Cardano is the 6th largest cryptocurrency with a market cap of over $15 billion.

Surprisingly, there is still a lot of confusion about Cardano and how it made it’s way so far up the crypto leaderboards.

This post aims to to take a closer look at Cardano and explore the features that make it a third generation blockchain.

So, what is Cardano?

In many ways Cardano is the reflection of it’s founder, Charles Hoskinson.

I was fortunate enough to meet Charles and see him speak at G20 Ventures Blockchain meetup in Cambridge, Massachusetts.

Charles commented on Cardano’s meteoric 2000% increase relative to the unrefined nature of the technology as “kind of funny because money people have only been in the space for a while and we’re already in the third generation.”

Many people who are not new to cryptocurrency can still remember when Bitcoin was still only $1 and you could never organize a meetup that drew the 400+ crowd and line out the door was this event garnered blocks away from Harvard University.

“You would never fill a room like this - you could say ‘free money/pizza, everything you want and we would get like 6 people’”.

This is actually quite a profound statement.

Between the Wall Street money that has come into the space and the surge of investors throwing money at whatever project seems the most viable - things are moving incredibly fast.

The whole nature of the space is changing.

But back in the early Bitcoin days of 2009-2013 the whole goal was simply to build a decentralized form of money that no third party could have control over.

While this concept seems silly and obvious now, at the time it was actually a hotly debated topic.

Miners would mine Bitcoin without a clear idea of its real value or if you could trade or sell it for anything.

But then it became valuable.

In a moonshot that is becoming relatively common in the space, Bitcoin surged from $1 to $250 during the Cyprus crisis.

“What this meant is that people started taking it seriously. And when they started taking it seriously, what’s the first thing that happens - people start commenting ‘yes,but… - they want to do something to it’”

Charles comments on the response of the community to find all of Bitcoin’s flaws and come up with their own solutions to them.

This led to the rise of all the alt-coins that flood the market today and even overlay protocols like Color Coins and Mastercoin.

As cryptocurrency and blockchain technology became a more exciting career path, Charles decided to hop on the wave. There was only one problem - he didn’t know anybody.

So, being an academic, he decided to teach a course on Udemy called “Bitcoin or How I Learned to Stop Worrying and Love Crypto”.

The success of this course allowed Charles to meet all the major players in the crypto community e.g. Adam Levine, Andreas Antonopoulos, venture capitalists, etc.

But what Charles is most known for is Ethereum.

After working on a project called Bitshares, where each time they would ship a protocol, they would want to make a bunch of changes to it - something horrendously difficult once you deploy a cryptocurrency.

So how do you upgrade after you’ve shipped?

“It would be so nice if you had a programming language or a scripting language that let you do that...”

Well at the time Vitalik Buterin, founder of Ethereum, was pulling his hair out while working on Color Coins and Mastercoin trying to get them to do reasonable things.

Then they hit on an ingenious idea - “wouldn’t it be nice if it was like the web when Javascript came to the browser and we just got a programming language and now we have Gmail and Facebook?”

This actually wasn’t a completely new idea.

In the 1990’s Nick Szabo was working on smart contracts and another under-appreciated pioneers of the space , Sergio Lerner was an early promoter of the use of turing-complete scripting contracts and a is a co-founder of the Rootstock project.

So Vitalik and Charles teamed up and built Ethereum as a second generation blockchain.

“I want my transactions to be smart and I want my transactions to do meaningful things” - this is the mantra of a second generation blockchain.

Ethereum and this idea generated massive criticism in the space and subsequently became worth $100 billion.

So the world caught on and decided that decentralized money was a good thing, as were smart contracts - but scalability was still an issue.

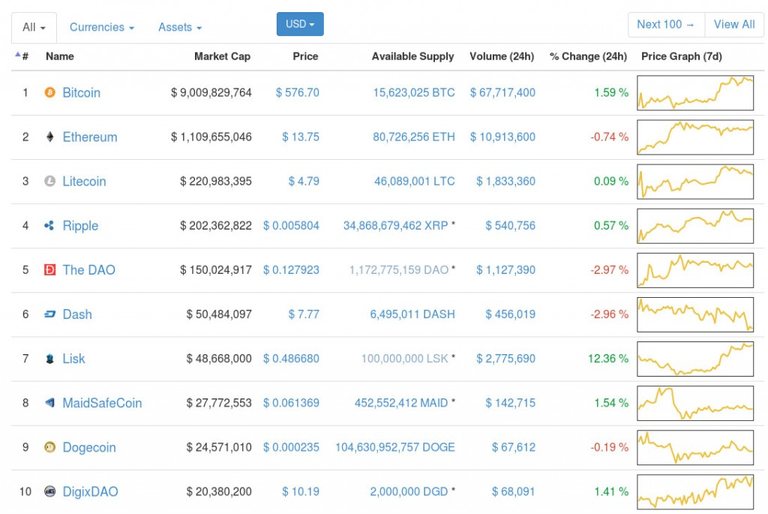

Besides scalability issues - there are thousands of alt-coins on coinmarketcap.com.

“But they don’t talk to each other. A lot of them are blind, deaf and dumb...Finally how do you decide to pay for things and to govern things with cryptocurrency?”

So this presents a governance crisis that blocks cryptocurrencies from mainstream adoption.

This is consequently the problem the Cardano aims to solve.

ICO’s are a nice influx of cash in the short term but they don’t provide a sustainable source of income for the growth and development of a cryptocurrency.

“So we have scalability problem...we have an interoperability problem in the ecosystem where we have thousands of cryptocurrencies and they’re all just not talking to each other well and we have a sustainability problem where basically you can’t figure out how to pay for things without these damn ICO’s”

This perfect storm is the ideal environment out of which Cardano, a third generation cryptocurrency aims to make a name for itself.