The fight between China’s tech giants Tencent and Alibaba today has never been fiercer. While Alibaba has an absolute advantage in online retail, Tencent has established an unchallengeable dominance in the game market.

Today, mobile revenue still relies heavily on the game industry. According to the recent report released by China Culture and Entertainment Industry Association (CCEA), more than 70% of APP income was generated by game players.

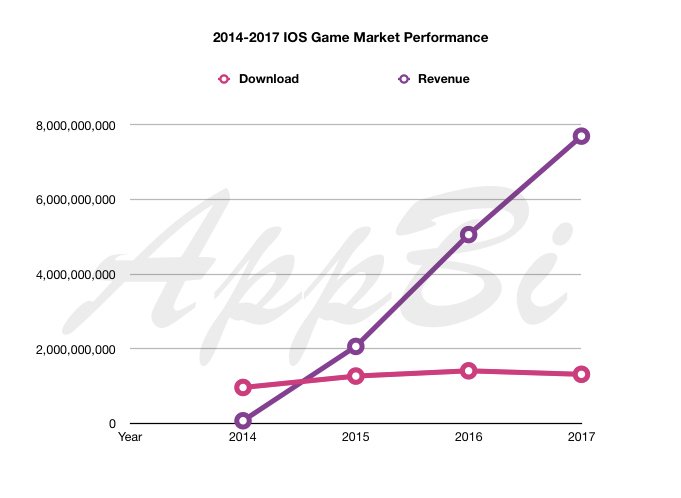

Since 2014, China experienced an explosive growth in game market. AppBi research shows the total revenue had jumped almost four times from 2014 to 2017. In 2018 Q1, China mobile game revenue reached 2,355,702,053.53 dollars, equivalent to the total in 2014.

The rapid growth of China game market and enthusiast players makes Tencent one of the biggest beneficiaries. While many overseas learned about the company through its instant messaging APPs WeChat which was a combination of Facebook, Whatsapp, and Groupon, Tencent’s biggest revenue generator was in fact, game.

The unbreakable game publisher

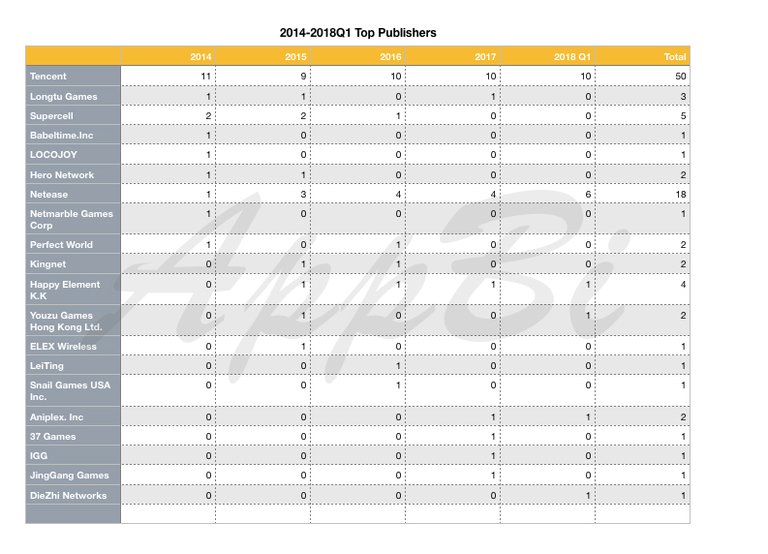

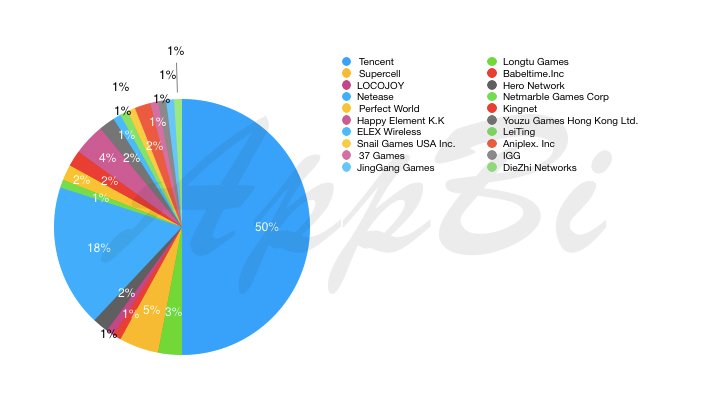

Among all games listed on “Top 20 Paid Games” from 2014 to 2018 Q1, Tencent constitutes 50% of the total. While Netease remains the second, it only has 18% ranked on the prestigious list. Since 2016, Aiqiyi and several other companies began to invest heavily in game development, but they take only a very small portion of the market share.

Tencent annual report shows one of the most profiting game is the King of Glory, the so-called local version of LOL which maintains a two-digit daily user growth rate. While Tencent’s profit jumped 61% in 2018Q1, it could not have done so without the strong performance of its game division.

King of Glory didn’t get all the glory

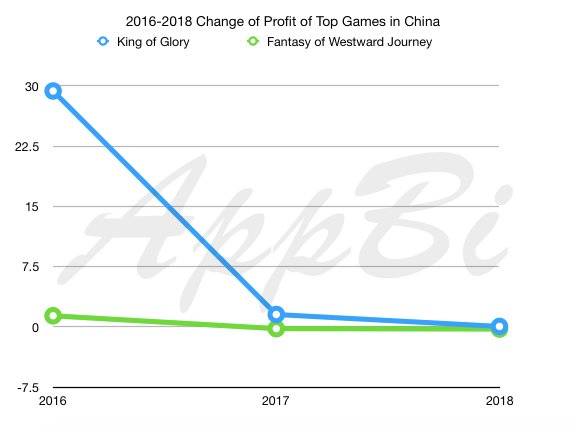

AppBi discovered some new trends from previous data. In 2016, King of Glory reached its peak with a growth rate of 29%, but the game popularity started to gradually drop with policy restrictions and growing competition. Similar to Netease’s star product Fantasy Westward Journey, the game even had a negative growth rate in profit this year.

In 2018 Q1, Netease’s game topped the fastest growing category whereas QQ Speed rose to become the new star of the Tencent family. Compared to previous years where Tencent and Netease carved up most of the profits, several start-ups grew to bcome the budding publishers in China’s game arena.

Rising profits, shrinking quality

AppBi studied every year’s Top 20 Games in Revenue in IOS store and found out astounding conclusions. Most of the top publishers are either injected by Baidu, Tencent, and Alibaba, or BAT itself. Small startups are suffering increasing difficulty to survive or go independent.

From 2016-2018Q1, most of the Top 20 profitable games are well-established IP or Chinese fantasy category, which proven to be very popular among Chinese consumers. There was a significant lacking in originality and innovation.

With more players generated by games like the King of Glory, China mobile users are expected to exceed 550 million, according to CCEA. However, the game market still requires more originality, talents, and better data-driven marketing strategy.

In 2018, Apple indicates it will continue to invest more in search ads, a rising marketing tool that could help hundreds and thousands of game developers to promote their games better.

AppBi provides search optimization services and has a promising track record of helping clients. With more small, mid-size game companies seeking opportunities domestically and overseas, AppBi could be an engine to drive the growth of China’s game market.