Background: We have seen coffee returning to the resistance line near $96 for the third time in the last 6 months. Right now, 98% of traders on XTB are in long positions and total volumes in long positions is slightly above that suggesting, the more experienced traders with larger capital agree with longs. Brasil, Vietnam and other major coffee producers have been increasing yearly production for over 20 years every year. In contrary, impending collapse of crops world wide due to disease pressures including leaf rust, borer beetles and lack of pollinators (bees) are a strong arguement for bulls. The reason, why Brasil is one of the largest coffee producers is their open pesticide policy. I will not include COT report in my analysis till we have lates data.

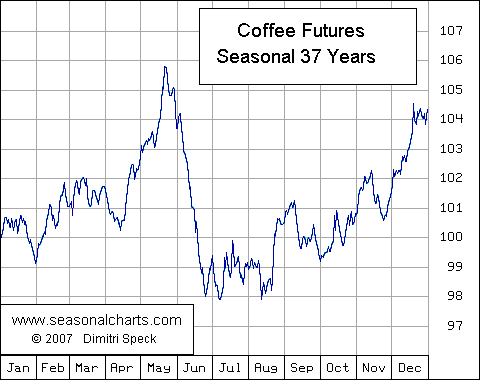

Analysis: I used standart slow stochastics for my analysis. You can see the buy signal is slowly forming. At the time of writing, latest red candle is already undone by the following green one. Coffee seems to reverse right now and will probably rally towards May yearly highs as 37 years seasonality suggests. Look for a signal to complete.

Seasonality chart: