College Costs and ROI

The theme of this website is mainly about cryptocurrency but I’ve been taking it more towards traditional finance and investing. And with that, I think I need to talk about possibly one of the biggest investments you could ever make. And one often made very early in life, going to college.

There’s a LOT of debate around college and how expensive it is – and it’s true, it’s very very expensive. There’s some talk of making college free for all Americans or increasing the subsidies and loans given to students to make things more affordable, or even price controls for tuition costs, etc. While, we could discuss the merits of these ideas, that’s not what this post is about, I’m going to discuss how you can find how if your chosen career path is going to pay off. And how you can figure out if you’re in a worth while degree or not.

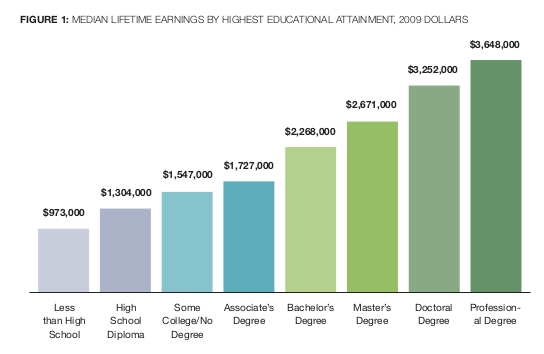

But while most experts agree that the cost of college generally pays off. And yes it’s true that most college graduates tend to make a million dollars more than the average. But that doesn’t mean your degree has a good return on investment. It might take years for that to pay off after you have accounted for all the internal and external costs.

But lets take a look shall we? Both on how to compute your ROI for any degree and for a degree close to my heart, Economics (being an economics graduate why not shrill a little here).

Calculate the cost of college for yourself

First off, we need to determine Total Cost of college. Total cost is straight forward, Total cost is your explicit and implicit costs. Lets take some costs of what a typical college student has:

Explicit costs:

Housing, books, tuition, food, and transportation costs (if any).

Implicit costs are things like:

Opportunity costs, and stress.

Then after determining all your costs you would take the marginal benefit you’d get after leaving college. That would be your expected first year earnings after graduating college with your current possible earnings with a high school degree.

So we can run some numbers for a common degree, like ASU’s Economics degree.

One easy thing is we can just look at their estimated costs – most schools provide this - but this is ASU's estimated costs.

ASU projects this for the following per year:

IN STATE ARIZONA RESIDENT STICKER PRICE

$28,048

| Tuition | $10,104 |

| Books and Supplies | $1,148 |

| Other Fees | $718 |

| Room and Board | $12,648 |

| Other Expenses Budget | $3,430 |

But the average high school graduate makes 28k a year. So over 4 years that’s 112k as well. Then lets assign our stress cost as another 2k a year, might be more depending upon how much stress school causes you.

So our implicit costs is 120k. Adding those we get a total cost 232,192 quite a bit of money, huh?

Further, lets look at the average first year earnings for economics graduates (but choose the degree you are thinking of going into), for economics it’s around 45k.

So we need to determine what the marginal benefit is per year for attending college. Which is our college income, 45k – our high school graduate income, 28k. For a marginal benefit of 17,000.

Finally, to determine our Return on Investment we need to divide our marginal benefit with our total cost. 232,192/17000 = 13.66. Or in other words, your degree will pay off in 13.66 years. Now obviously there are ways to increase your ROI (lowering the number of years till pay-off).

- Attend cheaper schools

- Attend highly prestigious schools – giving yourself a better job after graduation

- Use your network to leverage yourself into higher than average paying jobs

- Work during school so your opportunity cost is lower

- Get free assistant, aka funding for your parents

- Attend school for a higher paying degree

Summary:

Generally, the faster you get through school, landing a better job out of college, with lower costs, is how you get a good Return on Investment. However, school is hard and it can take a while to get through, which is perfectly fine. Virtually all degrees will get a return on investment, the question is how soon?I encourage you to research your future degree, your first year earnings, and run through the calculations above with your own costs. Lots of places will put mid-career as your earnings which could also be accurate but doing the above method gives you the absolute worst ROI you could be getting. So overtime, your return on investment will likely be better than the above calculations. But when preparing for the future, we should try to prepare for the worst and most likely case. Which, in this case is assuming the average.

But even if you are a returning student, a fresh high school graduate looking to go to college, or an older adult looking to return to college. This should outline the general idea on calculating your ROI for a potential college degree. Either way, best of luck with your college career and future.

Disclaimer and Author's Bio:

Kendon started TheCryptoDivision in 2017 in order to help people understand cryptocurrency and learn about the unique opportunities in the space. Kendon is an economics graduate from BYU. He is working for an investment bank in the foreign exchange department.

If you haven't invested in cryptocurrency yet, Kendon recommends using Coinbase as a good jump start. Invest $100 dollars into Bitcoin and you'll get another $10 dollars of Bitcoin for free using the coinbase link.

If you have liked my content and feel like supporting my page anonymously feel free to donate:

Bitcoin Wallet: 31xJ7rmDTD5TSS62wg5ipg2Nv6RvMPoXmN

Eth Wallet: 0x641a67147FE99E438F74cD868a4C8D97adFf51b2

Monero Wallet: 4262AwLVeLwVem8JNzLuQ73kjdjRJEpSygyGncSwnWZsCXC7v4a9WtvhTZopoJBeF8f5Z3SMyHUArHrpssobJbJU972137B

Kendon recommends trying to fight the fed's devaluation of your dollars by using SoFi's free banking and getting around 2% on your checking accounts. You'll also get a free 25 dollars.

The author gets support/income for this website by donations, using affiliate marketing, and google ads. But he has never taken any financial compensation for any research or post. This is not meant as financial advice. If you want to get into contact with me DM me on Twitter or email me at TheCryptoDivision@protonmail.com

Learn more about cryptocurrency Suggested reading:

https://www.thecryptodivision.com/do-you-really-need-a-blockchain/

https://www.thecryptodivision.com/best-cryptocurrency-referral-programs/

https://www.thecryptodivision.com/235-2/

https://www.thecryptodivision.com/eos-a-look-into-a-budding-platform-coin/

https://www.thecryptodivision.com/the-undervalued-powerhouse-in-crypto/

https://www.thecryptodivision.com/bmining-coins-work/

Follow me on:

Website: http://www.thecryptodivision.com/

Twitter: https://twitter.com/CryptoDivision

Facebook: https://www.facebook.com/TheCryptoDivision/notifications/

Steemit: https://steemit.com/@cryptodivision