In the realm of ventures, you'll frequently catch wind of stocks and bonds. They are both achievable types of venture. They permit you the chance to contribute your cash with a particular organization or company with the likelihood of future benefits. In any case, how precisely do they work? What's more, what are the contrasts between the two?

Bonds

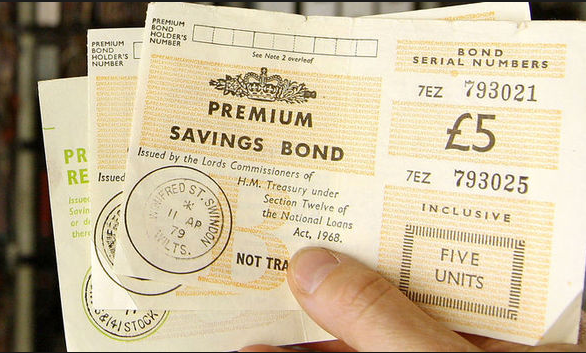

We should start with bonds. The least difficult technique to describe a bond is through the possibility of a progress. When you place assets into securities, you are fundamentally attributing your money to an association, organization, or council of your picking. That establishment, accordingly, will give you a receipt for your progress, close by an assurance of energy, as a bond.

Securities are obtained and sold in the open market. Change in their qualities happens depending upon the advance charge of the general economy. In a general sense, the financing cost direct impacts the estimation of your wander. For instance, if you have a thousand dollar security which pays the excitement of 5% yearly, you can offer it at a higher face regard gave the general advance cost is underneath 5%. Besides, if the rate of interest rises above 5%, the security, be that as it may it can even now be sold, is regularly sold at not as much as its face regard.

The method of reasoning behind this structure is that the budgetary experts deal with a higher rate of interest then the bona fide security pays. As needs be, the bond is sold at cut down an impetus remembering the ultimate objective to balance the opening. The OTC market, which is incorporated banks and security firms, is the most cherished trading place for securities, in light of the way that corporate securities can be recorded on the stock exchange, and can be purchased through stock delegates.

With bonds, not in the least like stocks, you, as the money related pro, won't particularly benefit by the accomplishment of the association or the measure of its advantages. Or maybe, you will get a settled rate of benefit for your security. Essentially, this infers whether the association is furiously productive OR has a shocking year of business, it won't impact your wander. Your security return rate will be the same. Your landing rate is the level of the primary offer of the security. This rate is known as the coupon rate.

It is in like manner imperative to recall that bonds have advancement dates. Once a bond hits its advancement date, the essential whole paid for that bond is returned to the budgetary authority. Unmistakable bonds are issued different improvement dates. A couple of bonds can have up to 30 years of advancement period.

While overseeing in bonds, the best theory chance that you stand up to is the probability of the key wander total NOT being paid back to you. Plainly, this peril can be to some degree controlled through the careful assessment of the associations or establishments that you place assets into.

Those associations that have more credit esteem are generally more secure endeavors with respect to bonds. The best instance of a "protected" bond is the organization bond. Another is the blue chip association bond. Blue chip associations are settled in associations that have shown and productive track records over a long cross of time. Clearly, such associations will have cut down coupon rates.

In the event that you're willing to put it all on the line for better coupon rates, by then you would likely breeze up picking the associations with low FICO appraisals, associations that are far fetched or shaky. Keep in mind, there is a marvelous threat of default on the bonds from tinier associations; in any case, the contrary side of the coin is that speculators of such associations are extraordinary advance managers. They get reimbursed before the financial specialists if there should arise an occurrence of a business going bankrupt.

Accordingly, for less danger, place assets into bonds from developed associations. You will most likely benefit from your benefits, in any case they will apparently not be huge. Or of course, you can place assets into tinier, dangerous associations. The danger is more critical, however if it pays off, your record will be more unmistakable, too. As in any hypothesis meander, there is a trade off between the perils and the possible prizes of bonds

Stocks

Stocks speak to offers of an organization. These offers give some portion of the responsibility for organization to you, the investor. Your stake in that organization is characterized by the measure of offers that you, the speculator, possess. Stock comes in mid-tops, little tops, and substantial tops.

Similarly as with bonds, you can diminish the danger of stock exchanging by picking your stocks deliberately, evaluating your ventures and measuring the danger of various organizations. Clearly, a settled in and surely understood enterprise is significantly more liable to be steady then another and problematic one. Also, the stock will mirror the security of the organizations.

Stocks, not at all like securities, vary in esteem and are exchanged the share trading system. Their value is construct straightforwardly in light of the execution of the organization. On the off chance that the organization is doing admirably, developing, and accomplishing benefits, at that point so does the estimation of the stock. In the event that the organization is debilitating or coming up short, the supply of that organization diminishes in esteem.

There are different manners by which stocks are exchanged. Notwithstanding being exchanged as offers of an organization, stock can likewise be exchanged the type of alternatives, which is a sort of Prospects exchanging. Stock can likewise be sold and gotten the share trading system once a day. The estimation of a specific stock can increment and reduction as indicated by the ascent and fall in the share trading system. Along these lines, putting resources into stocks is considerably more hazardous than putting resources into bonds.

The two stocks and bonds can wind up noticeably productive ventures. In any case, it is critical to recollect that the two alternatives additionally convey a specific measure of hazard. Monitoring that hazard and finding a way to limit it and control it, not the a different way, you to settle on the correct decisions with regards to your money related choices. The way to astute contributing is constantly great research, a strong technique, and direction you can trust.

Can I do this on my own or I'll need a stock broker?