The principle of this posting is not to fully explain the concept of the Elliot waves, but rather to make investors aware of the issue raised in the post title above.

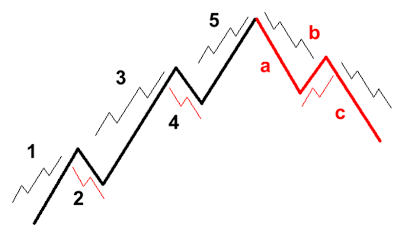

So, let's get down to what really matters: Elliot waves are composed of five dominant and impulsive wave and three more corrective wave waves. In Cardano (ADA) in the long term, we are in the last corrective wave, that is, we are in the "C wave". However, Ralph Nelson Elliot himself, the developer of Elliot's wave theory, has specified that "wave C" is at least the size of "wave A" and often extends beyond or up to 1.618 wave A.

In addition, it is necessary to affirm that when the "wave C" reaches the end, a new Elliot wave cycle will be initiated, and Cardano can return to the old top or not.

This perspective outlined above takes place in the long term, that is, something that can take a long time to occur. But we must be aware that the technical analysis is responsible for 50% of the market study, it may be that the developers of the Cardan (ADA) are successful and this will not occur. For the market occurs through the perspectives of individuals in relation to the uncertain future of the market and of the asset itself.

Below we see Elliot's wave model in order to compare it to the Elliot waves drawn on the Cardano chart (ADA):