Keeping up with changes in the legalized cannabis industry is a challenge for most retail investors. By the time you get the latest news or developments in the market, it’s already been priced into the stock: that’s the problem with relying on the mainstream media for your information: they didn’t even start talking about cannabis stocks until they were expensive.

For sustainable long-term returns, you’ve got to think like the world’s most successful billionaire investors: buy shares of companies that are trading below their intrinsic value, and if the price goes down, you can accumulate more shares. Do you think highly successful investors freak out if they buy shares of a great company and then the price goes down?

Heck no! They see this as an opportunity to buy shares that were already cheap at an even better price. But here’s the thing: this strategy only works with really good, profitable companies. Don’t even think about trying this will a company that’s not profitable or doesn’t have a great management team.

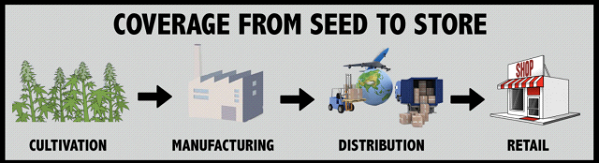

This is especially true when it comes to cannabis stocks: you can’t just buy random stocks in this sector and expect to be successful. The corporate press would have you buy the same handful of overvalued companies with little to no diversification – companies that only grow the plant but don’t cover any other part of the seed-to-sale cannabis supply chain.

_Courtesy: mjnewsnetwork.com _

_Courtesy: mjnewsnetwork.com _

You’d have a tough time identifying one company that can do all of these things effectively. However, one company based in Vancouver, C21 Investments Inc. (CSE:CXXI), has all the based covered through a strategy of acquiring brands that operate successfully across the various points of the cannabis supply chain.

These brands produce and distribute a broad range of premium-quality THC and CBD products from cannabis flowers, pre-rolls, cannabis oil, vaporizer cartridges, and edibles. And while C21 does hail from Canada, their brands are generating terrific revenues in key U.S. states.

Through their aggressive brand-building business model, C21 is able to compete aggressively in the rapid growth of the cannabis industry and to grow revenue and EBITDA. They already have extremely profitable operations in Nevada and Oregon, and are pursuing further opportunistic acquisitions of accretive businesses throughout the U.S.

93% Of Investors Generate Annual Returns, Which Barely Beat Inflation.

Wealth Education and Investment Principles Are Hidden From Public Database On Purpose!

Build The Knowledge Base To Set Yourself Up For A Wealthy Retirement and Leverage The Relationships We Are Forming With Proven Small-Cap Management Teams To Hit Grand-Slams!

As for C21’s leadership, I assure you that they’ve got decades of experience as the CEO has handpicked a team with a successful track record in horticulture cultivation, manufacturing, biochemistry, marketing, operations, capital markets, securities law, and finance. In fact, C21’s Board of Directors includes a seasoned senior executive with more than 35 years of experience in financial services, as well as a global horticulture cultivation expert with more than 30 years of experience in the field.

Along with their outstanding team, much of the company’s success stems from their selectivity: only the absolute best brands in the canna-business will do for C21. Key indicators they look for include strong, consistent sales and revenues, scalability in the quickly expanding legalized cannabis marketplace, and sustainable growth for the long term.

Sustainable growth means cultivating the finest cannabis brands with first-to-market status – like Silver State Relief, the very first legal dispensary in all of Nevada. Silver State’s flagship location serves more than 1,200 customers on a typical day; you’ll probably have to stand in line if you want to shop at their dispensary, but that’s exactly what I’m looking for as an investor.

All the way from seed to store, C21 Investments Inc. is generating revenue streams and providing value to shareholders. And so, you too can be like the world’s top billionaire investors: grab shares of CXXI while they’re still cheap, and watch them grow.

Best Regards,

Tom Beck

Research Partner, PortfolioWealthGlobal.com

Warning! This user is on my black list, likely as a known plagiarist, spammer or ID thief. Please be cautious with this post!

If you believe this is an error, please chat with us in the #cheetah-appeals channel in our discord.