A great way to keep your eyes peeled for potential dividend coins, is to subscribe to the UBIQ Ann Bot on twitter: https://twitter.com/ubiqannbot. I got an interesting alert today on a industrial mining farm ICO called StartMining, which is well worth a look.

A Brief Intro To StartMining

StartMining is a tokenised industrial mining farm with ambitious plans to build-out various crypto mining farms throughout energy efficient; Russia and Europe. StartMining will issue a share in the StartMining project through its ICO which is set to open 15.09.2017 — 14.10.2017 (https://startmining.com/).

https://www.youtube.com/watch?time_continue=2&v=VvEVnCRTQY0

StartMining Token + Dividend Rewards

The StartMining token has the ticker STMG with a circulating supply of 10Million. STMG's use cases include; a currency for use as an exchange for cloud mining capacities in the StartMining dashboard, or if you're more of a HODLR, you will be rewarded annually with a dividend payment of 40% of the companies profit (payment currency not yet defined in the whitepaper). 93% of the token supply will be issued to ICO investors, 5% for escrow and 2% for marketing. Unsold tokens after the ICO will be burnt with the project only reaching viability after hitting a minimum funding goal of $500,000.

Energy Efficient Locations

StartMining have ambitious goals of becoming leaders in the field of cyptocurrency mining. Their targets are set for operations of up to 4,000 farms with a total capacity up to 680 Gh/s Ethash. StartMining will aim to achieve this by mining in energy efficient locations, that also benefit from the cold climate, some of the potential locations include; Irkutsk, the Smolensk Region and the Krasnoyarsk region. Various location in Europe are also on the roadmap.

40% Cloud Mining Business Model

Part of StartMining's business model will focus on leasing out 40% of its power capacity to consumers in the market for cloud mining. Although potentially not as profitable, this method will give the team safety in the form of a diversified steam of income. StartMining hopes to capitalise on competitors in the cloud mining niche (Genesis-mining, Hashing24 etc) by means of compeditive pricing along with the added option of outright equipment purchase.

ICO Expenditure

The expenditure on setting up operations post ICO, will vary by the targets reached. Should the team reach the minimum viable funding of $500k, the allocation will go as follows:

- $340 000 Purchase of mining equipment

- $130 000 Real estate + utilities.

- $30 000 operating expenses (personnel, insurance, security, legal support, etc.)

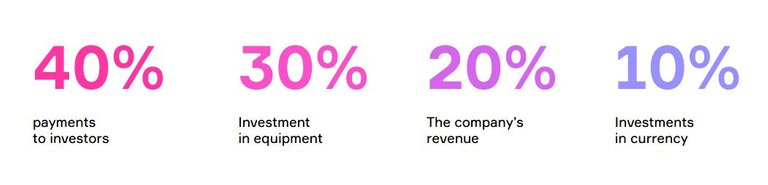

Annual Profit Allocations

The annual profit expenditure plan is forecasting for a 40% profit distribution amongst STMG token holders. 30% of profits will be reinvested into growing business infrastructure. 20% held for operational costs and 10% stored in currency reserves.

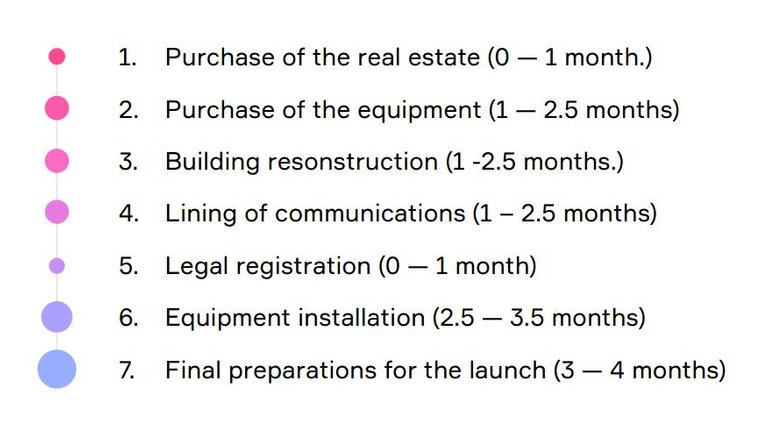

Roadmap

The set-up of the first operating industrial mining facility is scheduled for 4 months concluding the ICO.

Contingency Plan To Governmental Overreach

In the event of overreaching governmental regulations, the team have made mention of a contingency plan to sell off the underlying assets (property and mining equipment) bought with the ICO funding to distribute amongst token holders. Although this is a worst case scenario, its always a safer bet to have a plan B.

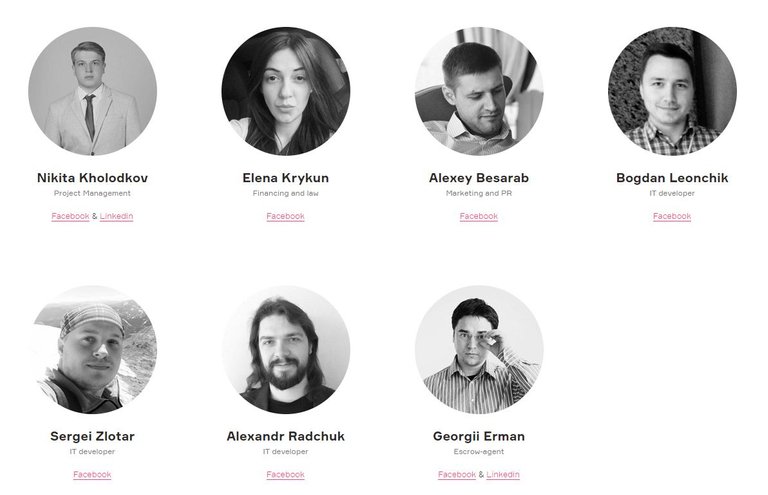

StartMining Team

When I first saw the StartMining name it hit me like a waving red flag. This is due to the cloud mining scam artists know as Startminer. However, after doing a little digging, I'm quite confident the team is indeed legit and have no relation to the clowns at startminer.com (as always do your own research on this!)

StartMining Whitepaper

https://startmining.com/whitepaper_eng.pdf

Conclusions

This is definitely a interesting project that has potential, if I was to critic the project, based on my concerns, it would be the profitability of mining against the rising difficulty. In saying this the team do have mentions of potentially positioning themselves into the staking game (similar to the MASS offering) which I find a massive plus (pardon the pun :P). The feature of StartMining that stands out the most to me, is the plan to grow this offering with 30% reinvestment back into more mining equipment PA. Should the team be able to hit the ground running post ICO, this project could have the potential to scale to become a solid earner.

Thanks for reading

PS half asleep today, don't be judging my punctuation. gramma-spellering

[Disclaimer: please do you own due diligence when investing and don’t solely take my point of view as the only angle. I highly recommend everybody dig through the projects bitcointalk, reddit and team linkedin profiles to help formulate your own opinion – I thank you so much for reading and wish you successful dividend returns]

Ryan Jorgensen | Stock Photographer | Blockchain Nerd

Twitter: @CryptoDividends

Website: http://jorgo.photography/

Crypto Dividends focuses on the niche blockchain business models that generate passive income without the need to sell or speculate. We seek to discover and promote the best dividend yielding cryptos.

Thanks very much for the ICO alert tips via ubiqannbot!

No worries Bud

rule 3: stay away from cloudmining

Been on hashflare and genesis for a while now and have made profit, so its not all doom and gloom in the cloud mining sphere. Wouldn't invest in Eobot though, shitey returns ;)

did you ROI on any?

Certain did, but not on Eobot, Eobot's difficulty seems to increase with every bitcoin price rise, which has me skeptical on their legitimacy.

speaking of the devil: http://mailchi.mp/hashflare/mining-profitability-continues-to-grow-1182309?e=9a1b60b00c

they just cancelled lifetime contracts

Yeah just saw that, no way its profitable now. How can they change pre-purchased lifetime contracts without any recourse. Very dirty on hashflare now :P

they just do it. just like genesis-mining did 2016 with all their customers.