August 7, 2016

Source - Bloomberg News

On any given evening, after Mark Hart and his wife have put their kids to bed, he’ll duck into his bedroom closet and close the door behind him. Then, by pixel-light, he goes to work. Hart, a hedge fund manager in Fort Worth, has a single fixation: the Chinese yuan. And at 9 p.m. Texas time, China’s financial markets are in full-throated roar 13 time zones away.

Surrounded by shirts and pants—the closet is more convenient than his basement office—Hart, 44, talks to Hong Kong, parsing the latest numbers and the scuttlebutt from Beijing and Shanghai. In the seven years since this all started, he might as well have learned Mandarin. (All three of his children speak the language now, unlike their old man.) Doggedness has cost him millions—not to mention investors, employees, and, at times, damn near his sanity. But he won’t, or maybe can’t, let go now.

Hart says China is headed for a fall.

Hart in his Fort Worth office.

Photograph: Brandon Thibodeaux for Bloomberg Markets Magazine

Sure, others in finance think so, too—now. But Hart, who’s little known outside a small hedge fund clique despite making a fortune on the U.S. housing bust and predicting the euro zone debt crisis, got in early on the China bear trade with currency options and held on. And on. And on. To some, he’s ahead of the curve. To others, he’s so far behind it he seems to have lost his way.

The world of finance can reward the bold, but it can also devour those whose conviction bends toward obsession. On one level, Hart’s story is a familiar tale of one man’s attempt to navigate those shoals. On another, it’s much more than that—an up-close-and-personal account illustrating one of the most important economic stories of our time: the ongoing tug of war between the free hand of the global marketplace and the Communist Party of China, which has sought to harness the power of capitalism without quite submitting to its will. In both stories, the ending remains unwritten.

“Mark is certainly a trend-setter,” says Harlan Korenvaes, the 65-year-old founder of $21 billion Dallas hedge fund HBK Capital Management, who now manages his own wealth. “But staying on these high-return, high-volatility trades could be to his detriment.”

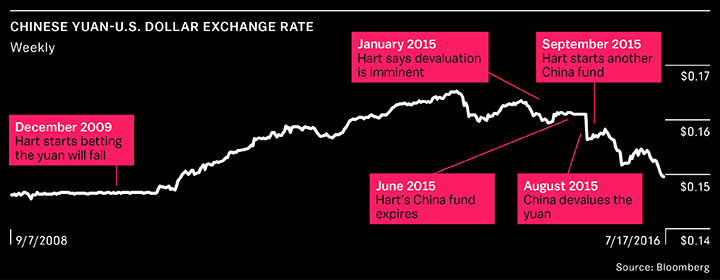

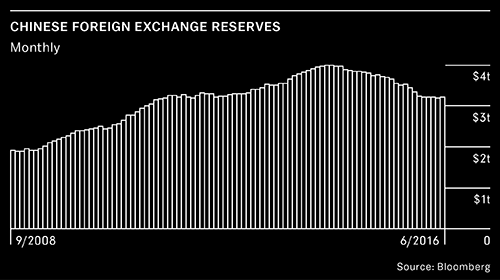

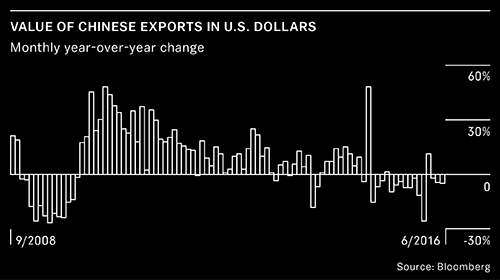

Hart’s case, in a nutshell, is this: China’s currency is wildly overvalued. By some accounts, the yuan’s real effective exchange rate vs. the dollar is twice as high as it was two decades ago and almost 40 percent higher than it was in 2008. Hart foresees a one-off devaluation of at least 30 percent, maybe more, with consequences worse than those of the global financial crisis. Otherwise, he says, Beijing will just burn through foreign exchange reserves trying to fight a losing battle.

“You have to go through the valley to the other side,” Hart says of China. “It’s not necessarily going to be pain-free. But it’s good.”

Hart might as well be talking about himself: He’s trudged through the valleys, felt the pains. Before he started betting against the yuan, his hedge fund, Corriente Advisors, managed $1.9 billion. He started the Fort Worth outfit, named after a breed of cattle used mainly for rodeo events such as bulldogging, in 2001, at 29. Employing a top-down approach to investing, he analyzed economic trends, studied price charts, and spoke with people to gauge sentiment. He did pretty well for himself, too, posting an annualized return of 30 percent through 2006 on rising markets.

Then he and his friend Kyle Bass, another, more famous Dallas-area hedge fund manager, cleaned up in the subprime mortgage bust. They bet against the market and sextupled their money in little more than a year. In 2007, Hart turned his gaze across the Atlantic and bet—correctly again—that European government bonds were headed for trouble. Some investors saw their money double. In short order, he’d made billions for clients. Then he set his sights on China.

It seems so long ago now. Even shutting his main hedge fund in 2012 and giving investors their money back after losses seems ages ago. Hart’s contrarian ideas previously had gotten him laughed out of meetings with investors and bankers, but “he was laughed out the hardest on the China trade,” says Adam Rodman, who worked as an analyst at Corriente until 2012 and now runs a hedge fund his former boss has backed. For a time, as the markets moved against him, Hart almost couldn’t bring himself to watch.

Yet on this warm May afternoon, he’s relaxed, walking barefoot around his office in a converted warehouse he owns on the outskirts of downtown. Hart is Texas born and bred, a product of the University of Texas at Austin, but his vibe is more Brooklyn hipster than Texas oilman. A lean 6-foot-2, he gives off a chill surfer-dude air.

Here, in the 24,000-square-foot space far from the canyons of Wall Street, he has a gym, a rec room, and an art gallery. A chalk-on-blackboard copy of The Raft of the Medusa, that icon of 19th century French Romanticism, dominates one wall of his lair. Joel Sternfeld photographs hang on the others. The bric-a-brac runs from vinyl records (the White Stripes are a favorite) to a teapot in the shape of Ronald Reagan with a green Mao hat sitting on top. A couple of slacklines are installed. Next door, in a second warehouse, he’s got a half-pipe for skateboarding.

Hart pretty much has the run of the place. Corriente has only five employees, down from 25 in 2008. He’s not bitter, at least not anymore. After all, he had a hell of a run. And if this trade pans out, he says, he may make a full comeback to the hedge fund industry.

“I’ve certainly broken a few phones,” says Hart.

Photograph: Brandon Thibodeaux for Bloomberg Markets Magazine

To understand how he got here, you have to go back to November 2008. That was when China first caught his attention. Lehman Brothers had just collapsed. Markets everywhere were reeling—except in Shanghai. Over there, the stock market started rallying. Why? Hart was puzzled, yet everybody from George Soros to Marc Faber seemed to be talking China up in early 2009.

Hart sniffed an opportunity, the kind of market divergence he often seeks. As with all his trades, he dug deep, reading constantly, carrying stacks of books and charts around with him, and poring over everything from China’s consumer savings patterns to nonperforming loans at the nation’s banks. His research led him to Jim Walker, the Hong Kong-based economist who predicted the market turmoil that swept East Asia in the late 1990s; Dr. Gloom, as he’s known, was also skeptical of China. Hart began building an informal brain trust, talking to other longtime China hands such as Logan Wright, now at Rhodium Group, and Victor Shih, a professor at the University of California at Irvine, who was warning about a credit bubble. “I drive people crazy,” Hart says. “I’m constantly prying.”

By December 2009, all that prying had helped him formulate his strategy. Hart’s big play: currency options that would pay off if the yuan fell sharply. About $225 million from investors poured into his China fund, a “special purpose vehicle” with a set mandate and time period. He used the money to buy contracts as far out as two years. It was, in the scheme of things, a relatively safe bet: If he was right, the payoff would be huge. If he was wrong, the options—bought for a few basis points—would expire worthless. Hart couldn’t blow up; he could only bleed to death. With the yuan trading at about 6.8 to the dollar, he figured he’d give his plan five or so years to work out.

With that, all those restless nights began.

At first, Hart woke up every half-hour to monitor the markets and call brokers in Hong Kong. He was still invested in Europe, too. It was all markets, all the time. “I had $25 billion of notional exposure!” he says of his yuan bet, leaning in close. “I wouldn’t say it was an obsession. It’s a lot of hours, a lot of work. You have to be completely committed.”

To some, Hart treads on dangerous turf. China’s central bank has warded off speculators by making it costly to bet against the yuan, says Frank Zhang, head of foreign exchange trading in Shanghai at China Merchants Bank. “It’s not wise to battle against the People’s Bank of China, because you’re not going to win,” he says. “Even if there are pressures for the yuan to weaken, the PBOC will likely manage market sentiment and let the currency fall very gradually.”

Hart takes exception to being known as a China-basher and clarifies that he’s not betting against the country’s central bank, with its $3.2 trillion currency hoard. In fact, he says, he shares the same position as the PBOC: long dollar, short yuan.

Hart talks with intensity about his trade, spanning topics from Premier Xi Jinping’s grip on power to the implied volatility of options. He says China experienced an unsustainable economic boom that attracted substantial foreign capital inflows and fueled excessive credit growth. The resulting imbalances—over-investment, asset-price bubbles—leave it vulnerable to a massive correction. You might assume he developed these ideas on the ground, but he’s actually never set foot on the mainland. “You’re just subjecting yourself to hearing what they want you to hear,” says Hart, who’s opted to send his analysts instead. The closest he’s come is Hong Kong—an “adult Disneyland,” he quips.

The Texan concedes his trading style isn’t for everyone—and sometimes, it turns out, it isn’t even for him. After starting to bet on the yuan’s fall in 2009, Hart watched as the currency moved in the opposite direction. A year passed. Then two. Then three. Then four. He was accustomed to making clients billions, yet here he was watching hundreds of millions of dollars’ worth of yuan options sink down the plughole. “Sometimes, to our detriment, we looked at these investment ideas not just as work, but as life’s work,” says Rodman, his former analyst.

Making matters worse, Hart was losing money on his European trade. His temper began to fray. His employees became demoralized, and he was barely spending time with his family. His father, also named Mark, was battling Parkinson’s disease. Hart was overwhelmed. “I felt like I was under siege,” he recalls. “I was working harder and not having any results.” He stands up, stretches his arms and legs, and sits down. “I’ve certainly broken a few phones.”

By late 2012 the yuan was still moving against him, strengthening almost 10 percent against the dollar since he started his wager. With stress taking its toll, Hart took a break to clear his mind. He kept a journal. He read Hemingway. Finally he concluded he couldn’t keep juggling every ball. After 11 years, Hart shut his main hedge fund and gave investors their money back. His European fund then expired, after losses.“

I blame myself. I’m the one who f---ed it up,” he says, raising his voice and shifting in his chair. “One big mistake that I made was that I believed China would recognize that it would be in their best interest to stop defending their currency once it became apparent that the days of foreign exchange inflows were over.“

It was insane,” Hart continues. “For a long time I’d let these trades dominate my life. I was too dogmatic.” He loses the thread for a moment and then says, half to himself: “I was so convinced I was right.”

Closing his main fund was one of the best decisions he’s ever made, Hart says: “It was incredibly liberating.” He pulled himself together, using Brazilian jiujitsu as an outlet. He went as close to vegetarian as a Texan can, barely touched alcohol, and made breakfast a regular ordeal: a few forkfuls of sauerkraut (fuel for a healthy gut); sardines and eggs (paleo staples); a vegetable drink; and a protein shake.

Then, in early 2014, the yuan began weakening. Hart held his breath, hoping to see the epic devaluation he’d long expected. He didn’t have much time left; the China fund, all he had left, was nearing its end. In January 2015, he went so far as to tell clients that a devaluation was imminent. He hoped to raise more money, but there was little uptake. “Mark Hart fatigue,” he says. The fund expired in June 2015 without turning a profit. He hung his head and took the summer off.

Two months later, in August, China devalued the yuan by more than it had since it ended a dual-currency system in 1994. Shock waves rippled across global markets as the currency weakened 1.8 percent on Aug. 11. That might seem minuscule, but even hardened China watchers were stunned, with Khoon Goh, head of Asia research at Australia & New Zealand Banking Group, saying he initially assumed financial news wires had published the wrong exchange rate.

Hart had just returned from a family vacation in Austin and was busy getting his kids ready for the school year. He almost didn’t notice: With no skin in the game, he hadn’t been paying attention. Even if he’d still had his wager in place, “it’s not like it would have really made me money,” Hart says. It would have on a mark-to-market basis for a while, but ultimately it wasn’t the big one-off devaluation he was waiting for. Nonetheless, the congratulatory e-mails began pouring in. “It was really satisfying,” he recalls. “It seemed as though my thesis was proving itself.”

That thesis happens to remain in play. Last September, Hart decided to take another stab at shorting the yuan and opened another China fund, raising about $50 million. Since then, others have taken aim at the currency—including David Tepper, Bill Ackman, and Bass, who’s started his own China fund. Bill Gross, the former star of Pimco now at Janus Capital Group, likened the pressure on the yuan to the 1992 attack on the British pound that turned Soros into the man who broke the Bank of England. Shorting the currency became such a crowded trade, in fact, that early this year China’s central bank went on the offensive to drive out speculators.

Hart’s latest fund is scheduled to expire in December.

Photograph: Brandon Thibodeaux for Bloomberg Markets Magazine

Hart hadn’t put all of his money to work when the PBOC tightened capital controls, intervened in currency markets, and waged a verbal campaign to support the exchange rate. Hedge funds run by Dan Loeb and Paul Singer were among those posting losses on the trade, which Hart says he avoided. And he’s since slowly added to his wager, buying yuan options a month or two into the future. “My mindset has been much better on China,” he says. “I’ve been a lot more willing to accept government action.” The currency has continued to weaken, hitting its lowest in more than five years on July 18. Even so, things may be turning around in China, with data from gross domestic product to retail sales fueling optimism that economic growth will steady. Foreign exchange strategists tracked by Bloomberg say the yuan will drop just 1 percent vs. the dollar by yearend, while the central bank has pledged stability against a basket of currencies.

Just how it will end is anyone’s guess, though Hart’s latest fund is scheduled to expire in December. He says that once the yuan weakens dramatically—and he insists it will—he’ll invest in an exchange-traded fund that tracks the nation’s biggest companies. “Even if he doesn’t win on this China trade,” Dallas investor Korenvaes says, “he’s one of the first guys that spotted it, and others came aboard.”

Outside, the temperature in Fort Worth is approaching 90F. Hart hasn’t touched the water bottle in front of him. Later, in the gym, he grapples with his jiujitsu instructor. He employs a body lock, making his instructor tap out before releasing him. “He let me win,” Hart says, laughing. Will China?

—With assistance by Saijel Kishan and Tian Chen

Hi! I am a content-detection robot. This post is to help manual curators; I have NOT flagged you.

Here is similar content:

http://www.bloomberg.com/news/features/2016-08-07/the-seven-year-short-hedge-fund-betting-on-yuan-refuses-to-quit