Welcome to a new series I'm doing named “From $656K Debt to Financial Freedom”. This is episode #1 here with me Jerry Banfield. I have 685k in debt and what I'm doing is making a live journal essentially of my journey from having this much debt in a position that might look hopeless to many of you that are reading.

I'm going to just document this from where we are today and go forward with new live episodes every week. What I'm imagining is by the end of this series, the debt will be completely gone and there'll actually be cash, assets, and income.

From $656K Debt to Financial Freedom

This will be really inspiring over a long period of time to just watch and read all of these episodes in order. There are so many “How to” books that are telling me how I should get out of debt, what I should do and all such advice.

From my understanding, what I really can use is just some understanding. It’s like, “Hey, I'm in this position right now. This is my reality and I'm working my way out of this”. This is important to go from $656K debt to financial freedom.

That is why I'm doing these because when you get into a challenging situation in life, you often feel like you're not alone and I want you to know that you're not alone.

If you've got a lot of debt, you're not alone at all and if you like this idea, please hit the like button. That'll let me know that this is a great idea.

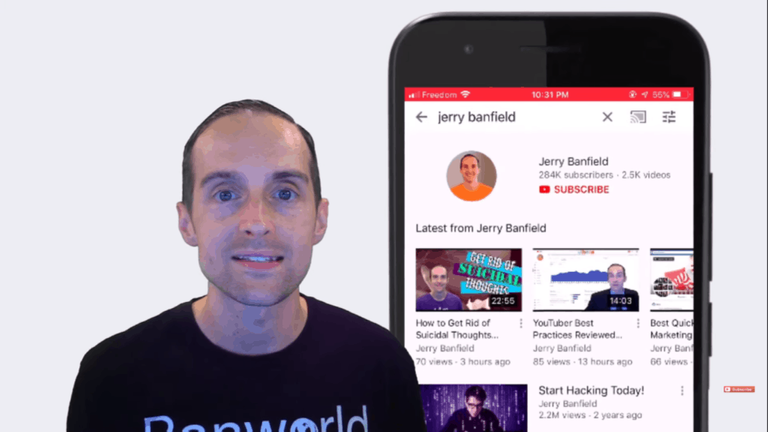

I’m confident that you’d want to see some more of these and for that, please make sure to catch the whole series by subscribing to my YouTube channel and check the playlists. The playlists will give you access to all of the episodes in order.

These are all based on a video I did before which is kind of a pilot episode of this called “35 With $484k in Debt and a Plan.

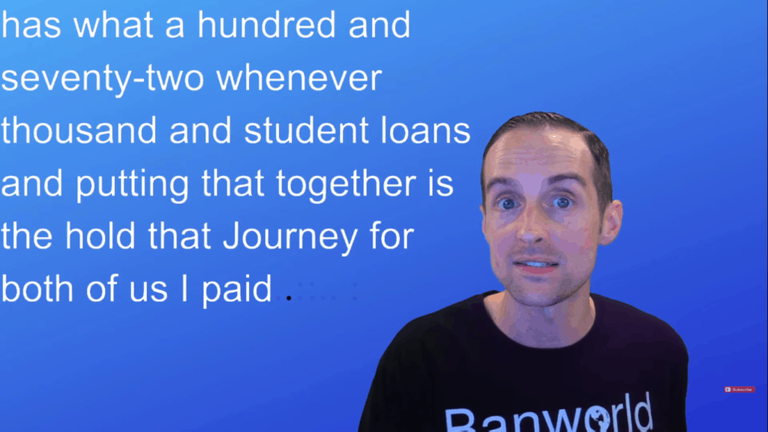

I've chosen to update the amount of the debt and do this with my family instead of just myself because individually, I have $484k in debt.

As a family, when you include my wife's $170k+ and student loan debt, it comes out to $656k in debt. Thus, my wife and I are a financial unit. We are doing this together to get out of debt.

Therefore, it shouldn't be just my debt and plan but it's my family's debt and plan. This is important to go from $656K debt to financial freedom.

From $656K Debt to Financial Freedom

All the books I've read have made the consistent point that it's all about your mindset. It's all about having faith at this point.

I don't see debt as a permanent part of my life. It's something very temporary and yet there are real changes I need to make out of it.

What I've been working on is balancing all of the positive messages about “Just believe and it will happen” with “Okay, what's my day-to-day reality? How do I actually cut down on my expenses and make some more money?”

Just a positive mindset and belief does not work on those day-to-day things itself. I need to work on that in a positive mindset and belief. This is important to go from $656K debt to financial freedom.

I've been reading books and some of the books I've read about making money actually got me in this position.

Those were all advised to borrow money aggressively to spend in order to grow your business. That's how I racked up over $200k in debt. This year was very aggressively going after building my business.

I borrowed money to pay people to build my business and things didn't work out just how I'd planned. The one thing I'm doing to help with the situation is that I'm selling what I put all that money into i.e, Uthena. That will help raise some money.

Tony Shark: Why do you have debt?

I have debt because I started borrowing money to go to school. The first debt I got was from student loans at 18 years old. I had no debt and I operated completely in cash without credit cards.

The universal advice I got from everyone in my life was going to school. My parents said, “You have to move out when you're 18 years old”. They hoped I'd go to a university which I did.

My primary plans fell through because the Iraq war started. The September 11th incident occurred and then all these wars started. I was thinking about going into the military.

Long story short, I ended up going to a college that had an ROTC program which was different than I had planned on and accepted an offer by signing on a letter of commitment.

I lost the full-ride scholarship and had to use my back-up plan that was to go to the University of South Carolina with a partial scholarship at which point I started borrowing money for student loans.

The key to being in debt is it's taking the very first loan that makes all the rest possible. Once, you've got one loan, taking another loan seems reasonable.

When you've got several student loans, taking a credit card, running up a small balance and ultimately buying a house seems very reasonable.

Similarly, when you've got a business, taking a business loan when your cash is a bit short seems fine as well.

When you're in this mindset and lifestyle of debt all the time, you get used to it. If you're like me, I've been constantly spending faster than it is ideal to get rid of the debt.

Instead of making “Paying off the debt” a priority which I paid off a whole bunch of debt before but I didn't pay it all off.

I couldn't get all of my wife's student loans, the mortgage and the rest of my student loans paid off before the financial opportunities I had gone away and the finances slowed down.

Thus, I got into debt by taking student loans and staying in the habit of being in debt since then.

What I've gone through with the debt thing too is the blame game which is funny because, in things like cancer, we look around and say “Wow”.

You wouldn't blame somebody for having cancer and yet we go on and blame people “Well, you are stupid for having all this debt”. Whereas, when someone has cancer, “Well, they're not stupid for getting cancer”.

You could really look at someone who has cancer and say the same thing as “You are stupid for having cancer the way you lived your life”. You smoked, drank, poor diet and you didn't exercise. The choices you made gave you cancer.

Thus, there is a big personal responsibility and everything in life but there's also some not personal responsibility and everything in life.

All the people in my life that I trust told me to go to college at any cost. Borrow money if you have to. That was the universal advice I got. Similar to cancer, there were things I did. I just followed advice.

Thus, I take responsibility for the position I'm in today by doing something about it. I also recognize the reason because of which I'm in this position today. It is the best advice I got from my friends and family.

The advice was, “Well, if you want a house, get a mortgage. If you want to go to school, take student loans if you can't get financial aid to cover all of it”.

Therefore, I had a hand in where I'm at and so did other people which is good because for getting out of debt, other people are going to have a hand in me getting out of debt and I am too.

Thus, I think that's a pretty in-depth answer.

The way I see out of this debt is a combination of cutting my expenses and earning more money. I'm focusing on doing both of these. It's easier to cut expenses and that can be done much faster and this is one of the lessons that has taken me a while to learn.

It is not only to cut expenses immediately and then focus on earning income but also don't grow the expenses back until the debt is annihilated. This is important to go from $656K debt to financial freedom.

This is the one I've run into a bunch of times and this is what I see people around me consistently doing as well.

What I noticed is anytime my finances started going in a positive direction, I paid off my debt but I also ramped up my spending to the point where I couldn't pay as much off on the debt.

When I had things go really well with selling my courses on Udemy, I paid off over $100k of my debt and about $40k+ of my wife student loans with that Udemy money.

However, I cranked my expenses up pretty high trying to make more and more sales instead of just taking the income and taking a more patient and steady approach.

We could have had our debt nearly paid off if I hadn't ramped my expenses up fast and then been so easy and comfortable to go back into debt.

What I can see I did this year is I raced ahead. I've noticed that huge ambition, racing and going ahead in this big tear that “I'm going to make something amazingly successful and I'm gonna do it overnight” allowed for borrowing too quickly.

I've made enough money that a lot of creditors gave me huge credit lines which is how I was able to rack up a lot more debt.

What I'm at today with this journal is giving some background of some context but it's also important to just look at “What can I actually do today?”. This is important to go from $656K debt to financial freedom.

It doesn't help me to go back through the history of it over and over again. Thus, the main thing in this journal is “What am I actually doing today?”. Today, I've been cutting my expenses all around the board everywhere I can.

From $656K Debt to Financial Freedom

I'm starting a new series on how my wife and I work our way out from $656K debt to financial freedom. Today's episode #1 is based on the previous episode I did before.

I'm doing this series because I see that this has a massive potential to help people just like me. I've read so many books about money and clearly, I've read so many books about money and they have not helped.

I've read so many self-help books and podcasts such as “Tony Robbins: Money Master The Game” and “You are a Badass at Making Money”. I keep listening and reading all this stuff about making money.

The problem/challenge is that it's often written by someone who's got a whole lot of money trying to tell me what I should do to get what they've got and often it's told from a long time in the future.

What I've noticed, when I talk about my past, I often don't do a good job because it's muddled by my future and I'm so excited to share this because I'm listening to a book by Cheryl Richardson “Waking Up in Winter”.

She's doing journal entries and this is really helping me. This is helping me to look around and identify in my life because I've noticed, the more I listen to things about making money, the more I get into making bad decisions with money.

It is because it's out of an area where I don't feel good enough about the money I have.

When I read a book and then Tony Robbins tells me how to make money in the stock market and I try. I follow that and I put something to work on it and yet now I'm in more debt than ever.

What all of these books are telling me is how to hustle and change my mindset but really when I read all these books, I actually end up feeling not good about myself and that's the ironic effect.

When someone tells you what you ought to do, there's this implied thing where I'm not good enough.

Therefore, I'm hoping that this will help people who maybe read a bunch of books like me and they're not making a difference to say, “Look, this is what I'm doing. I don't know what you should do but this is what I'm doing”.

Maybe hearing what I'm doing will help you somehow.

From $656K Debt to Financial Freedom

Given my current financial situation, I've been in a habit of spending more than I make for a long time.

Now, that doesn't mean I spend more than I make every single month. I've been in the habit of just spending without as much regard to my means to spend.

There's a delicate balance with this because right after college, I lived what I would call with a cheap mindset.

I would go out to eat and not leave tips because I figured the waitress was making more money than me. Therefore, she didn't need any more of my money. I ought to just keep it and that cheap mindset left me feeling broke and not making any more money.

When I got out of that mindset and I got a better job, I started going back to tipping.

There is a delicate balance in spending and giving money versus just being totally cheap and selfish with it and that's a balance I'm trying to walk in the following way yesterday. This is important to go from $656K debt to financial freedom.

I went to talk to my personal trainer. I've been paying $600 a month for personal training for the last several months and I talked to her.

I said, “Look, you saw that video. You know how much debt I have. What can we do about personal training? $600 a month is one of my biggest personal bills”.

So, personal means not something for my business and I've gutted my business expenses. Personal training is a very valuable part of my life. It really helps me look good and feel good. I love hanging out with her and talking with her.

From $656K Debt to Financial Freedom

Business expenses are the majority of where I've run up a bunch of debt this year. In fact, it's almost all the business expenses.

However, when you put maybe $10,000 of personal spending this year that could have been cut down or cut back and throw that in with the business expenses.

So, I gutted my business expenses last month. I did My Online Business Income Report for October 2019 — Live Q & A. You can watch the video below.

I spent $5,000 more than I made last month of my business. Why? Because I was trying to aggressively grow my business.

A lot of these books you read suggest “You got to spend money to make money. You got to be aggressive, take chances, go for it and spend money on ads”.

I've done so much of that this year and that approach provokes anxiety and I'm not interested in doing that anymore.

What I'm planning for my business going forward definitely is steady patient growth and it's taking me a long hard road to get here. Minimum expenses get all my debt across the board paid off. Very gently scale my business expenses up.

Every time my business is done well, I've ripped my expenses up super fast.

I'm so proud of my wife, especially she's just so peaceful with the debt. She says, ‘I know we're gonna work our way out of this”. This is important to go from $656K debt to financial freedom.

She's so trusting and she has even allowed me to make a lot of mistakes with my business this year. Too rapidly advancing on starting a new company, overly ambitious project and spending $10,000 to $20,000 a month that I was sure was going to work.

I'm so proud of my wife for walking this journey with me and being ok with me sharing this openly with you.

Kyle: The stock market and the casino are the same things.

Yes, the stock market and the casino have a lot in common. I have sold all of the stocks I had in 2017 which was about $16,000 or so.

I sold all of them to buy a Dash Masternode, blew that up to like $87,000 and got into a bunch of cryptocurrency stuff and I really trashed the rest of my business doing that.

Even though crypto made great money for a while. I trashed the very foundation of my business which was the YouTube channel offering very helpful content and online courses.

Those are the actions I took after reading “Tony Robbins: Money Master The Game” to get out there and play smarter than other people which I did.

I bought something I knew I could promote. So, promoted, sold higher, did the same kind of thing and well, here I am.

It was said that it can be challenging to cut your expenses and to spend it within your means. Yes, that's my experience too.

Borrowing money got me in the habit of spending above my needs and what I'm very grateful for is I've made every single payment on time for 13 years. I've never missed a payment on my debt or any of my credit cards.

I feel it's important to honor my obligations. That means, I think it's important that I pay that back as agreed rather than things I could do to just not pay it or get out of it.

I've paid back all and I'm paying back all the money I've borrowed and I intend to continue doing that because that's honest. This is important to go from $656K debt to financial freedom.

To me, it's not honest for me personally if I just take the money and I don't pay that back because I wouldn't want people to do that to me.

David: How can I get a good body?

Well, I'll answer this best I can here. This is the best I have felt about my body. I think this is the best this body has looked since I was 18 because these bodies change a lot in childhood.

This is the best I've felt about my body, the best it's looked and the best it's operated. What I've done to do that is “Focus on what I am eating”. What you eat is one of the biggest factors and how the body looks.

I remember going to my personal trainer. I got a personal trainer in 2013 because I wanted to lose weight and look better.

She said, “80% of the weight is what you eat”. I’m like, “Well, why am I coming to personal training if 80% of how my weight is what I eat? Why am I even bothering with this 20%?”

Now, vigorous exercise is very important however diet plus sleep are two of the biggest things for having a great body and what you eat.

I recommend or what I read that made the difference for me is a book called “How not to die”. That was huge. I read a book called “How not to die” and followed the instructions.

I've been following them for 3 and 1/2 years. Literally reading that single-handedly has got me at a healthy weight.

Also, I stay sober and go to Alcoholics Anonymous every day. I've got about 5 and 1/2 years sober and pretty much only drink water meaning no alcohol and no sugar drinks.

I'd hardly even drink tea/coffee. You might say it's boring. That makes a big difference. Even things like diet sodas have poisons in them that negatively affect your body and make you crave food.

Clean eating, whole plant fruits, vegetables, nuts, whole grains, and beans, that eating has helped me a lot to keep my body in good shape.

The better shape my body's in, the better I feel and the better I can do. That's made a huge difference over the years.

Also, getting good sleep. I consistently get 7 or 8 hours of sleep every night. Good sleep is imperative for repairing the body maintaining a healthy weight fixing all the functions.

I exercise every single day, try and get outside for about an hour every day at least for a walk and then I do personal training twice a week.

I was talking with my personal trainer.

Sometimes an important step in honesty is simply what we call in the recovery movement “Taking Inventory”. I did the video a couple of weeks ago on “35 with 484k debt and a plan”.

To prepare for that, for the first time all year, I'd actually looked at all my debt and added all the numbers up.

I just thought before that “Well, of course, I have debt. I owe money” but there's a big difference between knowing about how much you owe and sitting down and looking at all of it.

How much do I owe? Who do I owe it to? What's the minimum payment? How much interest in my paying? When will this be paid off? How much is my total minimum payment among all my different payments?

That was a huge step that helped me start taking the steps to reduce it. As long as I knew I had debt, of course, I want to spend responsibly but when I saw my debt was $75,000 higher than I thought it was as a result of my success before, that wasn't my doing.

It was hundreds of thousands of people helping me as a result of my success i.e. huge credit lines and great income. Then I was able to borrow money so fast, I didn't even realize how much I owed. The minimum payment was $8,000 a month.

Last month my business made about $8,000 in revenue which means even if I had no expenses, I'd pay them all out in minimum debt payments. It only counts the mortgage and it doesn't count me anything else.

What also got me started to financial freedom is somebody last week came in with a comment says “You have all this debt. You don't have any right to give advice” and it kind of triggered me because that's true.

What business do I have telling anyone else what they ought to do? What all of us have a right to do is share our story to say, “Hey, this is what I'm doing. This is what my life's like and this is how I got here”.

This is why I'm doing it. All of us have a right to share our stories. In fact, I find when people share stories with me, helped a lot.

Often someone sharing their story with me will help me a lot more than getting told what to do and how to do it. Because when I hear stories, I start picking things out myself.

It’s like, “Oh, I should take a vacation to visit my mother”. I come up with the idea of myself and that leaves me wanting to take action on it but I find when people just tell me what to do, I only care about getting the result.

If someone tells me what to do and how to do it, I don't get the result as they said. Like all of these money books, I've read.

From $656K Debt to Financial Freedom

All of the books I read gave me this advice. I executed the advice and I'm in the worst financial position I've ever been in and then that leaves me feeling kind of aggravated.

It’s like, “Is this advice really valid?”

Maybe, it's not valid for me and it was valid for you but I love hearing other people's stories because often then, I'll just come up with something on my own.

Thus, I'm also going forward in the mindset of “Let me not tell anybody else what they should do and just share what I'm actually doing”.

I literally had a breakdown one day and several other uncomfortable days. I did not want to talk about my debt openly like this.

The reason I do it is I've been conditioned, especially by being in recovery and all of your responses. I've been conditioned and I've seen that if I want to make a real difference, I need to share my stories of struggle.

Those will often make a real difference. If I'm not an expert, my advice will often be disregarded and if I give advice, someone applies it and it doesn't work, you get a lot of negative feedback out of that.

I'm grateful for all the courage I've shared, especially Alcoholics Anonymous meetings. The courageous sharing I've seen there helped me have the courage to step up and say “What video do I really need to make to help other people?”.

The thing that came up was “You need to talk about your debt. This is what bothers you every single day. This is what your mind is obsessed with fixing every single day and this is what you need to talk about to other people i.e. your struggle”.

I read “Kevin Trudeau's Natural Cures” book and I spent almost $2,000 buying stuff he recommended in the book. That includes,

- A juicer for $500.

- Air purifiers for $400.

- Trampoline for $250.

Thank God, I did not buy this $2,600 amulet. I was thinking about it and almost bought it but that's what happens when you're in the habit of constantly living beyond your means.

Now, I'm not saying debt is bad. I am very grateful for all the companies who've trusted me with money. In 2015, I was able to get my business to make crazy amounts of money i.e. $80,000 and $90,000 in different months.

In a 3-month period, I made over $200,000 on Udemy and it was because I borrowed money, spent it to build my business and spent it on advertising.

I ran a perfect little marketing and advertising system to rank my courses high and make a ton of sales.

Now, that was one-time when borrowing money went really well. It's nice if you're short to be able to borrow some money so you don't have to leave your home and get kicked out on the street.

Thus, I'm very grateful for all the money I've borrowed. I am not against borrowing money or taking debt. What I'm willing to become is a person who lives within their means.

The challenge is if you get used to being in debt, you get used to not living within your means.

One challenge that's come for me is I will not just work a bunch of hours to get out of this debt and that's aggravating me because I love my family. I love spending time with them.

My usual solution for the stuff is I'll just work harder and do more but for this, I will not miss out on seeing my family. Now, that's not to say I don't go to work and show up here but I won't just cut my family and self-care time so that I can get out of the money situation.

I'm committed to getting out of this debt while balancing my life. This is important to go from $656K debt to financial freedom.

I can say that I hope I've learned the value of taking a nice steady pace. There's nothing wrong with borrowing some money to build a business and launch your business.

In fact, you might not be able to do one without at least borrowing a little bit. There's nothing wrong with taking some student loans for going to school.

Once you've taken it, the challenge is when do you stop? When do you say, “Okay, I'm not borrowing any more money to go to school? I'm not borrowing any more money on credit cards to pay my bills. I'm not borrowing any more money to build my business”?

When will it be like enough is enough? When do you stop?

I'm actually very grateful for this debt as I'm having a good time with it. Yes, this is a fun challenge. The rest of my life is so set, so comfortable, so certain and so peaceful.

This debt, my business, and my mother are the only challenges I have. Thanks for all the love, support, and prayers. My mother has been a much easier spot in my life and I've gotten a better perspective and gratitude.

If it weren't for this debt, there would literally be almost no uncertainty in my life. What I am loving and enjoying about this debt is it gives me to create something absolutely incredible.

If I had not got myself into this position, I would not be able to do this vlog/blog, this story and I'm going to write a book on this also.

I wouldn't be able to create something that says, “Hey, I'll share my journey getting out of debt with you and I hope it's helpful”. I imagine that this has the potential to help a lot of people and I'm actually grateful for this debt in this situation because I'm learning so much for it.

That to me is also a critical part of the way out because earlier this year, I was really frustrated with this debt. I was feeling really stupid for having made $250k profit in 2016 and $696k profit since 2015 and then running myself into this debt.

Because of that, I was feeling really dumb about all the opportunities I missed and the more I felt that way, the worst my situation got.

I've looked around in my situation. I said, “How can this help somebody? How can I do some good with this because I know this isn't happening by accident?”.

Small Academy: Any advice for a newbie who wants to make a living out of the internet?

That's a really good question. I did a video on the fastest path to income online.

Here’s the “Fastest Path to Full-time Income Online” blog and its video below.

What I've noticed is for making money online, the fastest way to start from nothing is what my wife has done. She started out applying to jobs on Upwork.

She applied to jobs on LinkedIn, Google and online freelance legal writing jobs which she can do because she's an attorney.

She got jobs that didn't pay very well and she just worked her way up and now she makes $1,000 a week working probably 20-hours a week while taking care of the kids full-time.

I do what I can to make an hour or two here and there for her every day so she can work and then that's been a great gift for us that she can earn that money and then have some money to help out with the expenses.

I paid most of the expenses for the last several years. She paid them when we first got together and that's how she makes about a thousand a week with zero expenses and her business model actually inspired me.

I looked and I'm like “Wow! She just started out working online and within a year, she's making $1,000 a week with no expenses.

Then I compared it to my business model and here I am with all of this stuff and followers. I'm going in and losing money in my business. This has got to change.

From an eager point of view, I ought to be making a lot more money than she does. I'm the one who works full-time and the one who has a business online.

That's when looking at all this debt, I was like “Oh, I'll make a lot more money if I stop spending so much”. If my wife spends as I spend, we wouldn't have any money at all.

ASDF: You don't have more views on your latest YouTube video but you have created a course on “How to gain views?”.

My channel has got 27 million views on YouTube. I do know a lot about getting YouTube views and this has been an uncomfortable process and humility that I've again gone through recently.

It’s like, “Oh, why am I trying to impress people with my Youtube skills?”.

What people seem to be impressed about me is my honesty in sharing things that I'd rather not share with you like these debt episodes. Rather not share it and rather just focus on how much money and success I've made online.

Do I want to share 656K debt with you? Well, yes and no. I want to do the best I can to help you today.

Thus, I've made it. Last month I spent $4,000 on YouTube ads which were really freaking stupid given that caused me to lose money.

Last month I worked full-time online in my business and lost money. That's the opposite of going to work. Imagine, if you went to work and they charged you to go to work sometimes and other times they gave you huge paychecks. That's my business.

Thus, I'm focusing on I will impress/help with my honesty. I'm surrendering telling and giving up telling anyone else what they ought to do. In fact, I'm seeing a change that may be in progress.

There are so many experts out there that try and reel you in with what often as the experience digital marketer I see is kind of fake you know.

They're spending tons of money on ads. Therefore, to the untrained eye, it looks like what they're saying is working really good. When the only thing that's making it all work is the fact that they spend $100k a month on ads.

That's why they get so many views on their videos and then they reel you in with expensive coaching and all this. I think if you are like me, a lot of us are getting burnout on being told what to do and just feel like you're understood. So, going forward, my mission is to help you feel understood.

I don't care what anyone thinks of my views any more or my business anymore. Unless it's making a difference. So, that was a big transition I made and taking inventory of my debt is what helped me look at it.

It helped me say “It's time to stop trying to act like everybody else and impress people with your views and your following. Just be honest, try and help people”.

My book “Officer Banfield” has a lot of really good stories in it and I've got another book “Speaker Meeting 2017”. If you want to really get to know me, these 2 books are absolutely incredible in-depth.

Some people have just raved and said “Jerry, man! Your honesty was incredible”.

I go into much more detail in these books than I do here live about my personal life, my past and my struggles.

Other people who have read these books came out offended and afraid like “Oh my God! You are awful. How could you admit to these things?”

I recommend both of those books as they could really use a review on audible.

For books that I'm reading, if you'll please follow me Twitter, Instagram, Facebook or subscribe to my YouTube. What I'm doing is I'm consistently posting whatever the latest book I'm reading.

You can visit my shop on Amazon. I've got a reading list of a bunch of the books I've already read.

Leaders are readers in my experience. I love reading and I listen to a book almost every day. Right now, I'm listening to “Waking up in winter by Cheryl Richardson”. I just posted a picture of that on Facebook.

If you follow on Facebook, you'll always see the newest books I'm reading. “How not to die” was really helpful for diet. I'm about to read “Arnold Schwarzenegger: Total Recall”. I'm imagining doing an interview with Arnold Schwarzenegger one day.

I have “Talking to strangers by Malcolm Gladwell” up next and “Money & the Law of Attraction” up next as well. I've been reading books by Gabrielle Bernstein.

If you look on YouTube, I just did some book reviews of other books I read.

Here’s one of the book reviews I did. “Super Human by Dave Asprey”.

I have a certainty that (a) the truth is I am already debt-free. If something happens to this body and then my soul left it behind, wouldn't I have any debt?

Debt is only a part of playing a game in this-worldly reality. On the deepest level, there are absolutely no debts at all there. This is important to go from $656K debt to financial freedom.

Thus, in a spiritual sense, the most important sense, there's no debt and (b) my physical reality at some point in this body's existence unless it comes to a sticky early demise which I'm not planning on but you never know.

If things go how I plan within a relatively short period of time, this series will go from -656K to zero to an amount of cash in the bank and it will more focus on how I'm giving back to other people.

I love giving other people money. One reason my debt is so high is that I love giving other people money. I've donated tens of thousands of dollars to people online. I've done thousands and thousands of dollars of legit fun giveaways.

I did a bunch of giveaways before where literally people would post their cryptocurrency address in the chat and I would send them $20 in Bitcoin or Dash during the live giveaway. I've given just huge sums of money out that I could have just kept for myself and paid down my debt.

I saw a story that Bill Gates was in an airport in Boston. Bill Gates is one of the richest men on earth who is known as the founder of Microsoft.

Bill Gates was in an airport in Boston before everything went so well for him and he didn't have any money with him to buy a paper and the newspaperman gave him a paper for free twice.

He said that it happened in that same Airport 2 different times and when Bill Gates got rich, he thought of the newspaperman and wanted to give him a gift.

So, Bill Gates came back to this newspaperman and said, “Thank you for your generosity. I'm the richest man on earth now. I want to give you something”.

The newspaperman said, “Well, thank you for your offer but I don't need anything from you. I already am the richest myself".

He said, “For the richest man on earth, it's very easy to give somebody money but for a poor newspaperman to give somebody money, that's difficult”.

One of the lessons I've been through this year is to give when it's difficult. Anyone, when they're rich, can give extravagant sums and money but when you're poor, can you help someone else?

How can you still give money even when you're not sure where your next paycheck is going to come from?

At the beginning of this year, I had a sister who was struggling and going through a lot of changes in her family. Before I borrowed $200k+ this year and I had operated on cash-paying all my credit cards off, I had $5,000 in the bank with $10,000 in expenses.

My sister from what I heard was struggling a bit financially. I sent my sister $1,000 because I was certain that no matter what, I'd have money and be able to borrow money and pay my bills.

There's no way I was going to lose my house or anything important to me and I've just got this money sitting in the bank and she could make better use of it than I could.

So, one reason I've got so much debt is that I love giving other people money and there's got to be a balance but when you've got debt between how much you give other people and how much you use to pay off the debt, that's something I'm learning.

Luther: How do you keep going when you're failing again and again and again?

That's an awesome question Luther because I don't know what else to do. Actually, I just don't know how to quit, stop and give up and I've made a decision before that I will do my business.

I will do my business regardless of what else happens and will keep doing my business. This is important to go from $656K debt to financial freedom.

That is kind of a scary thing even thinking about quitting. I can't just drop what I'm doing and go somewhere else. I will do this as I love doing this and I will do it as long as I love to do it.

It kind of drives me crazy sometimes as yet, I guess I love being driven crazy.

I have so many people that love me and all the comments. All of this is how I keep failing and getting back up because there are so many people in my life that help me get back up.

My wife helps me get back up my mother and my kids. Just this morning I was crying with my son and I don't even know what I was crying about. The people in my life helped me get back up over and over and over again.

If it was just me I wouldn't but I'm able to fail just relentlessly because all the love and support I get from other people in my life. So, all the love and support you're giving me here is a part of that and I appreciate it.

Berry Eakin: Student debt is absolutely brutal these days.

It is. I only came out of undergraduate with $18,000 in student loans. I wouldn't even have got through on $18,000 in student loans like the first year.

$18,000 in student loans in college was enough to just have a resident advisor job and to have everything I needed and still when I was in college, I lived within my means. I just spent cash.

That's when I started getting credit cards after college but then it's a snowball.

I'm doing this as a show where it's like a journal and I'm just basically talking about what I'm thinking and what I'm going through specifically related to the debt.

Thus, this is all about the debt and going from $656K debt to financial freedom and everything surrounding that.

I am avoiding giving any kind of advice because I trust, if you listen/read all of the stuff I ramble on and on about, I trust you'll find whatever you need out of that and it will pop up within you.

Some of the things I share are about a mindset. These are the mindsets I have that helped me feel peaceful with my situation. It helps me to remember that money is only as real as all of us make it.

In fact, I had a breakdown one day. I'm like, “That's it. I'm done with the money, I'm not using money anymore, I'm going to just close all my accounts and screw everybody I borrowed money from”.

I told my wife this too. We were out in front of our house. That was the day I was trying to plan the 484k debt video.

I personally included the mortgage and all of my business and personal debt. I have $484k in debt and then my wife has $172k+ in student loans. Putting that together is the whole debt journey for both of us.

I've paid down like $50,000+ of my wife’s student loans over the years too as well as mine.

I had a breakdown one day pretty recently saying, “I'm not using money anymore as this is a stupid game that all of us are playing and I just refused to play”.

There was a homeless guy that I was talking to and I looked at him like he's courageous. He refuses to play this game of money. He won't go to work cuz he doesn't want to and he'll sleep wherever he can.

That's a man with courage. He refuses to play this game that all of us feel like we have to play and I thought I'll be courageous too. I just will stop playing this stupid money game.

Imagine, at some point in history, we didn't even have money. This is literally just a game we've created and playing.

What I came to the conclusion is that it's not best for me to help other people that I can do a lot more to help other people than by just basically acting homeless. This is important to go from $656K debt to financial freedom.

I have been so afraid of “What would happen when my debt got to the point I couldn't pay it?”. I mean, I've woke up in just terror. I've worked too hard and been in so much fear about what if I can't pay my debt.

The nice thing is thinking about not using money at all. By comparison, it seems like not a big deal. Well, if I totally opted out of the game of money, that would be a decision I made.

It’s like “Nothing the world's going to do to me as far as money goes. This is as bad as what I could do to myself".

Muthu Bhai: How do you repay your loans?

Well, I take the minimum payments every single month and right now, I'm focusing on doing new video courses. I'm going to film 2+ new videos for my new TikTok course and that will be uploaded on Skillshare and StackCommerce.

I'm going to make a new Udemy profile and upload it there. Maybe, I'll put it on some other websites as well.

So, I'm intending to repay my loans through my work and services. I'm intending to do things that you will find helpful and other people will find helpful and that will, therefore, earn money in some way.

Maybe something like this debt series could get good ad revenue. I'm opening myself up to whatever opportunities the universe has in store.

I trust if you want to make sure not to miss these, you'll subscribe to my YouTube channel or follow on Facebook.

You can go to jerrybanfield.com/podcast. I'll be putting these up if you just want the audio versions of these. I like to listen to audiobooks when I'm walking my dog and my baby in the morning.

Listening to audiobooks is one of the things that makes driving something I'm passionate about.

I also have a Mastermind and my partner group at jerry.tips/partners. I've got partners who teach online, especially on Udemy and often I'll get tips in my partner program.

For example, “Hey, this subject is really hot. I'll throw out one for you right here. Adobe Creative Cloud classes are really hot.

Thus, even though I'm gutting my business expenses, I am going to get an adobe cloud subscription for $50 a month and start making short little online courses on those Adobe Creative Cloud apps.

I believe those will have a good shot single-handedly to earn a few thousand a months.

Thank you very much for reading today. I love you. You are awesome. I'm so grateful you've made it all the way to the end of this or you hopped in.

There's a playlist on YouTube with all of these shows for you in that particular playlist. So, if you just want to watch this series, I'll put that in there.

I trust you will leave a like, follow, subscribe, come back and we'll do this again soon. Have a wonderful day and I'll see you for the next episode of going from $656K debt to financial freedom.

Love,

Jerry Banfield

Posted from my blog with SteemPress : https://jerrybanfield.com/from-656k-debt-to-financial-freedom/

Jerry, appreciate your transparency, but such an amount of debt is seemingly increasing by the day rather than the other way around. I am concerned. Have you seek financial advice from an expert planner or discuss with your debtors if reduction of principal is possible? Like certain services/goods your purchased for business expenses? Best of luck with getting out of the debt.

Congratulations @jerrybanfield!

Your post was mentioned in the Steem Hit Parade in the following category: