Back in early January 2018, I decided to learn more about cloud mining (“CM”). Bitcoin was around USD 15,000 and I wondered if CM was a viable entry point for small investors that is better than outright purchase.

Keeping this in mind, I decided to research a bit. It was obvious that the contract price, duration and BTC price were important factors. The less obvious factors were the difficulty and the hash rate. In retrospect, one sentence would be enough to explain: “Block time will remain around 10 minutes so as the computing power increases, the difficulty increases as well which results in a comparable reduction in your mining output.”

Between the hype, referrals, confusion and solid information — this was out there but somewhat fuzzy. Peering through the mist, I calculated a lower output, same BTC price and calculated a decent return for 1 year. I had already understood that the hash power would be significantly less useful when that year elapsed so lifetime contracts were not interesting.

I will not get in to withdrawal issues as this is not a review or a critique — so let’s stay on with general CM dynamics.

Since this was an experiment and a learning experience I was only willing to invest very little, so with USD 11, I bought 0.05 TH/s from Hashflare. https://hashflare.io/ There was one more thing I had to look into that I neglected. Can you guess?

Of course, it was the maintenance fee!

Here’s why I overlooked: It was USD 0.0035 for 0.01 TH/s. Each 0.01 TH mined 0.00000150 BTC at the time. So production was USD 0.0225 and the cost was USD 0.0035 (approx. 0.00000023 BTC). I thought that even if the difficulty went up by 5x by the end of the year, I would produce on average 0.00000090 BTC per 0.001 TH. This would still cover the cost and withstand some price decline as well.

Now for the second guess — what was wrong with this assumption? Anyone?

Other than a myriad of off-topic problems such as transaction fees and withdrawal problems, there was a compounding problem which kicked off in the perfect storm that ensued in the following weeks until now. It’s simple actually, freaking simple to overlook.. Maintenance fees are not in BTC, they’re in USD!

So 3 months in to the experiment, a review of factors is in order to understand the problem:

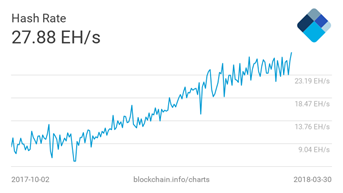

Hash rate: Up 86% from 15 million TH to 28 million TH.

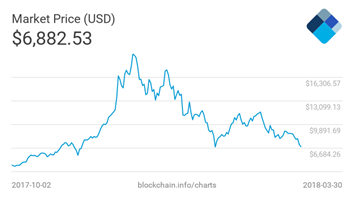

Price: Down 55% from 15,000 to 6,800.

Per 0.01 TH Production: Down 48% to 0.00000072 BTC.

Maintenance Fee: Same in USD.

Well, the funny thing is that same in USD translates to “Up 121%” in BTC terms to 0.00000051 BTC. Consequently the profit margin fell to 0.00000021 BTC. Now factoring in stable price and 2x hash power, this contract will mine around 0.00000059 BTC for the remainder of the year, pretty much covering the maintenance fees only. This outcome would result in around 80% loss and suspension of contract later in the year.

I’m slightly more positive than that! I’ll take a year end BTC price of USD 12,000 and can easily assume an output of 0.0001 BTC total for each 0.01 TH. That would be investing USD 2.2 per 0.01 TH and getting back USD 1.2, only 45% net loss.

For the skeptics of any specific CM provider, let me state that this pricing scheme was and is one of the better alternatives. The average will not be better than this, so focus on the big picture and not on names.

The response of the mining companies was to reduce prices and in Hashflare’s example they cut back to USD 1.2 which currently is loss making but in my assumption might just break-even for a new entrant.

To make an updated assessment, I used https://hashflareprofit.com/ and inputted the following: USD 7,000 BTC price remains stable, No reinvesting, Difficulty increase halved to 3% per 13 days.

For USD 120 1 TH investment, this nets USD 13, 89% loss. The break-even is around USD 13,600.

What this real life experiment shows is the following: CM is interdependent on a host of interacting variables such as Contract Price & Duration, BTC Price, Hash rate & Difficulty and Maintenance Fees. With the current metrics, CM is broken. A significant increase in hash power with prices decreasing so fast has been the short term death sentence which will linger for some months. Then it will clear.. Naturally that will happen with either BTC price increases and/or forced hash rate adjustment. When that happens, I believe this investment pooling model has life in it as long as the providers improve a lot on their transparency, quality of service and contract specifications. On these metrics, Genesis Mining https://www.genesis-mining.com/ seems to be the market leader albeit suffering from a chronic lack of capacity.

I’m a private equity investor by profession and I’ve only looked at the crypto scene since late 2017— almost a terrible time but a great opportunity to learn. I think 2017 saw an influx of short term profit seeking investment flowing in crypto currencies that distorted the market significantly to the upside and then down on the price metric. Yet on other metrics of Ponzi schemes, bogus mining companies and hilarious ICOs; the scene suffered furthermore but still managed to innovate very strongly on technology, community building and governance models.

Here’s when a writer would blurt out “but all is not bad” — I strongly differ, I think all is chaotic but well and that the damage is healthy. There are tremendous technological advances in the blockchain and crypto currency scene. Bitcoin is becoming a standard on its own, alternative currencies are providing alternative solutions, major web 3.0 work is undertaken, millions have been exposed to the scene and we might be just be at the second quarter of this long drawn out process that will profoundly alter most of what it touches.

March 31, 2018