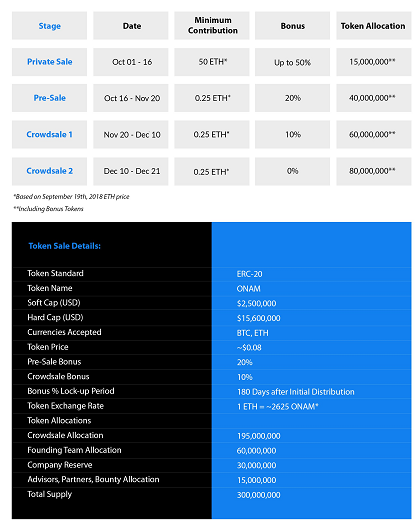

Token and ICO Information

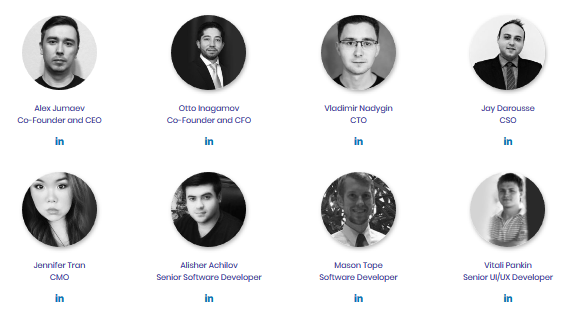

Meet the Team

Helpful Links

Reference link 1 : https://onam.io/wp-content/uploads/2018/10/Whitepaper-v1.5

Reference link 2 : https://www.forbes.com/sites/bernardmarr/2018/02/16/a-very-brief-history-of-blockchain-technology-everyone-should-read

Onam2018

Source 1

Source 2

Plagiarism is the copying & pasting of others work without giving credit to the original author or artist. Plagiarized posts are considered spam.

Spam is discouraged by the community, and may result in action from the cheetah bot.

More information and tips on sharing content.

If you believe this comment is in error, please contact us in #disputes on Discord

This post has been submitted for the @OriginalWorks Sponsored Writing Contest!

You can also follow @contestbot to be notified of future contests!