The ECB (European Central Bank) is presently operating under negative interest rates. This is something that the world never saw before. At present, it is estimated that somewhere around 1/3 of the global debt is paying a negative return.

European banks are pushed into a difficult position; they have the option of passing the negative rates on to their customers. Thus far, most of Europe resisted.

This might not be the case for too much longer. Germany is seeing an expansion of the number of banks that are now "paying out" negative rates to account holders. For the most part, it is targeting larger balances yet there are a few instances where this is drifting to lower levels.

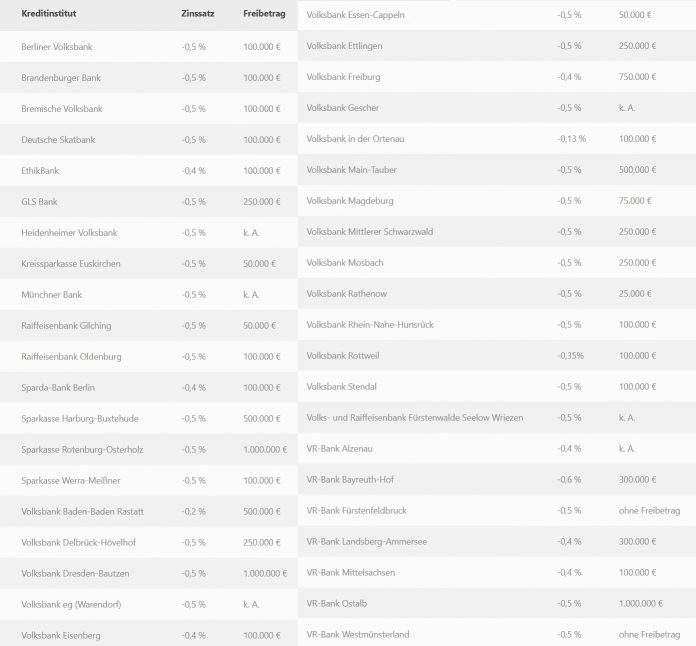

Source

There are 800 local German banks, of which 41 are now passing the negative rates on to customers. This might not sound like a great many in light of the total, but it is nearly double from about a year ago.

ECB chief Christine Lagarde is defending the policy; she also has set a path for it to change.

Lagarde explained that the key interest rate will only be raised once eurozone inflation “robustly” meets the central bank’s target of just below 2%. According to the ECB’s own economic forecasts, this is unlikely to happen for several years.

https://news.bitcoin.com/banks-negative-interest-rates/

According to the ECB itself, the present situation is expected to last several more years. This brings up the question of how many more banks will follow the trend we saw over the past year?

Not only is there the risk of hundreds of German banks paying out negative rates but we could see this extend throughout the European Union. This could be devastating to savers in those nations.

We already are seeing the flow of capital moved into riskier assets in an effort to find a return. A country like the United States is seeing the stock and housing markets holding up very well. Low interest rates are forcing people out of traditional investments such as bonds since they are paying only a couple percent.

Which brings up a bigger question: where does cryptocurrency fit into all of this?

The reputation of the entire sector is that it is risky and a speculator's paradise. This certainly was the case a few years ago. However, the industry matured a bit since then.

One thing that we see is the expansion of decentralized finance (DeFi). Since this is outside the Central Bank system, it is not obligated to operate under the same parameters.

The result is that entities are now allowing people to put up their cryptocurrency and receive greater returns than the banks are paying. After all, even in the low rate coutries, a 6% return in a crypto fund is much better than the 2% the Fed is paying.

Do we even need to point to the fact of how much greater it is than the negative rates the ECB is pushing?

There are articles popping up around the Internet surmising that stablecoins are going to be huge in the next couple years. Some analysts claim there is somewhere around $6 billion sitting on the sidelines just waiting to enter. This money will be better off sitting in a stablecoin earning 5%-8% as opposed to being in the traditional banking system where returns are low.

Volatility remains an issue for the cryptocurrency world. Investors who are seeking a safe haven are not likely to get involved in something that can drop 50% at the drop of a hat. The issue that cryptocurrency has is that this will be present until the market gets big enough to reduce the major swings that are common in smaller markets.

This provides a catch-22 situation. Volatility will remain until big money is involved yet the big money will enter after volatility is reduced.

The actions of the ECB and other Central Banks might make this all not relevant. They might unknowingly force people to take a harder look at what cryptocurrency is offering.

|  |

( Want an easier way? Use our SteemConnect proxy link! )

Disclaimer: This is a @steemvoter subscription payment post. Thank you to Steemvoter customers for allowing us to use your Steem accounts to upvote this post by virtue of your free subscription to the Steemvoter.com curation automation service. @steemvoter is proudly a @buildteam subsidiary and sister project to @dlease, @tokenbb, @ginabot, @steemsports, @btuniverse, techinvestor.io, @steemsports-es and @minnowbooster.

Beneficiary Declaration: 10% @sbdpotato and 20% @taskmaster4450 (Author)

This post earned a total payout of 17.258$ and 8.629$ worth of author reward that was liquified using @likwid.

Learn more.

This post earned a total payout of 0.060$ and 0.030$ worth of author reward that was liquified using @likwid.

Learn more.

This post earned a total payout of 0.048$ and 0.024$ worth of author reward that was liquified using @likwid.

Learn more.

Congratulations @btuniverse! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

You can view your badges on your Steem Board and compare to others on the Steem Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPDo not miss the last post from @steemitboard:

Vote for @Steemitboard as a witness to get one more award and increased upvotes!

What stable coin is offering 8%?

When the global system of fiat currencies finally collapses crypto’s will sky rocket in value.

Posted using Partiko iOS

Ok, we upvoted and reblogged to thousand followers.. Thank you so much to vote @puncakbukit as your witness and curator.

There is a few danish banks who have already put the negative rates onto their costumers.

These: Jyske Bank, Nordea, Sydbank and Spar Nord.

Congratulations @btuniverse!

Your post was mentioned in the Steem Hit Parade in the following category: