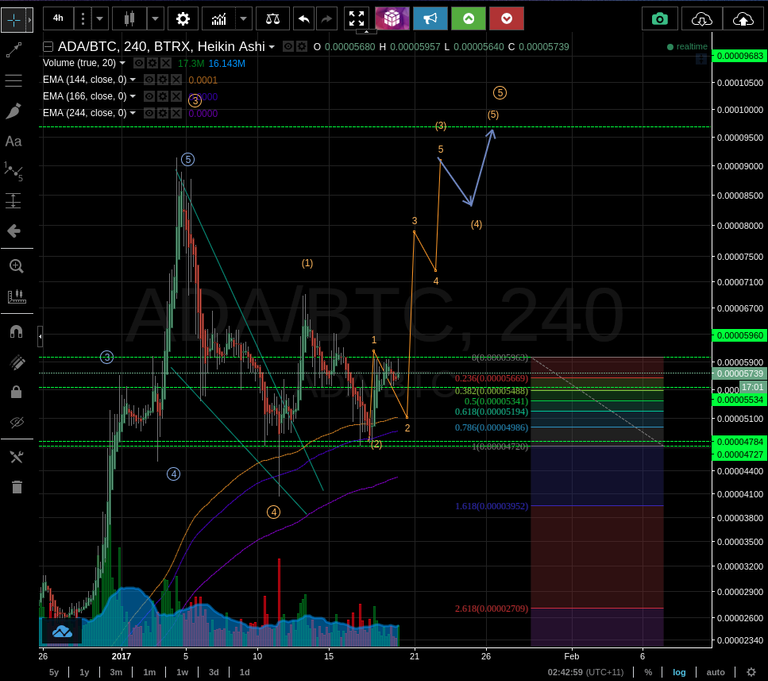

We had an impulsive break of the descending triangle. Prices bounced off of the moving average on 9/1/10 and have made a healthy retracement to the 166 MA where it appears we had an impulsive bounce which could possibly be the wave 1 of 3 of 5.

Two counts have been provided the bearish in blue indicates a possible 5 wave structure which implies further correction.

A closer inspection reveals a flag formation. Entry within the flag places stops bellow the 5530 support. If the flag formation breaks downwards we expect a bounce at the 0.618 and the 0.786 Fibonacci levels off of the 144 or 166 exponential moving averages. A close bellow 4786 sats invalidates the count and implies a more complex correction or the bearish blue count is in play implying a further drop in prices to prior support at about 3000 sats.